Nvidia (NVDA) has cemented its status once more as Wall Street’s market darling after an upbeat AI-fueled earnings call and an outlook that rocked the financial models of already bullish analysts.

Shares of the chip giant exploded 27% in trading on Thursday as results trounced analyst estimates. The company’s ticker page was the most active on the Yahoo Finance platform, followed closely by rival chip players such as AMD (AMD) and Intel (INTC).

If the gains in Nvidia hold, the company’s market value would rise more than $200 billion, which would mark the biggest one-day rise in history. Apple’s $191 billion pop in November 2022 is the current record holder.

It was Nvidia’s outlook that truly surprised the investing masses.

The company expects second-quarter revenue to come in at about $11 billion, plus or minus 2%. Wall Street was anticipating $7.2 billion.

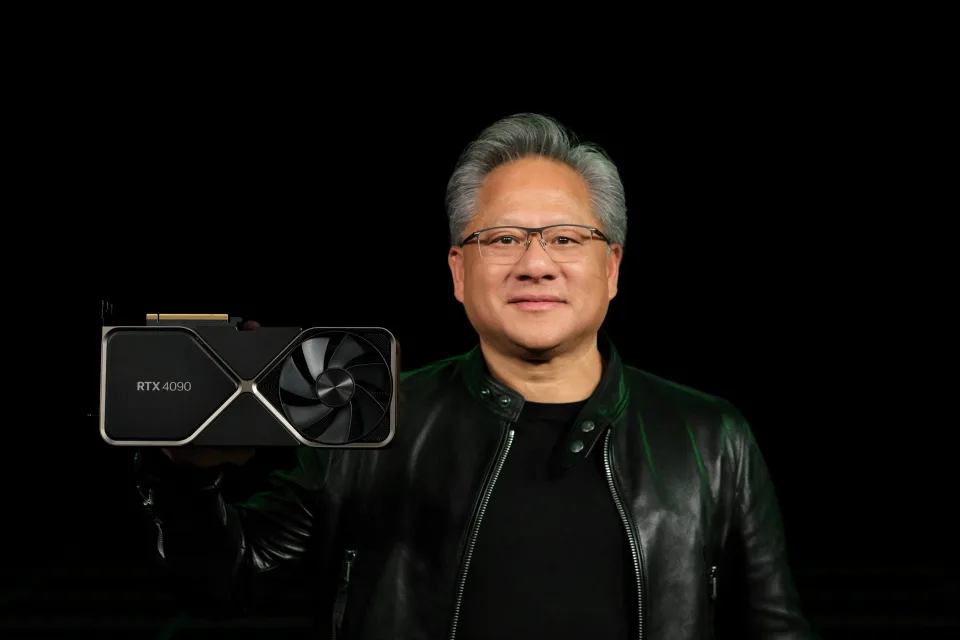

Nvidia founder and CEO Jensen Huang told analysts on the conference call the very upbeat outlook reflects a fundamental shift to accelerated computing. In turn, that places Nvidia’s chips that power generative AI in high demand.

“We’re seeing incredible orders to retool the world’s data centers. And so I think you’re seeing the beginning of, call it, a 10-year transition to basically recycle or reclaim the world’s data centers and build it out as accelerated computing,” Huang said. “You’ll have a pretty dramatic shift in the spend of a data center from traditional computing and to accelerate computing with SmartNICs, smart switches, of course GPUs and the workload is going to be predominantly generative AI.”

Here’s the vibe on Wall Street after Nvidia’s big quarter and outlook.

Ruben Roy, Stifel (Hold rating; $370 price target, up from $300): “Nvidia’s recent momentum continued as first quarter results beat consensus expectations and the company’s second quarter revenue outlook was significantly above high expectations. Nvidia remains in the sweet spot of AI-infrastructure wallet share as build outs of accelerated computing networks continue. As the company’s data center numbers grow, questions on the near-term supply environment are likely to continue. For now, while not providing explicit longer-term guidance, Nvidia management noted that data center-related demand visibility has increased and that the company has procured substantially higher supply for the second half of the year. We raise our estimates and target price and continue to view Nvidia as the best positioned near-term beneficiary of CSP capex spending trends.”

Tristan Gerra, Baird (Outperform rating, upgrade from Hold; $475 price target, up from $300): “We raised our estimates above consensus and added a Fresh Pick designation to Nvidia on March 20 reflecting our channel feedback about strong H100 orders notably related to ChatGPT emerging in March but we failed to upgrade at that time. As AI-related order momentum continues into the second half, annualized earnings of $10 are at reach within 2-3 quarters in our view, reflected in the valuation post earnings. Our raised next two-year EPS forecast assumes continued AI-related momentum driven by two secular growth trends: continued adoption rate for parallel processing-based acceleration in data centers, and the emergence of AI models notably related to ChatGPT and LLMs [large language models], all of which require GPUs.”

Atif Malik, Citi (Buy rating; $420 price target, up from $353): “While we had raised our target price and estimates into the earnings, Generative AI upside was bigger than we expected. Nvidia expects data center sales to roughly double in the July quarter driven by Gen AI demand from CSPs, consumer internet companies, and accelerated computing in enterprises. Nvidia estimates only ~4% of the $1 trillion data center CPU installed base over the last four years has been GPU accelerated, implying AI adoption remains in early innings.”

Dan Ives, Wedbush (no rating/price target): “There is not one better indicator around underlying AI demand going on in the hyperscale/cloud and overall enterprise market than the foundational Nvidia story. We view Nvidia at the core hearts and lungs of the AI revolution given its core chips train and deploy generative AI applications like ChatGPT. The Street was all awaiting last night’s Nvidia quarter and guidance to gauge the magnitude of this AI demand story with many skeptics saying an AI bubble was forming and instead Jensen & Co. delivered guidance for the ages.”

Ross Seymore, Deutsche Bank (Hold rating; $390 price target, up from $170): “After such a massive beat/raise/share price pop, the key question going forward is sustainability. We believe the drivers of it appear to be much more secular than cyclical (AI, DC accelerators crowding out CPUs, etc.), and Nvidia’s lead in this market remains sizable, but we remain uncertain as to the pace of such growth post second quarter and if/when the next DC digestion period may occur. Consequently, we are raising our 2024 revenue/EPS by a significant +37%/+70%, with our price target rising to $390 (based upon a consistent 40x P/E multiple). With Nvidia’s unique AI market leadership and the scarcity of alternative plays, we see little that could diminish investor optimism and recommend continuing to enjoy the ride.”