How EV Automakers Are Gearing Up for New Domestic Claystone Lithium Extraction Tech, Just Like the Halo and ELi Lithium Projects of Clear Sky Lithium (CSE:POWR) (OTC:CSKYF)

According to the Richest Man on Earth[1], Elon Musk, investing in lithium refining is a “License to Print Money.”[2]

Given his role as the most recognizable face of the Electric Vehicle (EV) revolution, Musk has seen first-hand how dire the world’s lithium supply situation has become.

This even led his company Tesla Inc. (NASDAQ:TSLA) file a patent in mid-2021 for a lithium extraction method from clay lithium deposits, in an environmentally friendlier way to secure the metal.[3]

Located only 242 kms away from Tesla’s Gigafactory in Nevada is the 2,024-acre claystone lithium deposit Halo Lithium Project, by Clear Sky Lithium Corp. (CSE:POWR) (OTC:CSKYF), a pureplay lithium company with leadership and planned key partnerships for the technology to develop it.

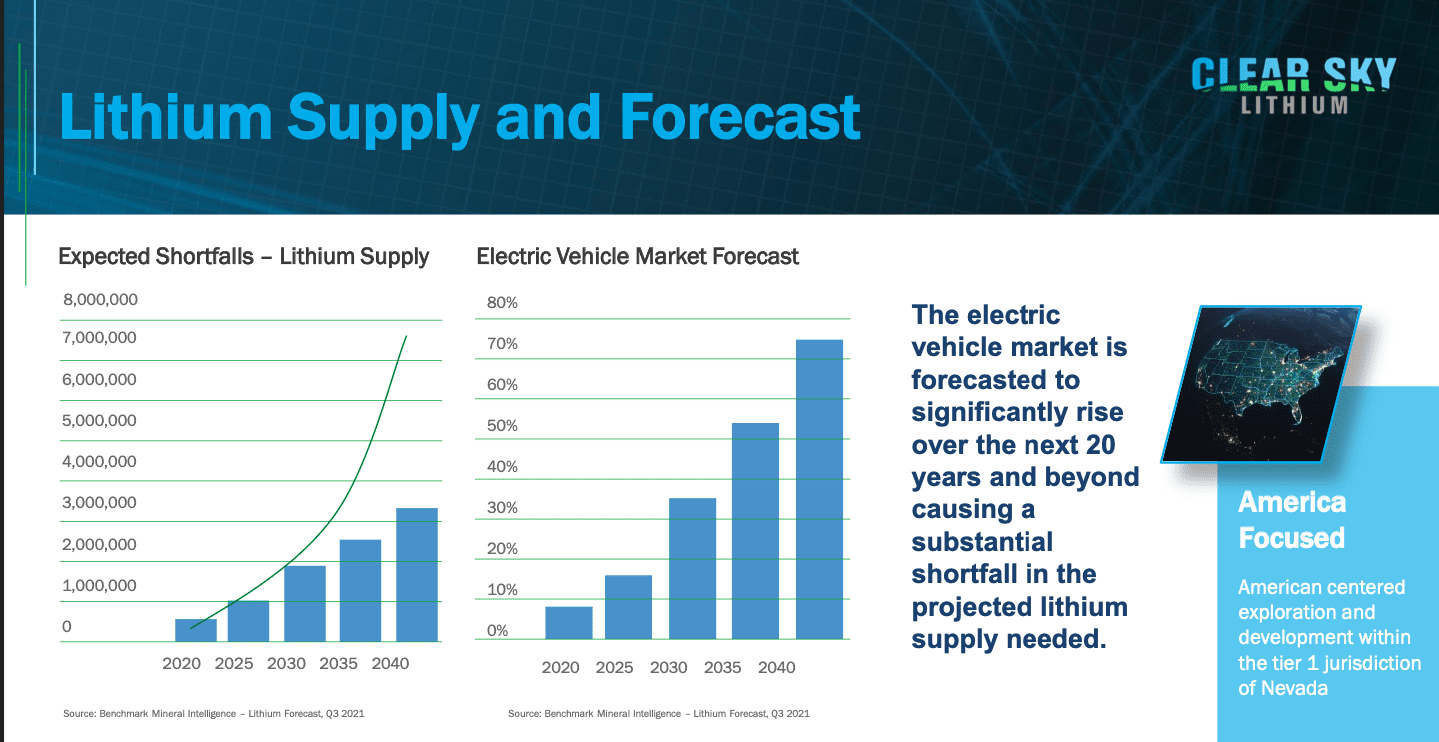

Over the last two years, the price of lithium has risen 13-fold,[4] as battery-quality lithium carbonate prices increased 485.8% year over year.[5]

According to the IEA, demand for lithium is projected to grow by ~40x by 2040.[6]

Analysts warn that the global lithium industry requires another $42 billion in investment just to meet 2030 demand of 2.4 million tonnes LCE—which is 4x the amount of lithium that will be produced in 2022.[7]

It DOESN’T MATTER that in 2021, global mined lithium production hit a record high of 100,000 tonnes—a 21% increase over 2020.[8]

It’s NOT GOING TO BE ENOUGH!

And the automakers can see it, as they frantically secure whatever supplies they can. In 2022 top bids for lithium up 140%, causing Tesla CEO Elon Musk to call the new price point ‘Insane Levels’.[9]

Even Ford Motor Company (NYSE:F) CEO Jim Farley has stated he doesn’t expect the costs of these raw materials to ease in the near future.[10]

Meanwhile, the EU just voted to ban ALL sales of gas/diesel vehicles by 2035.[11]

The Biden Administration has initiated the Defense Protection Act, subtitled “Critical Minerals for Clean Energy Economy”, designed to accelerate domestic manufacturing of clean energy while highlighting a need for a reliable supply chain.[12]

The same government signed the Inflation Reduction Act, which shifted the focus off of tax credits for all EVs, towards domestic vehicles made with domestically produced battery materials.[13]

It’s easy to see how global tensions and major international lithium market shocks[14] are reigniting the need for DOMESTIC lithium supplies:

- Russia/Ukraine conflict and its subsequent sanctions[15]

- Despite the country risks, African nations are getting more attention for their lithium supplies[16]

- China produces 80% of the world’s lithium, yet is still snapping up more[17]

- Inflation reduction act mandates lithium from friendly countries to receive a rebate[18]

- South America’s political shifts may be putting the continent’s lithium supplies at risk in the Lithium Triangle.[19]

- Conventional lithium mining operations are being attacked for not being ESG friendly enough.[20]

It’s impossible to ignore that the time is NOW for smart money to flow into long-term, ESG friendly lithium production, that’s safely located in favorable mining jurisdictions.

Knowing all of this, our research has led us to Clear Sky Lithium (CSE:POWR) (OTC:CSKYF), which checks ALL the boxes.

The Clear Sky Lithium project is located in central Nevada, proximal to THREE of the most favorable mining jurisdictions in the USA, according to the Fraser Institute—and is only 242km away from Tesla’s Gigafactory.

Now let’s dig deeper into the abundant reasons that Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) is poised to potentially revolutionize the way we produce lithium and meet the rapidly growing global demand for batteries in the world ahead.

RECENT NEWS:

- Clear Sky Lithium Partners with Processing Expert to Unlock Claystone Extraction

- Clear Sky Initiates Field Work at ELi Project

- World’s Biggest Graphite Mine Builder, Jean Depatie, Appointed Head Advisor of Clear Sky Lithium

- Clear Sky Initiates Work on Halo Project

- Clear Sky Lithium Reports 1,023ppm Li Grab Sample

10 Reasons to Invest in Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) as the Next Domestic Lithium Game Changer

1 Positioned to Capitalize on Lithium’s Rapid Demand Growth: Driven by the electrification of the globe’s automobile fleets, and the widely spreading green revolution, Clear Sky’s timing is perfect, as the price of lithium continues to skyrocket.

2 Defense Production Act The Biden Administration invoked the act to encourage domestic production of minerals required to make batteries for EVs and long-term energy storage. Under the act, companies that extract materials including lithium can receive government funding for feasibility studies on their domestic projects.

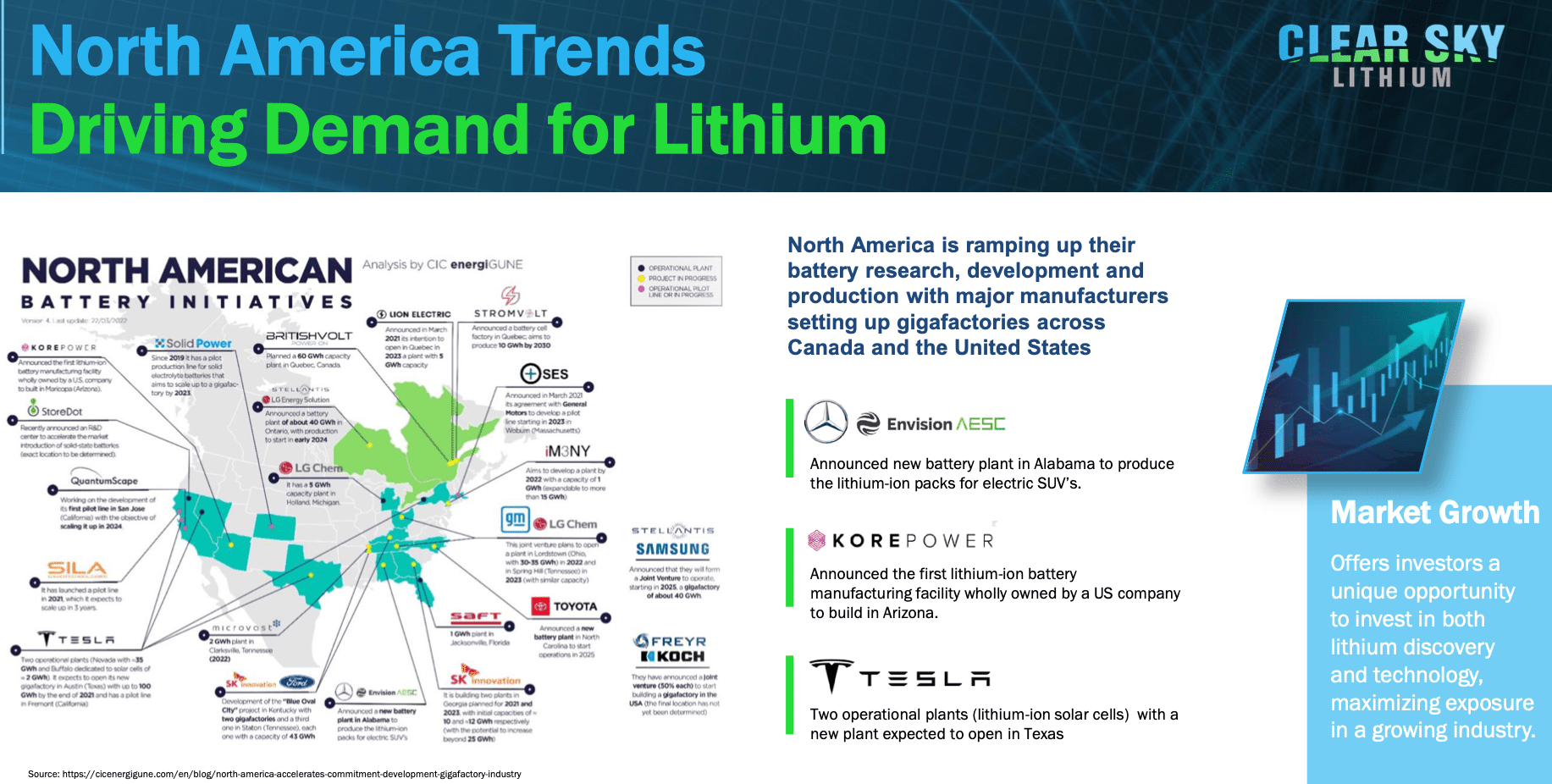

3 Geographic Proximity to North American EV and Battery Production: With the electrification of the economy, Clear Sky is strategically positioned as an integral provider of sustainable raw materials, in an ESG-friendly way.

4 Globally Respected, Favorable Mining Jurisdiction: Located in central Nevada, the Clear Sky Lithium project is proximal to 3 of the most favorable mining jurisdictions in the USA, according to the Fraser Institute.

5 Nevada is Open for Business: According to Nevada Governor, Steve Sisolak, “[Nevada has an] opportunity to become to energy what Wall Street is to finance, or what Silicon Valley is to technology.”[21]

6 Strategically Expanding Footprint: The Clear Sky team is investigating additional property acquisitions that meet strategic development goals for prospective mineralization and accessibility, including the newly acquired Halo Project, comprised of 98 mineral claims, located in Esmeralda and Nye Counties, Nevada.

7 Pedigreed Leadership Team: Led by experienced mining executives with a track record of de-risking and delivering. Also aiding the way for the company in a Strategic Advisor capacity is industry veteran Dave Wright who’s served in a variety of roles with Ingersoll Rand, Maxwell Technologies, New Generation Biofuels, Delphi Packard, HE Microwave, Delco Electronics and GM Advanced Engineering.

8 Proximity to Tesla: Their 100%-owned project consists of a 2,024-acre land package 242km from Tesla’s Gigafactory, with a clay lithium deposit much like the type the automaker has filed a patent for producing.

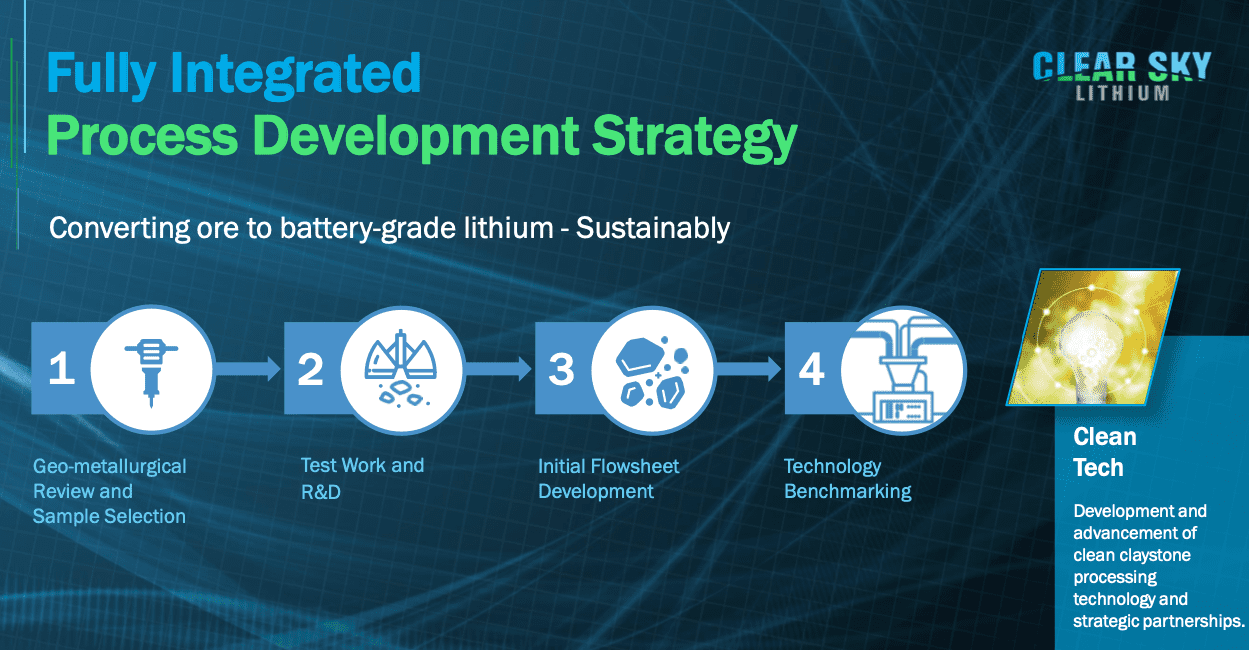

9 Engaged Tech Development: Strategy in place to team with expert minds with the aim to match and tailor processes to commercial demands, timelines and earnings potential. Clear Sky has already engaged MDS Technical for the development and testing of a patented membrane extraction technology tailored towards lithium bearing claystones.

10 Inflation Reduction Act: Within the $370 billion act, the government’s EV rebate manufacturer has been altered to be tied to lithium produced in North America, and not coming from or processed in China where currently 80% of the world’s lithium comes from.

Lithium Demand is Going Bonkers

Lithium expert Joe Lowry (aka “Mr. Lithium”) has already sounded the alarm to the market, warning there’s ‘Not Enough Battery Metal to Go Around’.[22]

Giants in the EV automaker space, including Ford, VW, and other large corporations are scrambling to secure long-term lithium supply deals as quickly as possible, including:

- Stellantis (Italian-American manufacturers of Chrysler, Dodge, Fiat, Jeep Maserati, and more) signed a 10-year deal with Controlled Thermal Resources[23]

- Glencore entered a Long-Term Commercial Agreements and Invested $200 Million into Li-Cycle Holdings

- GM signed a long-term lithium supply agreement with Livent and for Cathode Active Material with LG Chem for a goal of producing 1 million EVs in 2025.[24]

- Tesla released its list of battery metal suppliers, including Albemarle, Livent, Ganfeng (China), and Yahua (China) providing lithium as miners and refiners.

“I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business. We think we’re going to need to help the industry on this front.” – Elon Musk, CEO of Tesla Inc.

It’s very CLEAR that there’s no better time than NOW for innovators to prepare to produce MORE LITHIUM.

Which is why we see Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) as perfectly timed, perfectly located, and perfectly positioned to make a huge impact on the domestic lithium supply in the years to come.

Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) is Targeting a 100%-Owned Claystone Lithium Project in Mining-Friendly Nevada

Currently the ONLY producing lithium mine in the United States is owned and operated by Albemarle and is located in Nevada. It’s in this state that the bulk of the attention in the lithium sector continues.

As stated above, Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) has a strategy to succeed within Nevada, that involves one of the NEWEST deposit types in lithium exploration—claystone lithium.

The company’s intention is to contribute more than just its own lithium supplies, but also through the advancement of critical strategies specific to claystone lithium projects.

This includes extraction selectivity and impurity management, solid/liquid separation, and direct Lithium Hydroxide production.

As far as timing goes, investors are only recently learning about Clear Sky which only began public trading on June 13, 2022.[25] Fortunately for you, it’s still early enough in the story for bigger potential gains to be realized.

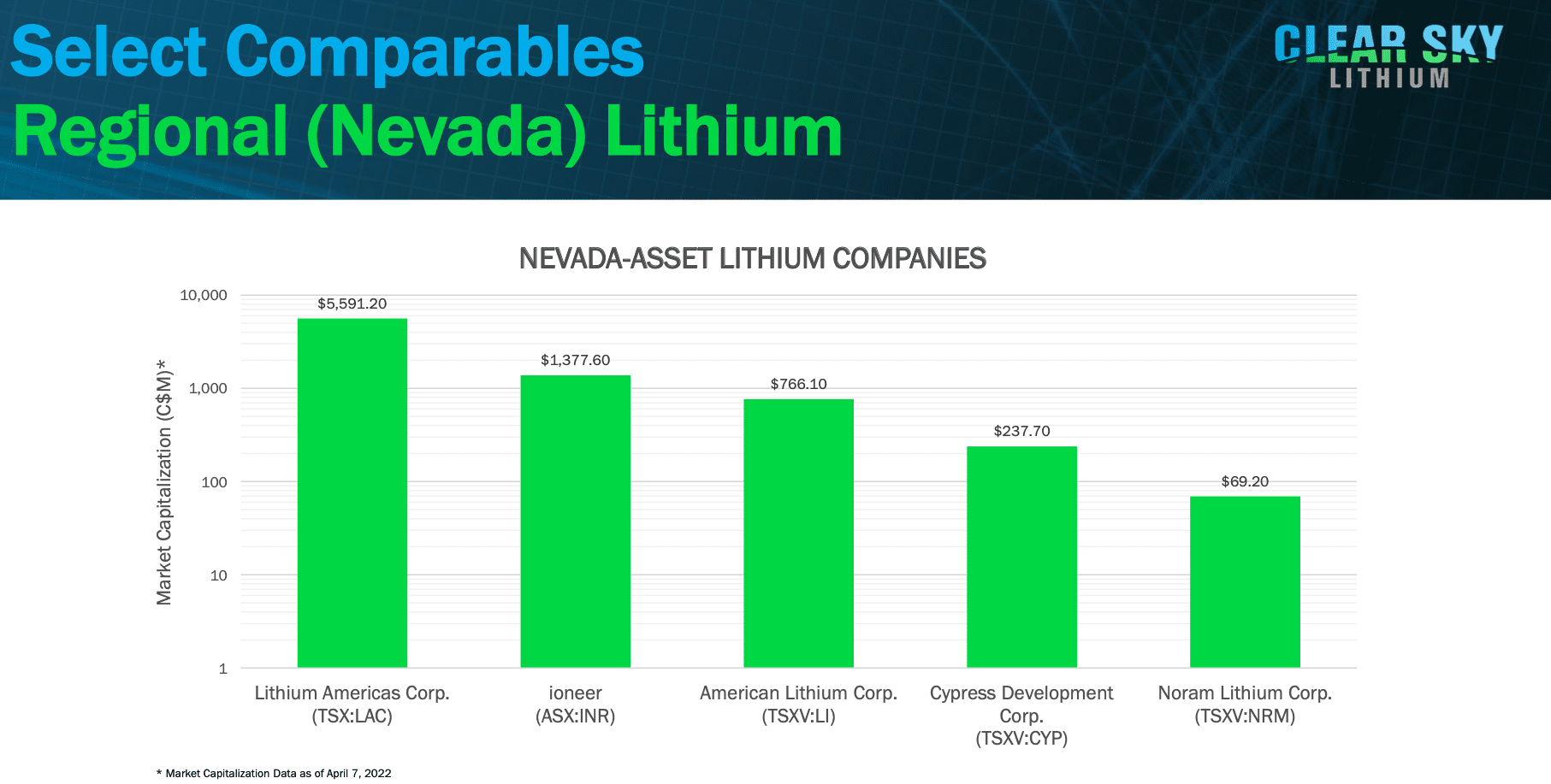

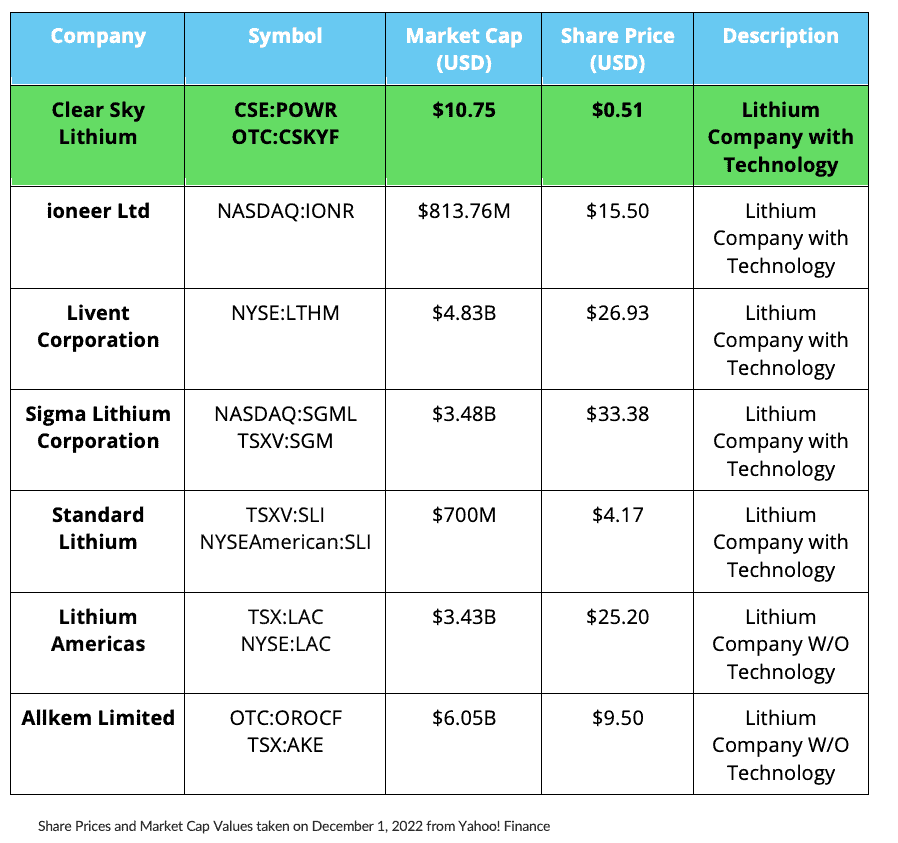

In order to get a better understanding of the true potential for Clear Sky Lithium, one should look to the market comparables those with just a resource, and those with a resource AND technology.

ESG-Friendly Claystone Lithium

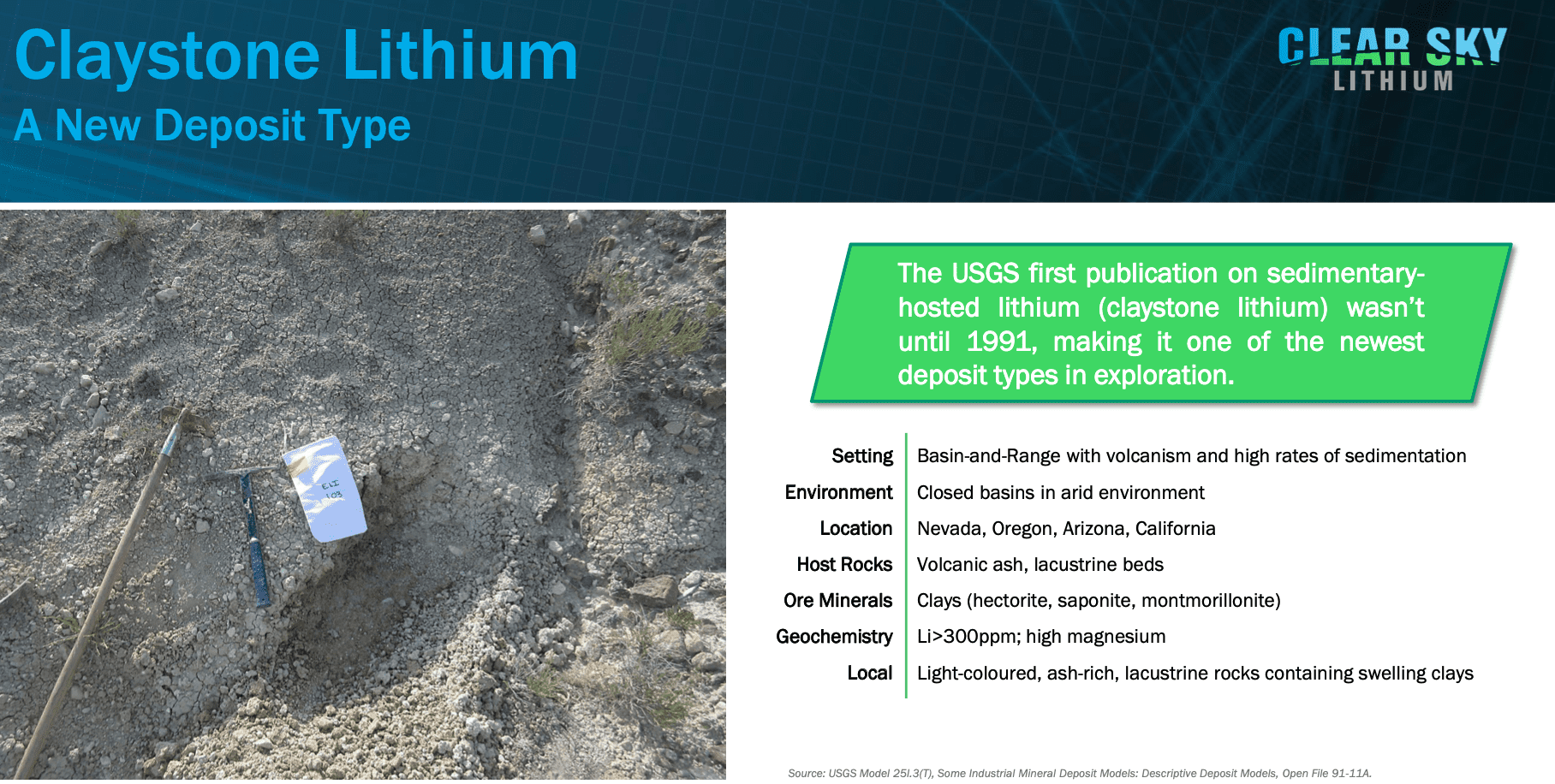

Claystone lithium is a relatively new deposit type, compared to lithium brines or hard rock lithium mining operations. Not until 1991 did the USGS put out its first publication on sedimentary-hosted lithium (claystone lithium).

So now Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) is working on planning its next phase of investigation, including additional surface sampling, geochemistry and mapping, minerology and petrology, as well as geophysics.

One of the biggest selling features of projects like Clear Sky Lithium’s Halo Lithium project, is the fundamental ESG qualities, including the lower environmental impact from a lower carbon footprint to a much lower water footprint.

This is the same type of lithium production that Tesla has openly sought, having submitted a patent application, titled “Selective extraction of lithium from clay minerals”.[26]

Much like Clear Sky’s intentions, Elon Musk said that Tesla is planning on low environmental impact for its mining.

“We take a chunk of dirt in the ground, extract the lithium, and put the chunk of dirt back where it was. It will look pretty much the same as before.” – Elon Musk, CEO of Tesla

Where Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) can contribute more than just its own lithium supplies, but also in the advancement of critical strategies specific to claystone lithium projects. This includes extraction selectivity and impurity management, solid/liquid separation, and direct LiOH production.

The ‘Nevada Advantage’

Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) owns 100% of the 2,024-acre Halo Lithium project in the state of Nevada, which not only houses the famous Tesla Gigafactory and the only currently-producing lithium mine in the USA.

According to the Fraser Institute, in 2020 ranked Nevada as the world’s most attractive mining jurisdiction[27], and continued to rank as a Top 3 jurisdiction in 2021.[28]

Meanwhile, the state’s government is pushing very hard to be to energy what Wall Street is to finance, or what Silicon Valley is to tech.

Clear Sky’s ESG-Friendly Claystone Production Proposition

One of the biggest selling features of projects like Clear Sky Lithium’s Halo Lithium project, is the fundamental ESG qualities, including the lower environmental impact from a lower carbon footprint to a much lower water footprint.

In order to move closer to its future production goals, Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) has planned key partnerships with academia, industry experts, commercial R&D labs, and end-users.

The claystone lithium proposition is the very same one that Elon Musk and Tesla have pursued, through the application for its patent described above.

Musk has described the process to be much like “using table salt to basically extract lithium from ore.”

Within Tesla’s summary in the application’s abstract, it shows that the process is a bit more complicated than the simple “table salt” description:

“Processes for extracting lithium from a clay mineral and compositions thereof are described. The extraction process includes providing a clay mineral comprising lithium, mixing a cation source with the clay mineral, performing a high-energy mill of the clay mineral, and performing a liquid leach to obtain a lithium rich leach solution.”

Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) has two projects:

1. Halo – between 2 half billion dollar Li companies. Halo project is believed to be underlain with the same lithium claystone as Lithium America’s TLC project.

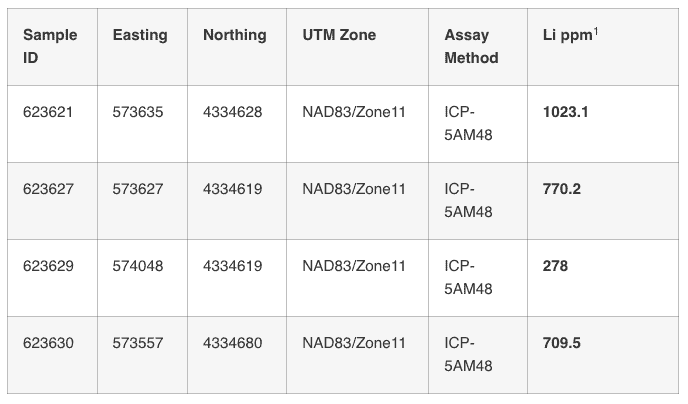

2. Clear Sky’s ELi project has had field work already initiated, with the latest results delivering the highest lithium values to date, ranging from 278-1,023.1 ppm, which improved upon the already +150 initial baseline surface samples collected which returned an average grade of 292ppm and ranged from 45-801.7 ppm, and historical sampling on the property returned an average value of 667.8ppm and ranged from 970ppm to 388ppm.[29]

In comparison, initial surface exploration on the comparable TLC Deposit returned surface grades from 129.5-1,380ppm Lithium.[30]

So now Clear Sky Lithium is working on planning its next phase of investigation, including additional surface sampling, geochemistry and mapping, minerology and petrology, as well as geophysics.

Strong Leadership Team

In order to take a new type of lithium deposit through to production, complete with guiding the appropriate technology to achieve it through to fruition, requires skilled hands and well-pedigreed expertise. Thankfully, Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) is fully equipped to handle such a task.

POWR’s leadership team includes:

Patrick Morris – CEO: Morris brings over 20 years of experience in management positions with public companies, providing expertise in capital markets and fund raising for the resource sector. He’s the former CEO of Gold Star Resources, and also co-created and co-produced the 1st nationally syndicated growth stock radio broadcast across Canada. With a keen focus on ESG and clean tech businesses, he sees locally sourced Li as a key to unlocking the future of transportation

Marco Montecino – Director: Montecino brings over 35 years’ experience of exploration projects and resource development in the Americas. Served as a Senior Consultant to Intrepid Mines and as VP, Exploration for Montana Gold. Has worked with numerous junior, intermediate and senior companies including Francisco Gold, Phelps Dodge, Placer Dome, Billiton, Alta Gold and Nerco Minerals. He was instrumental in the discovery of the Marlin Deposit in Guatemala and other gold deposits in Nevada, Mexico, and Central America.

Robert Birmingham – Director: Birmingham brings over 10 years’ experience in the mining industry and capital markets, with a focus on corporate development, investor relations and capital raising.

Chris Mackay – Director: Mackay as the President of Strand Development, oversees activities in the USA, including sourcing and analysis of new acquisitions, development and financing or refinancing. Strand currently has over 3,000 properties in major markets across the US.

Jean Depatie – Head Advisor of Project Development and Acquisitions: Depatie is a well-known expert around the world in mineral exploration and development, and minerals and mining corporate finance including mergers and acquisitions. He has enjoyed a distinguished international career spanning over 45 years of national and international experience in economic geology, having acted, directly or indirectly, as a consultant for organizations such as the United Nations, the World Bank, the Asian Development Bank, the Commonwealth Secretariat, the Québec Ministry of Natural Resources, and the Canadian International Development Agency. He is an economic geologist with a BA in math and physics, and holds both Bachelor’s and Master’s Degrees in Geology.

David (Dave) Wright – Strategic Advisor: Wright is a results-oriented engineering leader with extensive technical and management experience. He previously served in a variety of roles with Ingersoll Rand, Maxwell Technologies, New Generation Biofuels, Delphi Packard, HE Microwave, Delco Electronics, and GM Advanced Engineering. He has a track record of successful commercial product and process development.

10 Reasons To Start Paying Attention to Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) NOW!

1 Positioned to Capitalize on Lithium’s Rapid Demand Growth

2 Defense Production Act

3 Geographic Proximity to North American EV and Battery Production

4 Globally Respected, Favorable Mining Jurisdiction

5 Nevada is Open for Business

6 Strategically Expanding Footprint

7 Pedigreed Leadership Team

8 Proximity to Tesla

9 Planned Tech Development

10 Inflation Reduction Act

NOW IS THE PERFECT TIMING for smart investors to become a part of the ongoing Clear Sky Lithium (CSE:POWR) (OTC:CSKYF) story.

POWR has the growing lithium footprint with the potential to make a huge impact in the battery metals market, with a stated mission to contribute more than just its own lithium supplies, but also to advance critical strategies specific to claystone lithium projects.

We’re excited to watch this company as it marches its way through the processes of extraction selectivity and impurity management, solid/liquid separation, and onward to direct Lithium Hydroxide production.

So, do your due diligence, and GO RIGHT NOW and click here to sign up for the company’s newsletter to make sure you don’t miss out on any of Clear Sky Lithium’s news and milestones.

SOURCES CITED:

[1] https://www.usatoday.com/story/money/2022/06/20/richest-person-in-the-world/7664786001/

[2] https://cleantechnica.com/2022/08/09/invest-in-lithium-refining-a-license-to-print-money-elon-musk/

[3] https://www.mining-technology.com/news/tesla-new-patent-lithium-extraction/

[4] https://www.mining-technology.com/analysis/lithium-price-challenges/

[5] https://www.spglobal.com/marketintelligence/en/news-insights/research/lithium-costs-up-in-2021-continuing-to-surge-in-2022

[6] https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

[7] https://www.benchmarkminerals.com/membership/analysis-lithium-industry-needs-42-billion-to-meet-2030-demand/

[8] https://www.mining.com/global-lithium-production-hits-record-high-on-electric-vehicle-demand/

[9] https://www.mining.com/web/top-bid-for-lithium-up-140-after-musks-insane-levels-call/

[10] https://www.cnbc.com/2022/08/10/ford-ceo-doesnt-expect-electric-vehicle-battery-costs-to-drop-soon.html

[11] https://www.cnbc.com/2022/06/09/goodbye-gasoline-cars-eu-lawmakers-vote-to-ban-new-sales-from-2035.html

[12] https://www.energy.gov/articles/president-biden-invokes-defense-production-act-accelerate-domestic-manufacturing-clean

[13] https://electrek.co/2022/08/15/biden-will-sign-inflation-reduction-act-tomorrow-affecting-ev-credits/

[14] https://oilprice.com/Energy/Energy-General/The-World-Is-Scrambling-For-Lithium-Supply.html

[15] https://www.nytimes.com/2022/03/02/climate/ukraine-lithium.html

[16] https://www.forbes.com/sites/arielcohen/2022/01/13/china-and-russia-make-critical-mineral-grabs-in-africa-while-the-us-snoozes/?sh=2038d2486dc4

[17] https://www.onecharge.biz/blog/how-china-came-to-dominate-the-market-for-lithium-batteries-and-why-the-u-s-cannot-copy-their-model/#:~:text=%E2%80%9CChina’s%20success%20%5Bin%20battery%20manufacturing,for%20EVs%20was%20no%20accident.

[18] https://www.forbes.com/sites/rrapier/2022/08/14/energy-provisions-in-the-inflation-reduction-act/

[19] https://www.bloomberg.com/news/features/2022-06-23/lithium-king-crowned-in-dictatorship-sees-3-5-billion-fortune-at-risk#xj4y7vzkg

[20] https://capitalmonitor.ai/sector/raw-materials/resurgent-lithium-risks-backlash-from-esg-conscious-investors/#:~:text=%E2%80%9CFor%20lithium%2C%20it’s%20just%20about,Benchmark%20Mineral%20Intelligence%20in%20Melbourne.

[21] https://mobile.twitter.com/GovSisolak/status/1351714701286129665

[22] https://www.mining.com/web/mr-lithium-warns-theres-not-enough-battery-metal-to-go-around/

[23] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/060222-stellantis-ctr-sign-10-year-lithium-hydroxide-supply-agreement

[24] https://electrek.co/2022/07/26/gm-secures-long-term-supply-lithium-livent-cathode-lg-1-million-evs/

[25] https://finance.yahoo.com/news/clear-sky-lithium-commences-trading-124500441.html

[26] https://electrek.co/2021/07/09/tesla-patent-reveals-elon-musk-table-salt-lithium-extraction-process/

[27] https://www.e-mj.com/breaking-news/fraser-institute-report-nevada-most-attractive-mining-jurisdiction/

[28] https://www.fraserinstitute.org/studies/annual-survey-of-mining-companies-2021

[29] https://clearskylithium.com/clear-sky-lithium-reports-1023ppm-li-grab-sample/

[30] https://americanlithiumcorp.com/wp-content/uploads/2021/05/NI-43-101-Technical-Report_May-4_Final.pdf

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Clear Sky Lithium. advertising and digital media from the company directly (“the Company”). There may be 3rd parties who may have shares of Clear Sky Lithium, and may liquidate their shares which could have a negative effect on the price of the stock. Affiliates of MIQ have participated in a private placement with Clear Sky Lithium, which also represents a clear conflict of interest, and should be regarded as such. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Clear Sky Lithium, which were purchased in the open market and will continue to buy and sell shares in the open market without further notice. MIQ also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through future private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.