Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) Has Put Out Historically Incredible Numbers in its Latest GOBLET Study Results, including a near TRIPLING of Objective Response (ORR) Rate, and a Statistically Unheard of Complete Response (CR) Rate—LEADING TO THE FDA GRANTING FAST TRACK DESIGNATION FOR PELAREOREP.

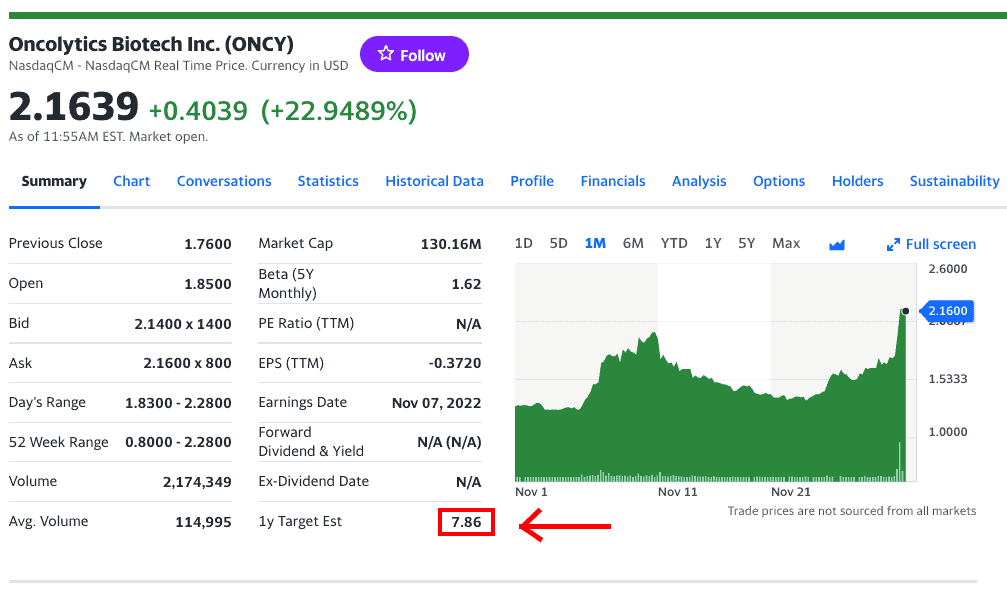

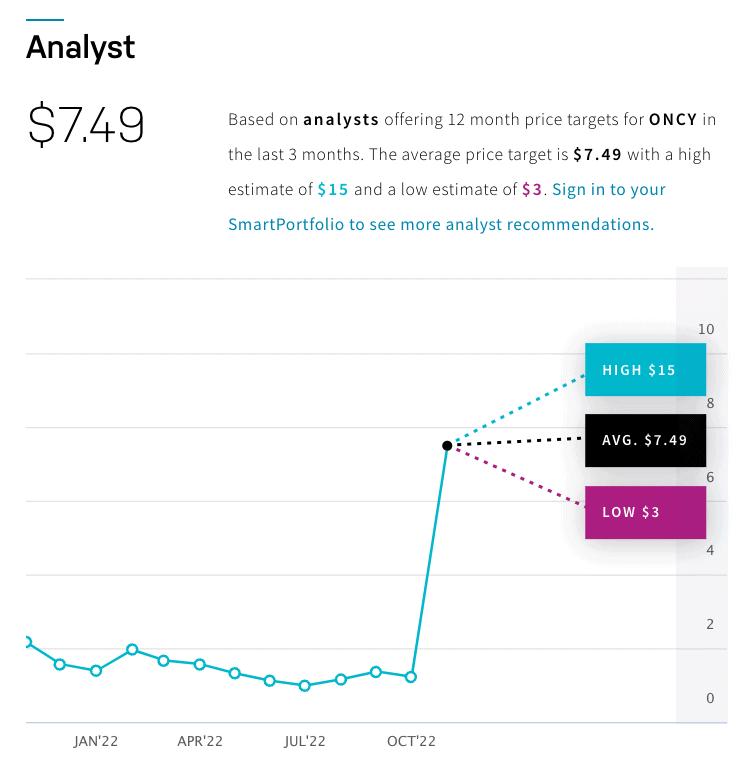

EDITOR’S NOTE* With Wall Street analyst coverage giving ONCY a price target of $15.00, these rock bottom prices you are currently seeing probably won’t last long – An earlier publication of this report saw a potential increase of 900% from its previous levels, prior to the beginning of what we believe will be a series of catalyst events on the horizon. NOW they’ve already begun with the FDA’s Fast Track Designation for pelareorep with pancreatic cancer. In the first day of trading after the Fast Track approval announcement, shares rose by 25%, showing that time is running out to get early positioning, so get positioned now! Take a look here: https://www.nasdaq.com/market-activity/stocks/oncy/analyst-research

We are getting closer and closer to downgrading pancreatic cancer from its reign as the highest mortality rate of all major cancers.[1]

Recently in the largest study of its kind (more than 10 million people),[2] researchers at the University of Surrey and the University of Oxford investigated known signs of pancreatic cancer[3] and discovered that it could potentially be diagnosed up to three years earlier—potentially increasing the chance of survival, and even making the disease curable if caught early enough.[4]

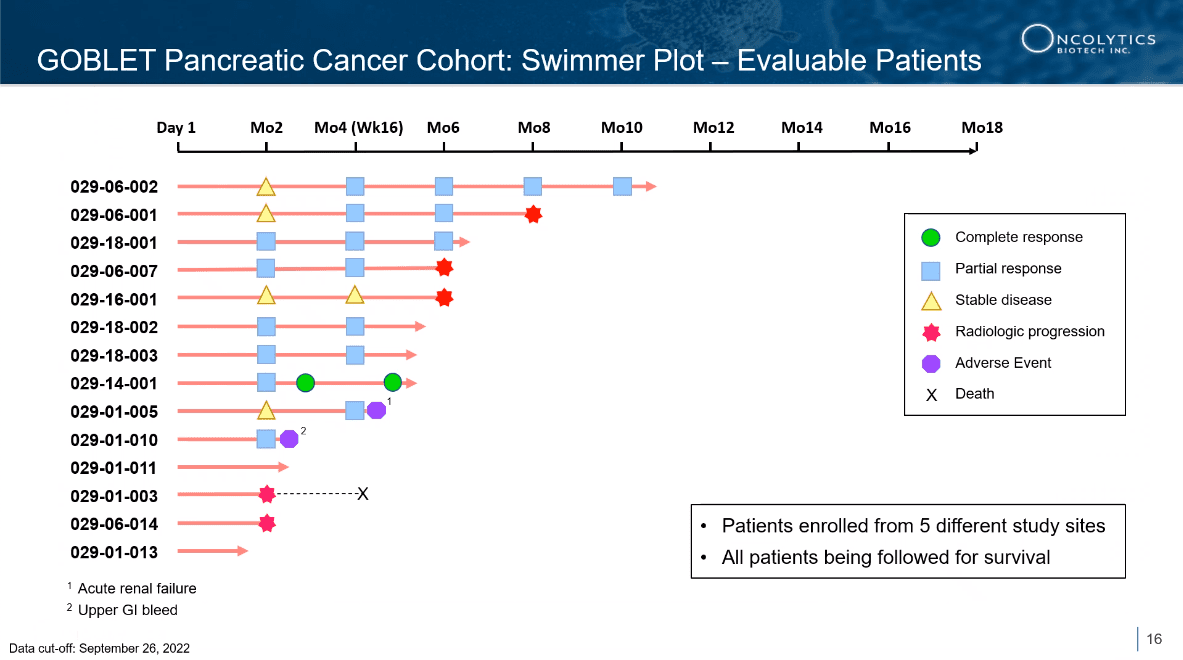

Now on top of this there’s even more promise coming from a potential therapy that’s delivered interim results from a Phase 1/2 study showing a 69% Objective Response Rate (ORR) in Pancreatic Cancer[5]—remarkably nearly triple the average ORR seen in historical control trials of another combination, which were only ~25%.[6]

As well, this new therapy achieved a Complete Response (CR), which in pancreatic cancer is almost UNHEARD OF. In a large historical control trial, there was a single CR in 861 patients, whereas this new therapy achieved a CR in just 13 patients—marking a significant potential 65x improvement over historical results!

The biotech company that developed this new therapy is Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC), with their proprietary flagship asset pelareorep, which recently received FDA Fast Track designation which could propel the company into near-term cashflow.

Longer-term trends in pancreatic cancer reported by NIH/National Cancer Institute in the 2022 Cancer report, included the greatest incidence rate increase in men was seen in pancreatic cancer, and had increased by 1.1% per year.[7]

Even though pancreatic cancer accounts for only 3% of new cancer diagnoses, it accounts for 8% of cancer deaths, and is the fourth leading cause of cancer deaths in the USA for both men and women.[8]

However, there’s HOPE…

Within the NIH/National Cancer Institute’s report it also described pancreatic cancer’s survival improvements, with pancreatic neuroendocrine tumors increased from 65.9% to 84.2% between 2001 and 2017, and for people diagnosed with pancreatic adenocarcinomas it increased from 24.0% to 36.7%. Five-year relative survival also increased between 2001 and 2013, from 43.4% to 65.2% for people with pancreatic neuroendocrine tumors, and from 4.4% to 6.6% for people with pancreatic adenocarcinoma.

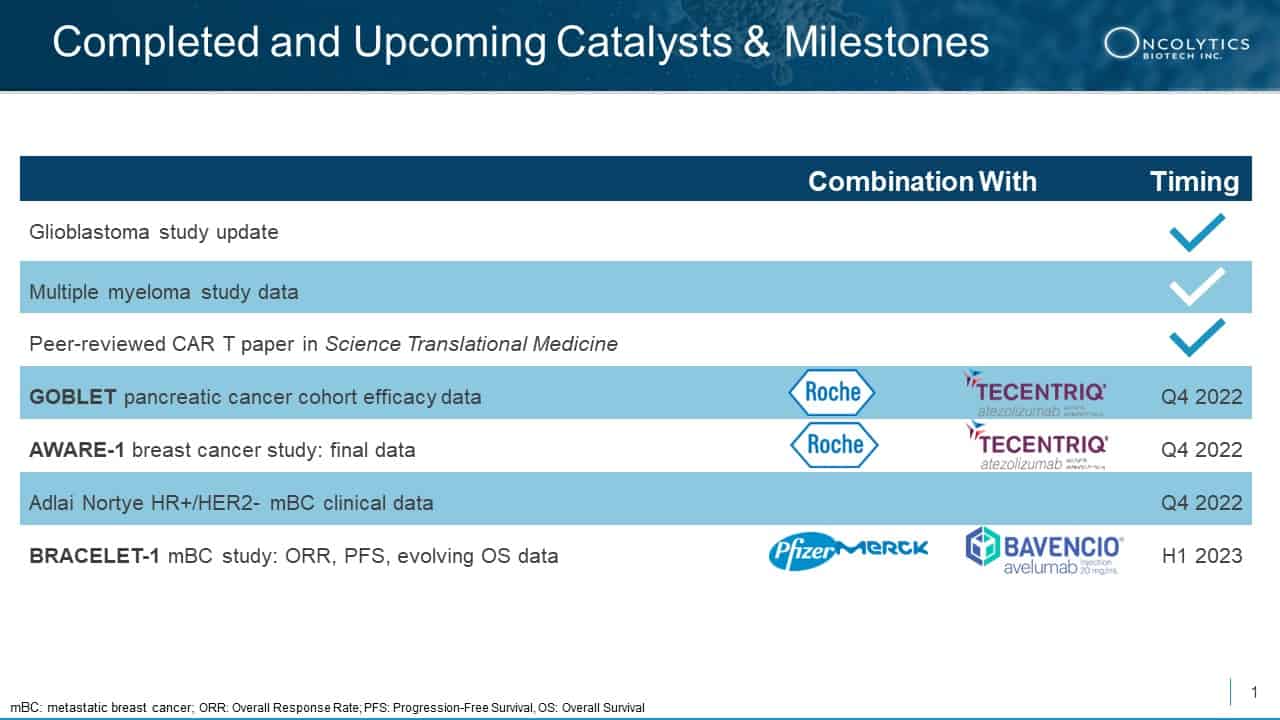

While all these signs of optimism are coming together, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) is fully funded for a projected runway of key milestones to the end of 2023—including other forms of cancer.

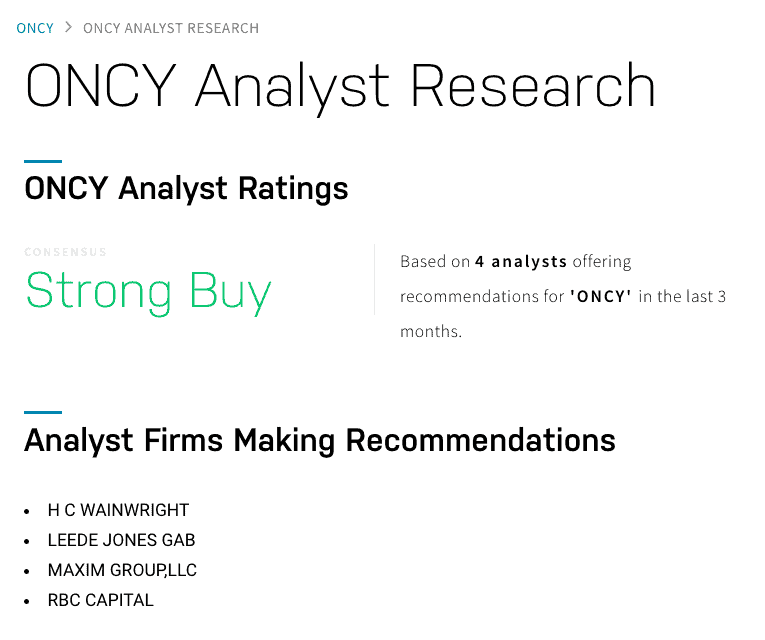

All of these potential catalysts on the horizon have caused analyst firms—4 of 5 currently cited by NASDAQ—to make a STRONG BUY recommendation for Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC), while they gave ONCY price targets that average $7.49 and run up to a high estimate of $15 per share, while Yahoo Finance is highlighting a 1-year target of $7.97, marking as high as a potential 594% increase over its current trading price of $2.16*.

(* – as of December 1, 2022)

As of November 28, 2022, the company has 5 firms with analysts giving ONCY coverage:[9]

- Cannaccord Genuity

- C. Wainwright

- Leede Jones Gable Inc.

- Maxim Group

- RBC Capital Markets

Now let’s break down the numerous reasons why we see Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) as THE BEST WAY to invest in the challenging world of biotech in the fight against cancer, with a company that appears statistically positioned to make a huge impact on the industry.

8 Reasons to Invest in Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) as a Cancer Battle Game Changer with PELAREOREP

1 Pelareorep’s Big League Partnerships and Combos: Pelareorep’s potential has drawn a partnership with Adlai Nortye, co-development with Pfizer and Merck KGaA, as well as collaborations with SOLTI and Roche, as well as combinations in development with Merck & Co., Bristol-Myers Squibb, and Incyte.

2 Near TRIPLING of Objective Response Rate (ORR): Compared to historical control trials by Dr. Von Hoff titled Increased Survival in Pancreatic Cancer with nab-Paclitaxel plus Gemcitabine yielded only about 25% ORR, while Oncolytics Biotech’s flagship pelareorep’s ORR was reported at 69% in the pancreatic cancer cohort with patients achieving a complete or partial response.[10]

3 Achieved a Confirmed COMPLETE Response (CR): Also in the most recent results, pelareorep achieved a confirmed CR, which is almost unheard of, given that pelareorep achieved this with one of thirteen evaluable patients, while historical control trials only achieved one CR from a total of 861 patients—that’s a 7.7% rate vs a 0.12% rate, or a +6,500% (or 65x) improvement over the previous industry benchmark so far.

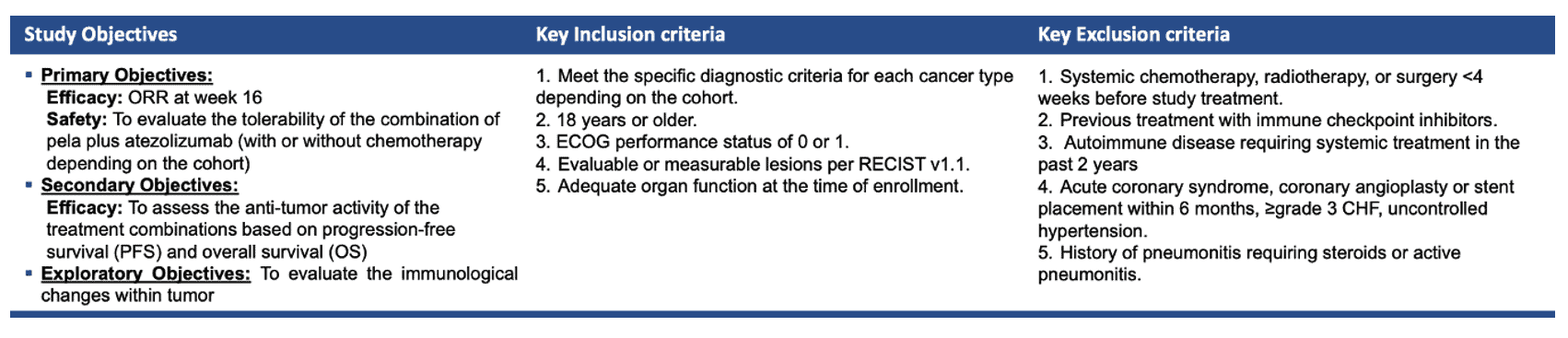

4 Fast Track Designation GRANTED: On December 1, 2022, Oncolytics Biotech announced that the FDA granted Fast Track Designation to pelareorep for use in combination with Roche’s anti-PD-L1 checkpoint inhibitor atezolizumab, and the chemotherapeutic agents gemcitabine and nab-paclitaxel, for the treatment of advanced/metastatic pancreatic ductal adenocarcinoma (PDAC).

5 Synergy with Immune Checkpoint Inhibitors (ICIs): The ICI market is expected to exceed $55B by 2025[11], despite as few as 1 in 5 patients responding to ICI therapy[12]. Pelareorep has clinically demonstrated its ability to synergize with these ICIs, perhaps enhancing their effectiveness.

6 More Important Data to Come: Not only did Oncolytics Biotech present incredible data from its GOBLET study that led to its Fast Track designation, but there is also an upcoming catalyst expected in the first half of 2023 from its Phase 2 pelareorep-ICI combo trial in HR+/HER2- breast cancer to facilitate the asset’s advancement to a registrational study.

7 Strong Leadership Team: Proven Management Team and Board of Directors that combines over 150 years of experience in drug development and the biopharmaceutical industry, including a World Congress Pharma Executive of the Year award winner Chair of the Board.

8 Fully-Financed Through 2023 : As of September 30, 2022, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) has $32.4 million in cash and cash equivalents, which provides projected runway through key milestones to the end of 2023.

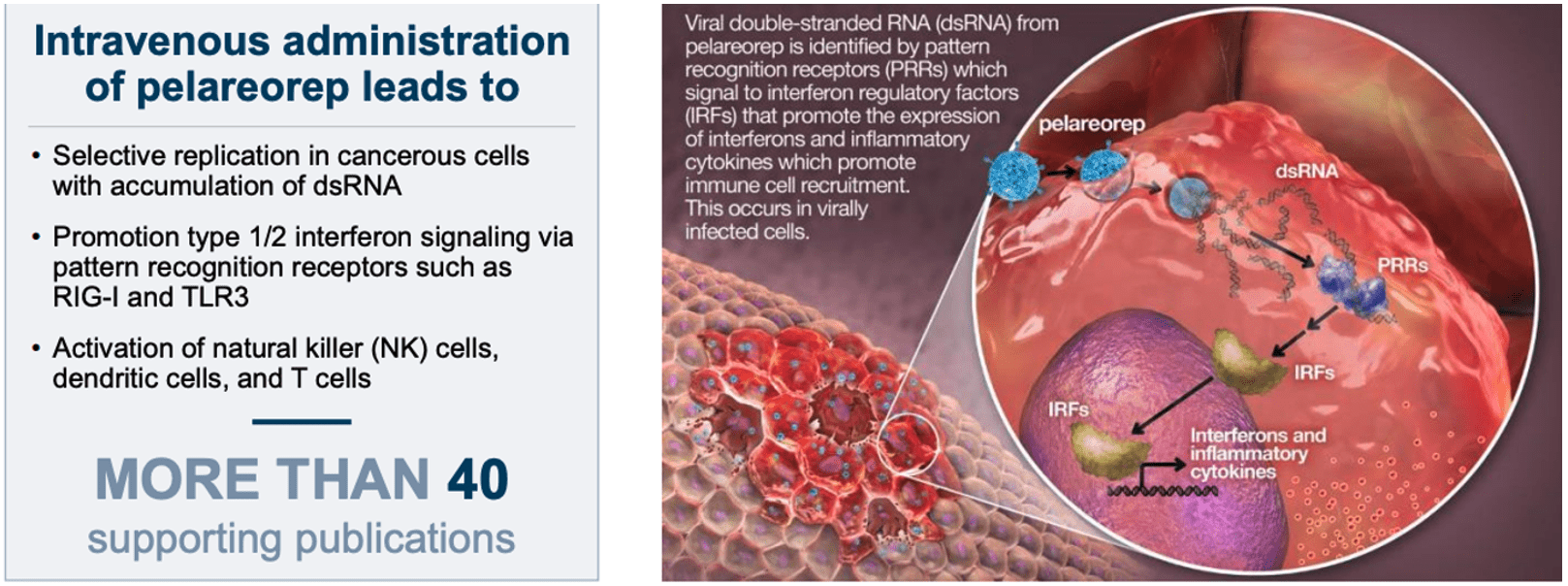

Pelareorep is an immunotherapeutic agent that generates an anti-tumor immune response, by training anti-cancer cells, while reversing immunosuppressive TMEs.

BREAST AND PANC: TWO LEGIT PATHS TO APPROVAL

Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) has been clear in its objectives to target important segments, beginning with Breast Cancer, which is projected to reach US$55.27 billion by 2027, growing at a CAGR of 13.1% along the way.[13]

But don’t discount the potential for pelareorep’s approval to treat pancreatic cancer BEFORE it gets to that stage with breast cancer.

Why?

Because pancreatic cancer is a much deadlier cancer with a much faster progression.

Currently with an 89% mortality rate within the first 5 years,[14] and a 99% mortality rate within five years for Stage IV pancreatic cancer, [15] diagnoses of this deadly form of cancer is a nearly automatic death sentence. Once pancreatic cancer has spread to other organs, surrounding lymph nodes, or other parts of the body, the average life expectancy is just 3-6 months.[16] For patients who are diagnosed before the tumor grows much or spreads, the average pancreatic cancer survival time is 3 to 3.5 years.[17]

In comparison, breast cancer diagnoses carry with them an average 5-year survival rate of 90% across all SEER stages.[18]

This means that it’s theoretically much easier to quantify efficacy and an improvement of survival in pancreatic cancer, as data collection is in a much, much smaller window.

For every month a patient outlives the average life expectancy in the pancreatic cancer cohort, the more quantifiable the potential impact a therapy’s use can be.

Which brings us to ONCY’s GOBLET study.

NOW FOR THE NEXT BIG CATALYST IN THE MAKING

Prior to the GOBLET study, the control benchmarks for success in pancreatic cancer came in the 2013 reference in the New England Journal of Medicine by Dr. Von Hoff, titled Increased Survival in Pancreatic Cancer with nab-Paclitaxel plus Gemcitabine.[19]

Why this study?

Because it fulfills the role of a historical control trial involving gemcitabine (gemzar) (Eli Lilly) plus nab-paclitaxel (Bristol-Myers Squibb).

How were the 2013 study’s results?

- The median overall survival (OS) was 8.5 months for the combo vs 6.7 months for gemcitabine alone

- The survival rate was 35% in the combo group vs 22% in the gemcitabine group alone at 1 year

- 9% vs 4% at 2 years

- The median progression-free survival (PFS) was 5.5 months in the combo vs 3.7 months in the gemcitabine only group.

- The response rate was 23% vs 7%

- 1 in 861 (0.12%) patients achieved a Complete Response (CR)

Those results were good enough to see the FDA approve nab-paclitaxel for use in combination with gemcitabine to treat patients with metastatic pancreatic cancer in September of 2013. [20]

To recap, before it was approved, nab-paclitaxel:

- Increased mean overall survival (OS) duration by 26.8%

- Increased median progression free survival (PFS) duration by 48.6%

- Increased 1-year survival rate by 59%

- Increased 2-year survival rate by 125%

- Increased response rate by 228.5%

Now, the GOBLET study is evaluating pelareorep in combination with Roche’s anti-PD-L1 checkpoint inhibitor atezolizumab and gemcitabine+nab-paclitaxel.

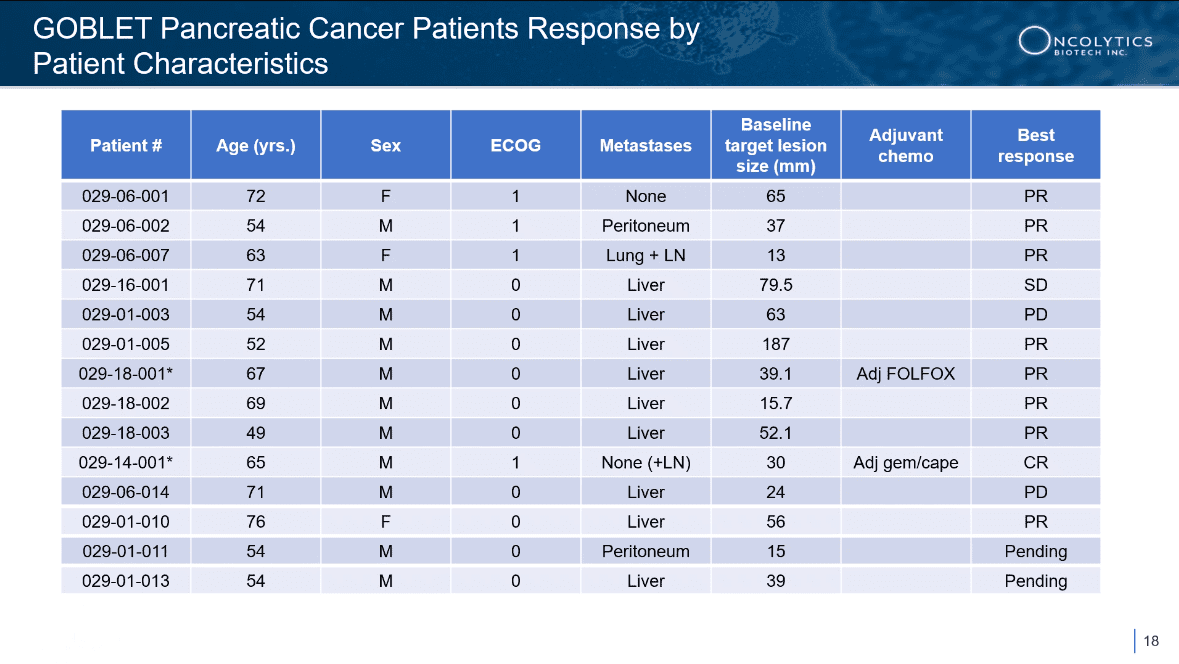

In late June, 2022, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) announced it had achieved success criteria for efficacy in the study’s pancreatic cancer cohort.[21]

NOW… we have the updated results from the phase 1/2 GOBLET study’s first-line advanced/metastatic pancreatic ductal adenocarcinoma (PDAC) cohort.

And they… were… FANTASTIC!

- 1 in 13 (7.7%) evaluable patients achieved a confirmed Complete Response (CR)

- 8 of 13 (61.5%) evaluable patients achieved a PR

- 2 of 13 (15.4%) evaluable patients achieved stable disease (SD)

- 9 of 13 (69.2%) evaluable patients achieved a response

- The observed ORR of 69% is substantially higher than the average ORR of ~25% reported in historical control trials of gemcitabine and nab-paclitaxel in pancreatic cancer[22],[23],[24],[25]

- GOBLET’s PDAC cohort exceeded the protocol-specified success criterion for Stage 1 of ≥ 3/12 objective responses

- The studied treatment combination has been well tolerated, with no safety concerns identified to date

A copy of the poster is available on the Posters & Publications page of Oncolytics’ website (LINK).

IMPORTANT UPDATE:

On December 1, 2022, Oncolytics Biotech proudly announced the FDA granted Fast Track Designation to pelareorep in combination with Roche’s anti-PD-L1 checkpoint inhibitor atezolizumab, and the chemotherapeutic agents gemcitabine and nab-paclitaxel, for the treatment of advanced/metastatic pancreatic ductal adenocarcinoma (PDAC).

“Receiving this Fast Track designation is an important accomplishment that speaks to the impressive response rate and the durability of the response in our PDAC study, and it also reflects the pressing need to improve upon the standard of care in this indication. With our core programs in breast and pancreatic cancer both nearing pivotal trials, and eligible for the Fast Track program’s numerous benefits, we believe we are at a crucial point in Oncolytics’ evolution and are excited for what’s ahead.”

– Dr. Matt Coffey, President and Chief Executive Officer of Oncolytics Biotech Inc.

FRIENDS IN HIGH PLACES

Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) has established a successful partnership with Adlai Nortye in China, Hong Kong, Macau, Singapore, South Korea and Taiwan. As per the relationship, there is an upfront and milestone payments of up to $86.6 million, with $65 million tied to potential development expansion.

Perhaps most notable are the ongoing studies Oncolytics is performing with Pfizer, Merck KGaA, Incyte, and Roche. These involve checkpoint inhibitors, targeting metastatic breast cancer, early-stage breast cancer, triple-negative breast cancer, pancreatic cancer, colorectal cancer, and anal cancer.

BONUS CAR-T PROGRAM

When Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) sought out the perfect combination for its flagship pelareorep’s immunotherapy capabilities, it became more and more obvious that the company was destined to enter the CAR-T therapy field, which has been dubbed a breakthrough treatment for patients with certain types of blood cancers, such as lymphoma and leukemia.

In 2020, treatment using CAR T-Cells led to complete remissions in 70% of patients[26] with anti-CD19-resistant acute B-cell leukemia.

It’s the perfect complement.

Pelareorep is a naturally derived, non-genetically engineered oncolytic virus that can be delivered intravenously and that preferentially infects cancer cells. This means that pelareorep attacks and kills cancer cells while leaving healthy cells intact. As the virus kills cancer cells, it alerts the body to the presence of these cells and activates the immune system against the tumor. Despite being a virus, pelareorep is not known to cause any disease has been shown to be safe in over one thousand patients.

CAR T cells, meanwhile, are created by drawing blood from a patient’s own body, separating the T-cells (which help produce an immune response and kill infected cells ), and genetically engineering them to produce receptors (chimeric antigen receptors, or CARs) on their surfaces.

It is thought that pelareorep will enhance the effect of CAR T-cell therapy because the virus alerts the immune system to the presence of cancer cells, which can be good at hiding from the immune system. Treating them with pelareorep exposes them, and signals CAR T-cells to mount an assault on the cancer.

For an extremely in-depth overview on what CAR T is and how it works, please watch this video located here:

THE BRAINTRUST BEHIND ONCOLYTICS BIOTECH

In order to take a proprietary biotech asset such as pelareorep through the trials along the road to approval, the entire process requires good stewardship. Thankfully, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) is in VERY capable hands, built upon experience among management and directors with several leaders in the sector such as Amgen, Bristol-Myers Squibb, GSK, Sanofi Pasteur, National Institutes of Health, Harvard Medical School, and Princeton University.

ONCY’s leadership team includes:

Co-Founder, Director, President & CEO – Matt Coffey, PhD, MBA

Dr. Coffey completed his doctorate degree in oncology at the University of Calgary with a focus on the oncolytic capabilities of the reovirus. The results from his research have been published in various respected scientific journals, including Science, Human Gene Therapy, and The EMBO Journal.

Head of Clinical Development and Operations – Thomas Heineman, MD, PhD

Dr. Heineman completed his medical degree and doctorate in Virology at the University of Chicago. His drug development experience spans more than 25 years including 15 years in the biopharmaceutical industry. He has held senior roles at GSK, were he led the clinical development of Shingrix, and at several biotechnology companies where his focus has been oncology and immuno-oncology. Dr. Heineman has led clinical programs in multiple oncology indications including breast cancer, pancreatic cancer, B-cell lymphoma, glioblastoma and colorectal cancer.

Global Head of Business Development – Andrew de Guttadauro

de Guttadauro is +25-year biopharmaceutical commercialization and business development veteran, who’s held executive and senior-level positions at leading pharmaceutical and biotechnology companies, including as VP of Corporate Development at Vical supporting the execution of distribution agreements for Allovectin®, and a variety of positions at Amgen where he contributed to the success of Enbrel®, Aranesp®, and Epogen® before joining MedImmune to lead marketing efforts for the FluMist® inhaled influenza vaccine. He also served as Director of Strategy at Biogen Idec.

Chair of the Board – Wayne Pisano, MBA

Pisano was recognized as Pharma Executive of the Year by the World Vaccine Congress in 2010. He served as the President and CEO of VaxInnate, and has been a Board Member of Immunovaccine since 2011. He is the former president and CEO of Sanofi Pasteur, one of the largest vaccine companies in the world. He’s credited with driving Sanofi Pasteur’s leadership within the worldwide influenza market and capturing 50% of global sales.

The remaining leadership roles, Board of Directors, and Scientific Advisory Board consist of highly qualified members, with senior level experience with such companies and institutions as: Ernst & Young LLP, Nabisco, Hospital for Sick Children, Aptose Biosciences, Achillion Pharmaceuticals, National Cancer Institute-Frederick Cancer Research and Development Center, GPC Biotech, Harvard Medical School, Princeton University, Massachusetts General Hospital, EMD Serono, Breast International Group (BIG), SOLTI – Breast Cancer Research Group, Amgen & BMS IO Network and more.

Director – Deborah M. Brown, B.Sc., M.B.A.

Brown is currently a Managing Partner at Accelera Canada, a specialty consultancy firm that assists emerging biopharma ventures in the United States and Europe with the development and implementation of Canadian market strategies. She held progressively senior roles at EMD Serono from 2000 to 2014, including Executive Vice President of Neuroimmunology for the company’s U.S. operations, and President and Managing Director of the company’s Canadian operations. In 2012, Brown was Chair of the National Pharmaceutical Organization (now Innovative Medicines Canada) and served on its Board of Directors from 2007 to 2014. She currently sits on the Boards of Life Sciences Ontario, the Strategic Executive Advisory Council for Canadian Cancer Trials Group, and her local SPCA.

Director – Bernd R. Seizinger, MD, PhD

Dr. Seizinger currently serves as chairman/board member in a number of public and private biotech companies in the U.S., Europe and Canada, including: Vaccibody, Oxford BioTherapeutics, Aprea, CryptoMedix, and BioInvent. Previously he was President & CEO of public oncology company GPC Biotech; VP Oncology Drug Discovery and – in parallel – VP Corporate and Academic Alliances at Bristol-Myers Squibb; and Executive VP and CSO, Genome Therapeutics. Prior to his corporate appointments, he held Senior Faculty positions at Harvard Medical School, Massachusetts General Hospital and Princeton University.

RECAP: 8 IMPORTANT POINTS for Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC)

1 Big League Partnerships and Combos

2 Near TRIPLING of ORR

3 Confirmed CR

4 Fast Track Designation GRANTED

5 Synergy with ICIs

6 More Important Data to Come

7 Strong Leadership Team

8 Fully-Financed Through 2023

BEFORE YOU GO

Now that you’ve read this far, the case has been made strong enough for you to get into action.

With what we believe are catalysts events coming in the very near future, and with the data we’ve already seen, we believe THIS IS THE PERFECT TIME for smart investors to seriously follow the ongoing ONCOLYTICS BIOTECH INC. (NASDAQ:ONCY) (TSX:ONC) story.

So, do your own due diligence, and don’t forget to click here to sign up for email alerts to make sure you don’t miss out on any of ONCY’s news and milestones.

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Oncolytics Biotech Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Oncolytics Biotech Inc. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Oncolytics Biotech Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://pancreatic.org/pancreatic-cancer/pancreatic-cancer-facts/#:~:text=Pancreatic%20cancer%20has%20the%20highest,States%20after%20lung%20and%20colon.

[2] https://theconversation.com/pancreatic-cancer-could-be-diagnosed-up-to-three-years-earlier-new-study-192129

[3] https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0275369

[4] https://www.hopkinsmedicine.org/health/conditions-and-diseases/pancreatic-cancer/pancreatic-cancer-prognosis

[5] https://ir.oncolyticsbiotech.com/press-releases/detail/586/oncolytics-biotech-presents-updated-clinical-data-at-sitc

[6] https://www.nejm.org/doi/full/10.1056/nejmoa1304369

[7] https://www.sciencedaily.com/releases/2022/10/221027170415.htm

[8] https://www.sciencedaily.com/releases/2022/10/221027170415.htm

[9] https://ir.oncolyticsbiotech.com/analyst-coverage

[10] https://ir.oncolyticsbiotech.com/press-releases/detail/586/oncolytics-biotech-presents-updated-clinical-data-at-sitc

[11] Cowen and Company, LLC, “Therapeutic Categories Outlook,” February 2021;

[12] JAMA Netw Open. 2019 May; 2(5): e192535

[13] https://www.fortunebusinessinsights.com/industry-reports/breast-cancer-therapeutics-market-100163

[14] https://pancan.org/facing-pancreatic-cancer/about-pancreatic-cancer/survival-rate/

[15] https://www.hopkinsmedicine.org/health/conditions-and-diseases/pancreatic-cancer/pancreatic-cancer-prognosis

[16] https://pancreatic.org/pancreatic-cancer/pancreatic-cancer-facts/

[17] https://www.hopkinsmedicine.org/health/conditions-and-diseases/pancreatic-cancer/pancreatic-cancer-prognosis

[18] https://www.cancer.org/cancer/breast-cancer/understanding-a-breast-cancer-diagnosis/breast-cancer-survival-rates.html

[19] https://www.nejm.org/doi/full/10.1056/nejmoa1304369

[20] https://www.cancer.gov/types/pancreatic/research/nab-paclitaxel-gemcitabine#:~:text=In%20September%202013%2C%20the%20U.S.,results%20of%20the%20MPACT%20trial

[21] https://ir.oncolyticsbiotech.com/press-releases/detail/578/oncolytics-biotech-achieves-success-criteria-for-efficacy

[22] Von Hoff D et al. N Engl J Med 2013; 369:1691-1703 DOI: 10.1056/NEJMoa1304369

[23] O’Reilly et al. Eur J Cancer. 2020 June; 132: 112–121. DOI:10.1016/j.ejca.2020.03.005

[24] Karasic et al. JAMA Oncol. 2019 Jul 1; 5(7):993-998. DOI: 10.1001/jamaoncol.2019.0684

[25] Tempero et al. Ann Oncol. 2021 May; 32(5):600-608. DOI: 10.1016/j.annonc.2021.01.070