Stock Markets

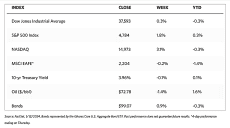

All the major stock indexes ended higher for the week. The Dow Jones Industrial Average (DJIA) realized a modest gain of 0.34% while its Total Stock Market rose by 1.70% for the week. The broad S&P 500 Index advanced by 1.84%. Meanwhile, the technology-heavy Nasdaq Stock Market Composite surged ahead by 3.09%, outperforming the DJIA, the S&P 500, and the NYSE Composite which inched up by 0.25%. The CBOE Volatility Index (VIX), which measures investor risk perception, dipped by 4.87%. Large-cap growth stocks outperformed the broader market as did the Nasdaq technology stocks. Friday this week was the unofficial end of the earnings season, with the country’s four largest banks (Citigroup, Bank of America, JPMorgan Chase, and Wells Fargo) reporting fourth-quarter results on that day.

Stocks showed some weakness on Thursday morning when the Labor Department released the consumer price inflation data, indicating that investors were closely watching inflation results. While the CPI was slightly higher than expected, core CPI (excluding food and energy) was in line with consensus estimates. For the whole of 2023, core CPI rose by 3.9%, the slowest 12-month pace since mid-2021. Markets will remain closed in the coming Monday in observance of Martin Luther King, Jr. Day.

U.S. Economy

While consumer price inflation was moderately troubling, the produce price data released on Friday was more encouraging. The headline wholesale prices receded by an additional 0.1% in December, the third straight month that they declined. PPI rose 0.1% while core PPI rose by 1.8% for the whole of 2023, lower than expected and below the overall inflation target set by the Federal Reserve at 2.0%. With the start of the New Year, the labor market appeared to be in a healthy condition. Some 202,000 workers filed for unemployment benefits in the first week of January, according to reports by the Labor Department. This figure is well below expectations, as well as the lowest since mid-October. The report also indicated that 1.83 million filed continuing claims, likewise the lowest since October.

This week also saw the release of two surveys that indicated that consumers and small business owners remained wary concerning the economic outlook, although to a lesser degree than in recent months. Among investors, the rise in optimism seemed palpable which is likewise reflected in the strong performance of the stock market in December. Despite small business owners remaining pessimistic, the NFIB Small Business Optimism Index still rose more than expected and hit its highest level since July. The yield on the benchmark 10-year U.S. Treasury note fell back below 4% over the week, indicating that fixed-income investors were mostly unmoved by the modest upside performance in the consumer inflation data.

Metals and Mining

The gold market remains strong in the opening weeks of the new year as geopolitical uncertainties in the Middle East continued to provide demand for safe-haven assets. The recent interest in the approval of a Bitcoin ETF, while making waves, is not foreseen to make a strong impact on the gold market, unlike its effect in 2021. It became evident in the last two years that when uncertainty is high, investors return to investments that they can hold and have tangible value. Compared to cybercurrencies, gold is an investment with thousands of years of history as a reliable store of wealth. Although demand may be sluggish central banks continue to accumulate gold almost as quickly as it is mined out of the ground. The People’s Bank of China began buying gold in December and just this past week bought nine tons of this precious metal.

This week, the spot prices of precious metals generally moved sideways. Gold gained 0,18% from its closing price last week of $2,045.45 to close this week at $2,049.06 per troy ounce. Silver neither moved up nor down, remaining at its price last week of $23.19 per troy ounce. Platinum slid by 5.45% from its price in the previous week of $964.18 to its closing price this week of $911.64 per troy ounce. Palladium lost 5.12% of its previous week’s closing price of $1,030.56 to end this week at $977.83 per troy ounce. The three-month LME prices of industrial metals were mostly down. Copper came down by 1.47% from its closing price one week ago at $8,463.00 to its closing price this week at $8,339.00 per metric ton. Zinc lost 1.89% of its last price in the previous week of $2,562.50 to end this week at $2,514.00 per metric ton. Aluminum ended lower by 2.38% from its previous week’s close at $2,273.50 to end this week at $2,219.50 per metric ton. Tin remained hardly changed, inching up by 0.04% from its close a week ago at $24,622.00 to its close this week at $24,631.00 per metric ton.

Energy and Oil

Multiple tankers were prompted to divert from the Suez Canal, with Danish shipping company Torm joining the ranks of European companies currently avoiding the Red Sea transits. This continued as the tensions in the region escalated, culminating with the largest US/UK attack on Houthi positions since the start of Operation Prosperity Guardian. The militaries of the United States and the United Kingdom embarked on joint strikes against Houthi militant targets in Yemen. Targets of the assault were radars as well as missile and drone-launching sites of the terrorist group, prompting a call from Saudi Arabia for restraint in the Red Sea area. As a consequence, for the first time in 2024, ICE Brent futures have traded above the $80 per barrel mark. The upside in oil, and possibly even more so for gas, appears to be far from over as the shipping industry tilts towards a blanket ban on all transits through the Bab el Mandeb Strait.

Natural Gas

For the report week beginning Wednesday, January 3, to Wednesday, January 10, 2024, the Henry Hub spot price rose by $0.63 from $2.60 per million British thermal units (MMBtu) to $3.23/MMBtu. The closing Wednesday was the second consecutive day that the Henry Hub was above $3.20/MMBtu. The last time the Henry Hub price was at $3.00/MMBtu or above for more than one day was in early November 2023. Regarding Henry Hub futures prices, the price of the February 2024 NYMEX contract increased by $0.371, from $2.668/MMBtu at the start of the report week to $3.039 at the end of the week. The price of the 12-month strip averaging February 2024 through January 2025 futures contracts rose by $0.142 to $3.008/MMBtu, with higher prices next winter driving up the 12-month average. The January 2025 futures contract advanced to higher than $4.00/MMBtu on January 9, which is significantly higher than futures prices for all other months in the strip.

For this report week, international natural gas futures prices decreased. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.12 to a weekly average of $11.44/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.03 to a weekly average of $10.35/MMBtu. In the week last year corresponding to this report week (for the week starting January 4 and ending January 11, 2023), the prices were $27.67/MMBtu in East Asia and $22.02/MMBtu at the TTF.

World Markets

The lack of any strong indications as to where interest rates are headed brought little activity to European stocks over the week. The pan-European STOXX Europe 600 Index ended the week practically unchanged as traders weighed the likelihood of interest rates staying higher for longer than they expected. Major stock indexes were mixed but the German DAX, French CAC 40 Index, and Italian FTSE MIB registered modest gains. The UK’s FTSE 100 Index dipped by 0.84%. European government bond yields were volatile for the week, due to dovish comments made by policymakers at the European Central Bank (ECB) being offset by moderating market expectations that an interest rate cat will materialize soon. Germany’s benchmark 10-year government bond yield closed the week close to 2.2%, while in the UK, the yield on the benchmark 10-year government bond inched upward in response to November data showing Britain’s economy grew slightly more than expected.

In Japan, strong gains were registered in the stock markets after a holiday-shortened week that opened on Tuesday. The Nikkei 225 Index surged by 6.6% while the broader TOPIX Index jumped by 4.2%. The indexes rallied to their highest levels in almost 34 years, bolstered by the continuation of highly stimulative monetary policy and weakness in the yen that boosted Japan’s exports. The yen hovered at its lowest levels in a month, softening beyond JPY 145 against the U.S. dollar. Hot U.S. inflation reports reduced expectations regarding the time it would take before the Federal Reserve would decide to cut interest rates. The yield on the 10-year Japanese government bond (JGB) held at around 0,6% during the week as it searched for a clear direction.

Chinese stocks descended after data revealed that China’s deflationary cycle continued into December and raised expectations of increased government support in 2024. The Shanghai Composite Index dropped by 1.61% while the blue-chip CSI 300 fell by 1.35%. The Hong Kong benchmark Hang Seng Index declined by 1.76%. The country’s CPI fell by 0.3% year-on-year in December. This is the third monthly decline, coming from November’s 0.5% dip as food prices were weighed down by lower pork prices. The producer price index fell by 2.7% from one year ago compared with November’s 3% decline, marking the 15th monthly reduction. The most recent inflation data raised some analysts’ expectations that China’s central bank may lower its key policy rate and infuse the financial system with more cash at its next policy meeting, on concerns that the economy may succumb to sustained deflation. In the meantime, China’s exports rose by a better-than-expected 2.3% year-on-year in December, following 0.5% growth in November.

The Week Ahead

Among the important economic data scheduled to be released in the coming week are retail sales and building permits for December. as well as industrial production and capacity utilization for the same month.

Key Topics to Watch

- Empire State manufacturing survey for January

- Fed Gov. Christopher Waller speaks

- Import price index for December

- Import price index minus fuel for December

- U.S. retail sales for December

- Retail sales minus autos for December

- Fed Vice Chair for Supervision Michael Barr speaks (Jan. 17)

- Gov. Michelle Bowman speaks

- Industrial production for December

- Capacity utilization for December

- Business inventories for November

- Fed Beige Book

- New York Fed President John Williams delivers opening remarks

- Atlanta Fed President Raphael Bostic speaks

- Initial jobless claims for Jan. 13

- Philadelphia Fed manufacturing survey for January

- Housing starts for December

- Building permits for December

- Consumer sentiment (prelim) for January

- Existing home sales for December

- Fed Vice Chait for Supervision Michael Barr speaks (Jan. 19)

- San Francisco Fed President Mary Daly speaks

Markets Index Wrap-Up