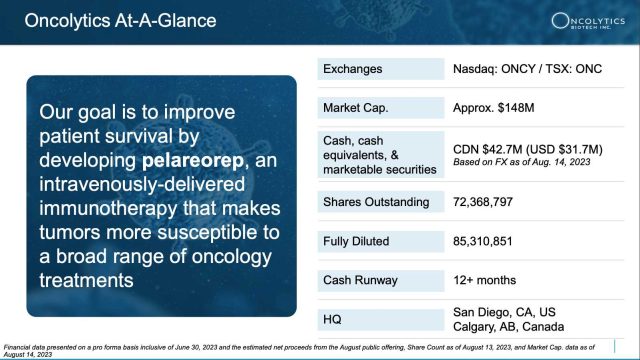

After an Astounding Surge in Patient Response Rate in their GOBLET Study and Earning an FDA Fast Track Designation, Wall Street Analysts are Touting Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) as a Universal STRONG BUY Rating, and Eyeing a Potential $15.00 Price Target (Currently at $2.20). Don’t Miss this Chance to Explore this Rising Star in Cancer Research. Get Ahead of this News TODAY!

Issued on behalf of Oncolytics Biotech Inc.

Cancer is gripping the headlines and our lives with a frightening new urgency. Once a concern mainly for older adults, startling data reveals that early-onset cancer rates have surged 79% among those aged 15 to 49 since 1990.[1], [2]

It’s a crisis in plain sight, affecting younger generations at an alarming rate.

Take pancreatic cancer as a harrowing example. This year alone, an estimated 64,050 Americans will be diagnosed with this deadly disease, and tragically, over 50,000 will not survive.[3]

The trend is especially stark among young women, most notably in the Black community.[4] Clearly, the need for innovative cancer treatments is reaching a fever pitch.

The pharmaceutical landscape is taking note of this crisis. Big players like AstraZeneca, Roche, and Pfizer are pouring billions into acquisitions of biotech firms pioneering groundbreaking cancer treatments. [5],[6],[7],[8],[9],[10]

The focus is on powerful, targeted drugs that could rewrite the narrative of this debilitating illness.

In this critical landscape, one company has recently received significant validation for its contributions to pancreatic cancer research:

Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC)

Not only has it been awarded a $5M grant[11] from PanCAN, the Pancreatic Cancer Action Network, but its flagship asset, pelareorep, has also been selected for PanCAN’s ground-breaking Precision Promise pivotal Phase 3 clinical trial.

Now, with the $5M grant in hand, Oncolytics Biotech can continue the next stage of its research focused pelareorep, including pursuing a new combination with modified FOLFIRINOX chemotherapy with or without an immune checkpoint inhibitor. Previous to the award, ONCY successfully raised another US$15 million in order to continue the advancement of its pelareorep clinical programs in both pancreatic and metastatic breast cancers, with significant support from an institutional investor.[12]

Late in 2022, pelareorep earned the FDA’s Fast Track Designation[13] for treating advanced/metastatic pancreatic cancer.

With promising drug trials, impressive presentations on the horizon, and an industry ripe for their advancements, let’s now take a deeper look at Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC)—a small company ready to take a giant leap in the fight against cancer.

8 Reasons Why Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) and Pelareorep Could Be Big News in Cancer Treatment

1 Top-Notch Collaborations: Pelareorep is attracting big names in the business. Not only have they been selected by PanCAN to feature in a pivotal Phase 3 clinical trial, but they’re also teaming up with well-known companies like Pfizer, Merck KGaA, Roche, and Adlai Nortye. They’re also working with Merck & Co., Bristol-Myers Squibb, and Incyte.

2 Better Response Rate: Pelareorep’s response rate in pancreatic cancer is nearly 3X better than existing treatments[14]. This means it helped more patients fight off their cancer more effectively.

3 Complete Response Recorded: A complete response is when the cancer disappears entirely. This is a big deal. It happened to 1 out of 13 pancreatic cancer patients in the GOBLET study treated with pelareorep. That’s a MUCH higher rate than a previous trial[15] that had just one complete response out of 861 patients.

4 Fast Track Stamp: The FDA has given pelareorep a ‘Fast Track’ designation. This means the treatment could be available sooner to those who need it most. The FDA is fast-tracking pelareorep’s use with another cancer drug called atezolizumab and chemotherapy for advanced pancreatic cancer.

5 Boosting Other Treatments: Pelareorep can be used with immune checkpoint inhibitors (ICI), a type of drug that can be effective in fighting cancer, but only works for some people. Pelareorep might help more patients benefit from these inhibitors. The ICI market is expected to hit around US$168.76 billion by 2032[16], despite as few as 1 in 5 patients responding to ICI therapy[17].

6 Exciting Data on the Horizon: Oncolytics Biotech has already shared promising data about pelareorep, and there’s more to come. They are expected to deliver new information from their colorectal cancer and pancreatic cancer cohorts of the GOBLET trial in the second half of 2023, which many believe could lead to further advances. As well, pelareorep was chosen for inclusion in PanCAN’s Precision PromiseSM pivotal phase 3 platform trial, which is expected to open in early 2024.

7 Experienced Team: The team behind pelareorep knows what they’re doing. They have over 150 years of combined experience in drug development and the biopharmaceutical industry.

8 Well-Funded: Oncolytics Biotech is in a good financial position. Now with a recent $5M grant award from PanCAN, and an additional US$15M raised with the support of a significant institutional investor, they have enough money to cover their key projects for the next 12 months and beyond.

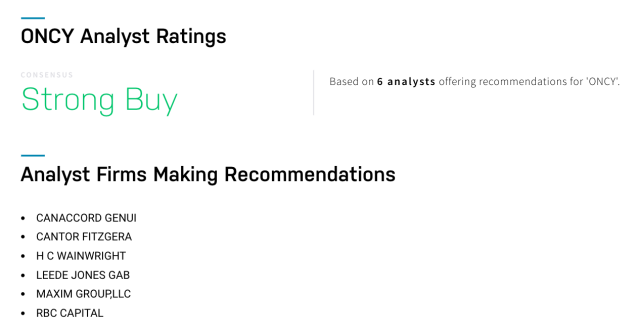

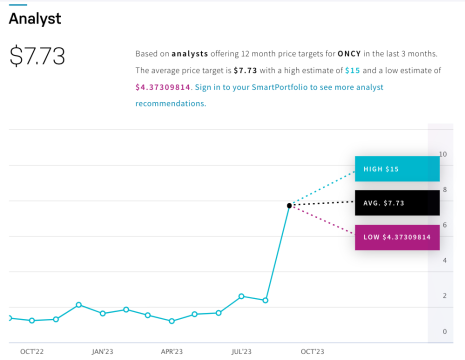

The Experts’ Verdict: A Strong Buy

According to the consensus of analyst ratings on NASDAQ.com, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) is receiving a STRONG BUY rating from experts.[18] With an average price target of $7.73 and a high estimate of $15, they’re expecting a significant jump from its current share price of ~$2.20 as of September 29, 2023.

That’s a potential-high projected growth of nearly 6x its current price, or an increase of +580%!

So, what are these analysts seeing that the rest of the market might be missing?

So, what are these analysts seeing that the rest of the market might be missing?

While we can’t speak for them, we believe it should be crystal clear by now why ONCY is one of the most promising opportunities we’ve spotted in years.

You’ve already seen why Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) is a star in the making, what’s coming down the pipeline very soon, and why NOW is the ideal time for investors to take action.

Big Pharma -> Big Cancer Investments

In the ever-evolving landscape of cancer treatment, pharmaceutical giants are making monumental moves.

For example, Pfizer acquired Trillium for $2.3 billion[19], a firm that has developed two innovative drugs aimed at boosting the body’s natural defenses against cancer. They didn’t stop there; Pfizer also shelled out $43 billion[20] to acquire Seagen, another pioneer in cancer treatment solutions.

Not to be outdone, Amgen is on the brink of closing a $27.8 billion deal[21] with Horizon Therapeutics. Horizon caught everyone’s attention by crossing significant FDA hurdles with their new cancer drug[22]. Similarly, Takeda, a behemoth in Japan, is collaborating with Hutchmed from Hong Kong, dedicating up to $1.13 billion[23] in developing a colorectal cancer drug. This indicates that the race for effective treatments is a global pursuit.

AstraZeneca is making waves as well, with their drug, Enhertu, gaining praise for its effectiveness against breast cancer. [24] The drug is nearly twice as effective as other treatments, revolutionizing expectations for patient outcomes.

Sanofi is also throwing its hat into the ring, having acquired Synthorx for $2.5 billion[25]. This purchase gives Sanofi access to a drug that takes the best parts of older treatments while eliminating the negative side effects.

Last but not least, Roche’s acquisition of Genentech for $47 billion back in 2009 has paid off significantly. Genentech’s portfolio of top-selling cancer drugs escalated from $7 billion in 2008 to a staggering $21 billion by 2018. [26]

What does this mean for Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC)?

It means that Oncolytics is well-positioned to become a crucial player in this competitive and rapidly expanding landscape. With their flagship asset, pelareorep, already selected for the PanCAN Precision Promise pivotal Phase 3 clinical trial, the company is on the brink of groundbreaking advancements in pancreatic cancer treatment.

What’s more, PanCAN’s recent $5 million grant award underscores the promise and potential of pelareorep, solidifying its role as a catalyst for innovation in the fight against this devastating disease.

The pattern is clear: pharmaceutical titans are willing to invest billions to acquire companies with promising cancer treatment assets. Given Oncolytics Biotech’s emerging success, especially in the realm of pancreatic cancer—a disease with rising incidence rates in younger populations—the company could very well be on the radar for potential acquisition by industry giants. It’s not just about the money; it’s about the accelerating need for effective treatments and the companies that are agile and innovative enough to meet that demand.

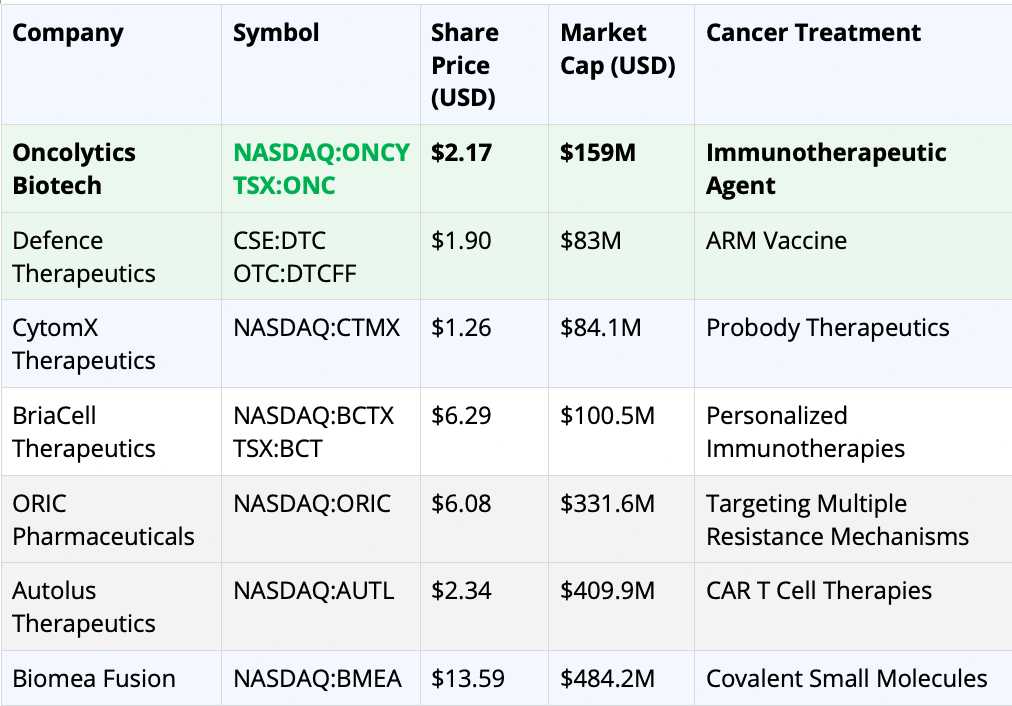

ONCY Among Its Peers

Now let’s look at how Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) stacks up to its peers as a potential takeout target in the future by pharma giants looking for an oncology winner:

*Share price and market cap taken from Yahoo Finance on midday September 29, 2023

In the world of cancer treatment, companies are always racing to find the next big thing. Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) stands out in this busy field, and here’s why.

Share Price & Market Cap

First, let’s talk numbers. Oncolytics Biotech has a share price of $2.17 and a market cap of $159 million. That’s a pretty strong position compared to companies like Defence Therapeutics and CytomX Therapeutics, whose market caps are approximately $100 million. It means Oncolytics has more financial muscle to push its research and grow its business.

Treatment Focus

Oncolytics is working on an “immunotherapeutic agent,” which is a fancy way of saying it helps your body’s defense system fight cancer better. This is a hot area in cancer research, attracting big investments and interest from pharma giants. Some companies like Autolus Therapeutics are focused on CAR T Cell Therapies, but these are still being tested and could have years to go before getting the final nod from health authorities, whereas pelareorep is already well underway and on the FDA’s radar, having already received Fast Track Designation for breast cancer and pancreatic cancer.

Recent Achievements

Let’s not forget Oncolytics was recently awarded a $5 million grant from PanCAN and was chosen for a critical Phase 3 trial. This shows the industry believes in what Oncolytics is doing and puts the company in a prime spot for future growth or even being bought out by a bigger fish in the pond.

The Bigger Picture

Companies like Biomea Fusion might have a higher market cap ($484.2 million), but they’re focusing on “covalent small molecules,” a different arena from Oncolytics’ focus on immunotherapeutic agents. Different doesn’t mean better, and given the urgency around finding effective cancer treatments, Oncolytics’ direction seems very promising.

Pelareorep vs Pancreatic Cancer

The Urgent Need for Better Pancreatic Cancer Treatments

The Urgent Need for Better Pancreatic Cancer Treatments

Pancreatic cancer is one of the deadliest forms of cancer, requiring urgent attention for effective treatments. Sadly, only about 11.5% of patients survive beyond five years after diagnosis, according to the U.S. National Cancer Institute. Estimates suggest that by 2028, approximately 135,000 people in major markets will need treatment for advanced or metastatic pancreatic cancer[27].

Limited Efficacy of Existing Therapies

Current treatments, such as chemotherapy, show limited effectiveness. For example, when gemcitabine and nab-paclitaxel are used as the first line of defense against pancreatic cancer, they shrink the tumor in only about 25% of cases[28]. Immune checkpoint inhibitors (ICIs) only work for less than 1% of patients[29], highlighting the desperate need for improved options.

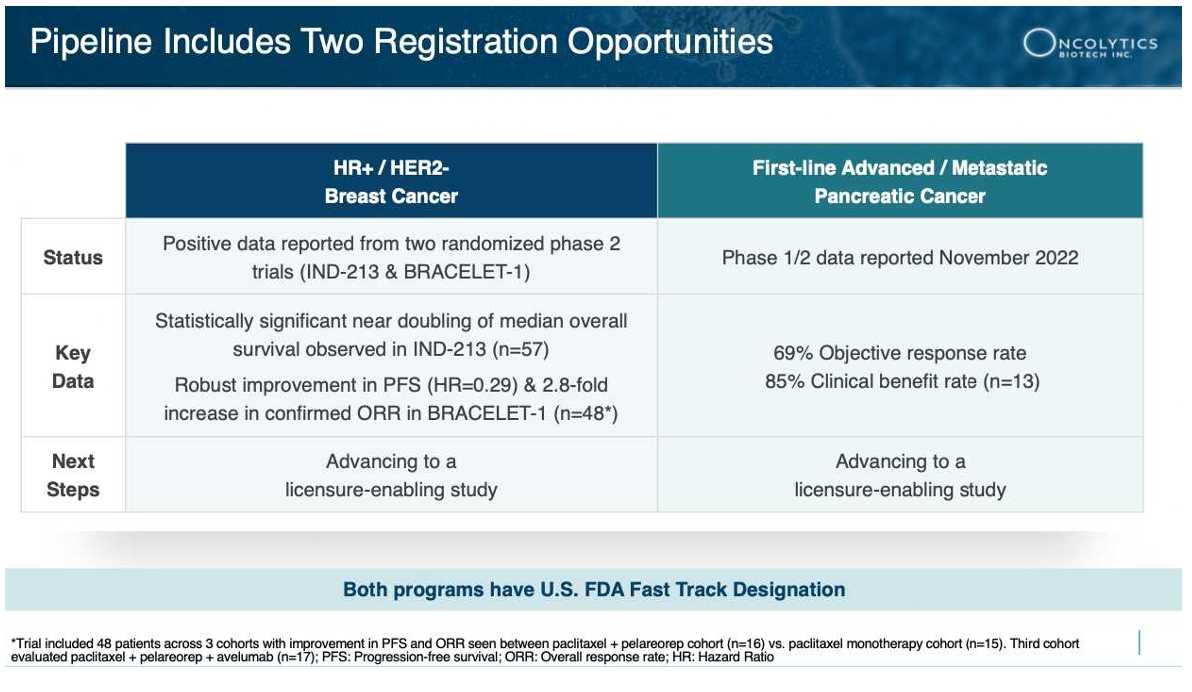

Stunning Results from the GOBLET Study

The GOBLET study, a critical investigation into pelareorep’s effectiveness when combined with atezolizumab (an immune checkpoint inhibitor) and chemotherapy, is painting an extraordinary picture. What’s been unveiled so far is nothing short of remarkable: an unprecedented 69% response rate in the initial batch of evaluated patients.

To fully understand the magnitude of this breakthrough, let’s put it in perspective. Compared to the usual 25% response rate observed with chemotherapy mentioned above, this skyrockets way above the norm, nearly tripling the success rate. It’s not just about the numbers. It’s about the real, tangible hope this offers to patients who have been in dire need of more effective solutions.

PanCAN’s Precision Promise Inclusion

These achievements have not gone unrecognized, as the Pancreatic Cancer Action Network (PanCAN) officially selected pelareorep for inclusion in its innovative adaptive Phase 3 clinical trial, Precision PromiseSM[30]. The Precision Promise study is designed to evaluate pelareorep in combination with a checkpoint inhibitor and the chemotherapeutic agents gemcitabine and nab-paclitaxel. This novel trial is expected to minimize the number of patients required to generate licensure-enabling data, accelerate development, reduce costs compared to a traditional trial, and support approval as a treatment for first-line metastatic pancreatic ductal adenocarcinoma.

Oncolytics expects to open the Precision Promise investigational treatment of pelareorep, a checkpoint inhibitor, gemcitabine, and nab-paclitaxel in early 2024.

As well, PanCAN has recently signaled its level of confidence in pelareorep, by awarding Oncolytics with a $5M grant, to help push further research.

Pelareorep’s FDA Record

FDA Fast Track Designation: A Significant Achievement for Oncolytics Biotech

Recognizing the ground-breaking results from the GOBLET study, the FDA awarded Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) a Fast Track designation in December 2022. This decision came on the heels of Oncolytics’ presentation at the Society for Immunotherapy of Cancer (SITC) 37th Annual Meeting, where they showcased the remarkable 69% objective response rate.

Fast Track designation is a significant milestone. It’s specifically designed to speed up the development and review of therapies that can treat severe conditions and address unmet medical needs. For a therapy to earn this privilege, it has to show a substantial advantage over existing treatments. Pelareorep, demonstrating nearly triple the average response rate compared to existing treatments, fits this bill impressively.

“This Fast Track designation is an important accomplishment that speaks to the impressive response rate and the durability of the response in our PDAC study. It also reflects the pressing need to improve upon the standard of care in this indication. We are excited for what’s ahead.”

– Dr. Matt Coffey, President and Chief Executive Officer of Oncolytics Biotech Inc.

Indeed, this designation adds another feather in Oncolytics’ cap, marking a pivotal moment in their journey to bring forward a more effective treatment for pancreatic cancer. As the GOBLET study continues, the anticipation for more positive outcomes grows, and with it, the promise of pelareorep transforming the landscape of cancer treatment.

MEET THE EXPERTS AT ONCOLYTICS BIOTECH

Getting a new medical treatment like pelareorep ready for patients involves many steps and a skilled team. The experts at Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) are just the right people for the job. They have worked at leading companies and universities, such as Amgen, Bristol-Myers Squibb, and Harvard Medical School.

Let’s meet some of them:

Matt Coffey, PhD, MBA – Co-Founder, Director, President & CEO

Dr. Coffey is a cancer expert who has studied how a virus can help fight cancer. His research has been published in many notable scientific journals.

Thomas Heineman, MD, PhD – Head of Clinical Development and Operations

Dr. Heineman is a medical doctor who has spent over 25 years developing new drugs. He’s worked on projects for many types of cancer, including breast and pancreatic cancer, at places like GSK.

Andrew de Guttadauro – Global Head of Business Development

Mr. de Guttadauro has spent over 25 years helping new medical treatments reach patients. He has been a leader at big companies like Vical and Amgen.

Wayne Pisano, MBA – Chair of the Board

Pisano is an award-winning leader in the field of vaccines. He used to be the head of Sanofi Pasteur, one of the biggest vaccine companies in the world.

There are many other talented people at Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) too, from their other leaders to their Board of Directors and Scientific Advisory Board. They have worked at top companies and institutions like Ernst & Young LLP, Amgen, and Princeton University.

For example, Deborah M. Brown, B.Sc., M.B.A. is a Director who helps new medical businesses grow. She’s worked at EMD Serono and is now a leader at Accelera Canada.

Another Director, Bernd R. Seizinger, MD, PhD, is an expert in cancer drug discovery. He’s worked at Bristol-Myers Squibb and held top roles at Harvard Medical School and Princeton University. He’s now on the board of several biotech companies.

In short, Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC) is guided by some of the best minds in the business.

RECAP: 8 Take Aways for

RECAP: 8 Take Aways for

Oncolytics Biotech Inc.

(NASDAQ:ONCY) (TSX:ONC)

1. Top-Notch Collaborations

2. Better Response Rate

3. Complete Response Recorded

4. Fast Track Granted

5. Boosting Other Treatments

6. Exciting Data on the Horizon

7. Experienced Team

8. Well-Funded

BEFORE YOU GO CLICK AWAY!

You’ve made it this far, so it’s clear you’re interested. With big events on the horizon and the progress we’ve already seen, we think NOW IS THE RIGHT MOMENT for savvy folks to keep a close eye on Oncolytics Biotech Inc. (NASDAQ:ONCY) (TSX:ONC).

So, take some time to do your own research, and don’t forget to sign up for email alerts. That way, you’ll stay updated on all the exciting news and milestones from ONCY. We’re here to keep you informed!

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Oncolytics Biotech Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Oncolytics Biotech Inc. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Oncolytics Biotech Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://www.thelancet.com/journals/langas/article/PIIS2468-1253(23)00039-0/fulltext

[2] https://globalnews.ca/news/9938796/cancer-cases-young-adults-study/

[3] https://www.cancer.org/cancer/types/pancreatic-cancer/about/key-statistics.html#:~:text=of%20pancreatic%20cancer-,How%20common%20is%20pancreatic%20cancer%3F,will%20die%20of%20pancreatic%20cancer.

[4] https://www.cedars-sinai.org/newsroom/study-confirms-pancreatic-cancer-rates-rising-faster-in-women-than-men/

[5] https://www.reuters.com/breakingviews/super-chemo-will-be-big-pharmas-next-tussle-2022-05-16/

[6] https://www.forbes.com/sites/greatspeculations/2019/07/10/was-the-47-billion-acquisition-of-genentech-in-2009-a-good-deal-for-roche/?sh=5c78818aa1aa

[7] https://www.fiercebiotech.com/biotech/eat-me-pfizer-swallows-cd47-biotech-trillium-2-3b-takeover

[8] https://www.wsj.com/business/ftc-settles-with-amgen-over-27-8-billion-deal-for-horizon-therapeutics-b96a2d69

[9] https://ir.horizontherapeutics.com/news-releases/news-release-details/horizon-therapeutics-plc-announces-fda-approval-update

[10] https://www.fiercebiotech.com/biotech/sanofi-inks-2-5b-synthorx-takeover-to-gain-il-2-cancer-drug

[11] https://finance.yahoo.com/news/pancreatic-cancer-action-network-selects-120000574.html

[12] https://finance.yahoo.com/news/oncolytics-biotech-successfully-raises-us-125000351.html

[13] https://oncolyticsbiotech.com/press_releases/oncolytics-biotech-receives-fda-fast-track-designation-for-the-treatment-of-advanced-metastatic-pancreatic-cancer/

[14] https://oncolyticsbiotech.com/press_releases/oncolytics-biotech-presents-updated-clinical-data-at-sitc-annual-meeting-showing-a-69-objective-response-rate-and-confirmed-complete-response-in-goblet-studys-pancreatic-cancer-cohort/

[15] https://www.nejm.org/doi/full/10.1056/nejmoa1304369

[16] https://www.precedenceresearch.com/immune-checkpoint-inhibitors-market#:~:text=The%20global%20immune%20checkpoint%20inhibitors,forecast%20period%202023%20to%202032

[17] JAMA Netw Open. 2019 May; 2(5): e192535

[18] https://www.nasdaq.com/market-activity/stocks/oncy/analyst-research

[19] https://www.fiercebiotech.com/biotech/eat-me-pfizer-swallows-cd47-biotech-trillium-2-3b-takeover

[20] https://www.aljazeera.com/news/2023/3/13/pfizer-buys-seagen-for-43bn-boosts-access-to-cancer-drugs

[21] https://www.wsj.com/business/ftc-settles-with-amgen-over-27-8-billion-deal-for-horizon-therapeutics-b96a2d69

[22] https://ir.horizontherapeutics.com/news-releases/news-release-details/horizon-therapeutics-plc-announces-fda-approval-update

[23] https://www.fiercepharma.com/pharma/takeda-makes-113m-deal-hutchmed-cancer-drug-fruquintinib

[24] https://www.reuters.com/breakingviews/super-chemo-will-be-big-pharmas-next-tussle-2022-05-16/

[25] https://www.fiercebiotech.com/biotech/sanofi-inks-2-5b-synthorx-takeover-to-gain-il-2-cancer-drug

[26] https://www.forbes.com/sites/greatspeculations/2019/07/10/was-the-47-billion-acquisition-of-genentech-in-2009-a-good-deal-for-roche/?sh=5c78818aa1aa

[27] https://stockhouse.com/news/the-market-herald-news/2023/06/15/anatomy-flagship-asset-oncolytics-biotech-s-cancer-immunotherapy

[28] https://www.nejm.org/doi/full/10.1056/nejmoa1304369

[29] Luchini C, Brosens LAA, Wood LD, et al. Gut 2021;70:148–156

[30] https://finance.yahoo.com/news/oncolytics-biotechs-pelareorep-selected-inclusion-110000604.html