ISSUED ON BEHALF OF ONCOLYTICS BIOTECH

Groundbreaking breast and pancreatic cancer data suggest Oncolytics Biotech (NASDAQ: ONCY) (TSX: ONC) is vastly undervalued—but not for long.

Every so often, a biotech company achieves clinical milestones that could redefine treatment paradigms, yet the market fails to react immediately.

For savvy investors, these moments offer a rare opportunity to get ahead of the curve—before the broader market wakes up.

That’s EXACTLY the scenario unfolding with Oncolytics Biotech (NASDAQ: ONCY) (TSX: ONC).

Recent Phase 2 BRACELET-1 results demonstrated a remarkable 76% estimated improvement in survival for HR+/HER2- metastatic breast cancer patients, and the company is making strides in pancreatic cancer with the PanCAN-funded GOBLET trial.

But here’s the twist: the stock still trades at just $0.90, despite analysts projecting a target of $4.85—a potential upside of over 400%.

In less than FIVE MINUTES, we’ll break down why this overlooked stock could be biotech’s next big success, with examples of how similar companies achieved explosive growth after hitting milestones.

Let’s explore why Oncolytics Biotech (NASDAQ: ONCY) (TSX: ONC) is poised to deliver massive gains.

WHAT Analysts Are Saying + WHY the Market Is Slow to Catch On

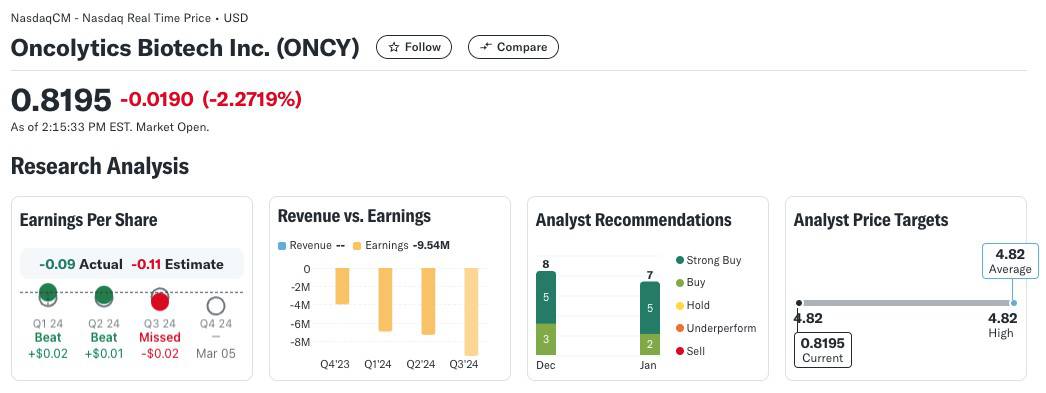

Currently trading at $0.82, Oncolytics Biotech Biotech (NASDAQ: ONCY) (TSX: ONC) presents a compelling opportunity with a 1-year analyst price target of $4.79, representing a potential upside of over 487%. According to data from Yahoo! Finance (taken on January 17, 2025)[1], analysts have issued 8 Buy ratings, including 5 Strong Buys, showcasing strong confidence in the company’s trajectory.

But here’s the surprising part: despite the remarkable results from Oncolytics’ BRACELET-1 Phase 2 trial, the market has yet to fully recognize the company’s potential.

Why hasn’t the market caught on yet?

Studies show that smaller biotech companies often experience delayed stock responses to breakthrough results. The big jumps in share price usually happen after significant milestones like regulatory approvals, pivotal Phase 3 data, or partnerships with major pharmaceutical players.

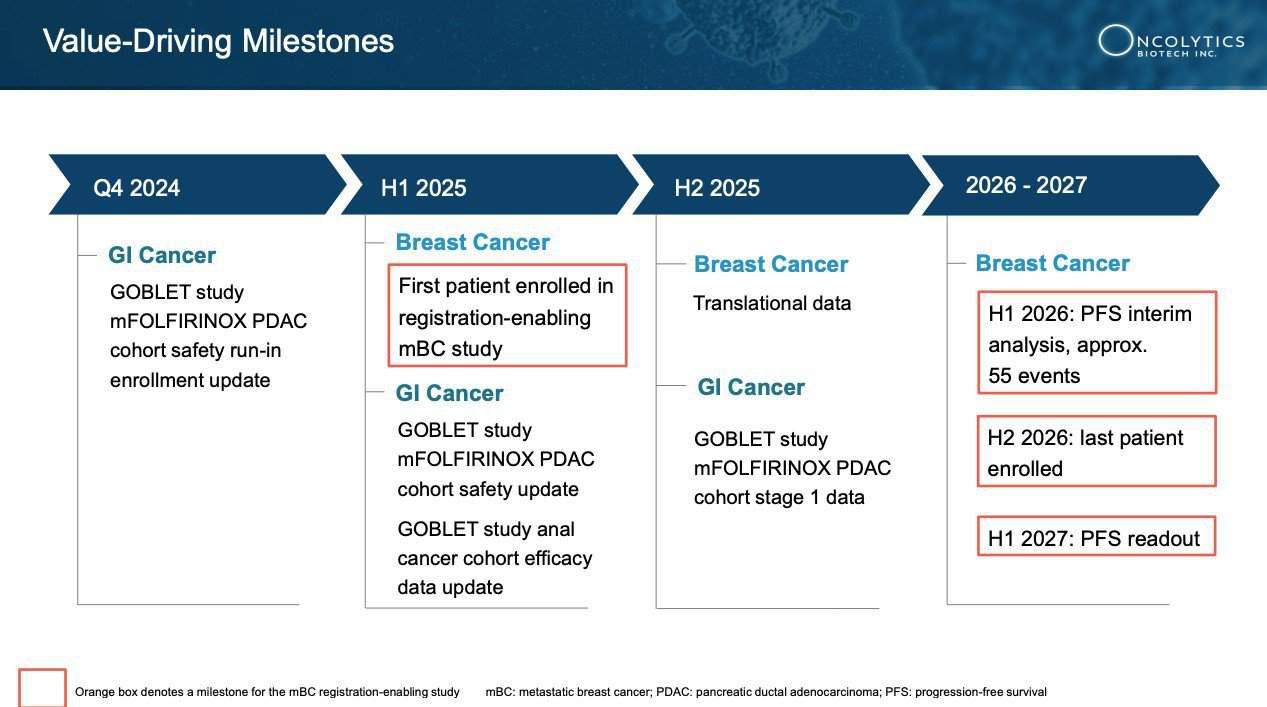

NOW… with Oncolytics progressing toward a registration-enabling study in metastatic breast cancer and advancing its pancreatic cancer program with funding from PanCAN, the stage is set for significant catalysts in 2025.

For investors, this lag in market reaction could be your window to act before the big move.

The analysts see it. The data supports it. And yet, the market hasn’t fully priced in the potential. This is the kind of opportunity that savvy investors dream of—where you can get in before the crowd and reap the rewards as the market finally catches up.

Time is ticking. Don’t let this chance pass you by.

WHAT the Market Missed in BRACELET-1’s Results:

- The Data Was Overwhelmingly Positive, Not Marginal:

- Median overall survival (OS) for pelareorep combined with paclitaxel wasn’t reached, meaning more than half of the patients were still alive at the end of the study. This represents significant long-term survival benefits—a groundbreaking result in metastatic breast cancer.

- Unmatched OS Improvement:

- The estimated median OS of 32.1 months versus 18.2 months in the control arm is a 76% improvement. In the world of clinical trials, this is exceptional, but for breast cancer specifically, it’s transformative.

- The Market Underreacted:

- Despite these promising results, the market failed to respond meaningfully. Stocks often move on sentiment rather than data, and the current sentiment failed to appreciate the magnitude of this breakthrough. However, savvy investors can spot the disconnect—this is a moment to act before the market corrects itself.

How Does Oncolytics Stack Up to Comps?

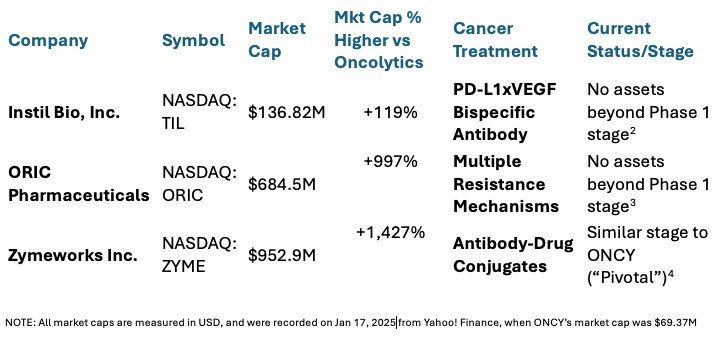

In the oncology space, Oncolytics Biotech (NASDAQ: ONCY) (TSX: ONC) stands out for its Phase 2 success in metastatic breast cancer and its advanced pancreatic cancer program.

To illustrate its potential, we compare Oncolytics to two groups of companies: larger peers with higher market caps but less clinical progress and past biotech stocks that experienced exponential growth at similar stages.

Group 1: Larger Market Caps, Earlier-Stage Pipelines

Several companies are currently valued far higher than Oncolytics Biotech (NASDAQ: ONCY) (TSX: ONC) but are in earlier stages of clinical development. This creates a discrepancy between their market value and Oncolytics’ potential, as pelareorep progresses through trials with promising results.

Here’s a look at the companies with larger market caps but behind in the trial process compared to ONCY, which, as of January 17, 2025, was just over $62M.

Group 2: Case Studies of Biotech Stocks That Surged

As we’ve seen before, smaller biotech companies like Oncolytics often experience delayed market reactions to positive trial data[5],[6].

The companies below were in similar positions, with their stock prices surging after releasing key clinical data or hitting major regulatory milestones.

These examples show how the market catches up when the full potential becomes undeniable.

Case Study 1: Candel Therapeutics Inc. (NASDAQ: CADL)

- Market Cap Surge: $19.52M to $318.27M (Nov 2023 – May 2024)

- Catalyst: Candel’s stock took off after positive Phase 2 data in pancreatic cancer[7], reporting a 130% improvement in median overall survival (OS) over the control group—a strong comparison to Oncolytics’ 76% improvement in breast cancer.

- Relevance: Both companies focus on oncology with strong clinical data. Candel’s market cap jumped from ~$20M to over $300M, echoing Oncolytics’ current size and potential for a similar run.

Case Study 2: ADC Therapeutics SA (NYSE: ADCT)

- Market Cap Surge: $37.75M to $439.75M (Nov 2023 – May 2024)

- Catalyst: ADC Therapeutics surged after positive Phase 2 lymphoma data[8]. The significant rise was driven by strong clinical results, just as Oncolytics is poised to leverage its breast cancer results.

- Relevance: Like Oncolytics, ADC is focused on oncology, and its Phase 2 success led to a huge market cap increase—proof that positive data in this space can trigger massive stock gains.

Case Study 3: G1 Therapeutics Inc. (NASDAQ: GTHX)

- Market Cap Surge: $58.03M to $405M (Oct 2023 – Sep 2024)

- Catalyst: G1’s rise was fueled by post hoc analyses from its Phase 2 metastatic triple-negative breast cancer (mTNBC) trial[9], showing improved OS with subsequent therapies.

- Relevance: As another oncology company with a direct breast cancer focus, G1 offers a compelling comparison to Oncolytics, showing how successful Phase 2 results can drive significant growth in market value and eventually lead to an acquisition, as G1 was acquired by Pharmacosmos in mid-September 2024,[10] less than a year after the catalyst for a nearly 600% increase over that duration.

**Bonus**: Pancreatic Cancer Program

While breast cancer is the focus, Oncolytics’ pancreatic cancer program also shows promise, with prior trials demonstrating remarkably improved OS and PFS in pancreatic cancer patients, garnering FDA Fast Track Designation.

Don’t Miss This Opportunity!

The market hasn’t caught on yet, but when it does, Oncolytics Biotech could soar. With analysts predicting a +487% upside and a registration-enabling study on the horizon, now’s the time to act. The data is strong, and those who see the opportunity now could reap the rewards.

Click here to learn more about why Oncolytics is one of the most undervalued biotech stocks today.

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Oncolytics Biotech Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Oncolytics Biotech Inc. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Oncolytics Biotech Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[2] https://instilbio.com/pipeline/

[3] https://oricpharma.com/pipeline/

[4] https://www.zymeworks.com/pipeline/

[5] https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0272851

[6] https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0071966

[7] https://ir.candeltx.com/news-releases/news-release-details/candel-therapeutics-announces-positive-interim-data-randomized

[8] https://ir.adctherapeutics.com/press-releases/press-release-details/2023/ADC-Therapeutics-Announces-Initial-Results-from-Investigator-Initiated-Phase-2-Clinical-Trial-Evaluating-ZYNLONTA-in-Combination-with-Rituximab-in-Patients-with-RelapsedRefractory-Follicular-Lymphoma-FL/default.aspx

[9] https://investor.g1therapeutics.com/news-releases/news-release-details/g1-therapeutics-presents-new-post-hoc-analyses-indicating

[10] https://www.globenewswire.com/news-release/2024/09/18/2948213/0/en/Pharmacosmos-Group-and-G1-Therapeutics-Announce-Successful-Closing-of-Tender-Offer.html