When it comes to bear markets, investors can take comfort from history, which suggests that where there’s a beginning, there’s always an end.

And according to Bank of America, investors have only got a few bear-market months left to endure after the U.S. benchmark S&P 500 SPX, +0.22% tumbled into bear territory at the start of this week. And then will come a bull market.

Per history, B. of A. Global Investment Strategy’s chief investment strategist, Michael Hartnett, points out, the average peak-to-trough bear-market decline is 37.3% over a span of 289 days. Matching that pattern would put the end of the pain on Oct. 19, 2022, which happens to mark the 35th anniversary of Black Monday, as the stock-market crash of 1987 is widely known, with, again according to statistical averages, the S&P 500 likely bottoming at 3,000.

A popular definition of a bear market defines it as a 20% drop from a recent high. As of Thursday, the index was off 23.55% from its record close of 4,796.56 on Monday, Jan. 3, 2022.

And an end typically marks a new beginning, with Bank of America noting the average bull market lasts a much longer 64 months with a 198% return, “so next bull sees the S&P 500 at 6,000 by Feb. 28,” said Hartnett.

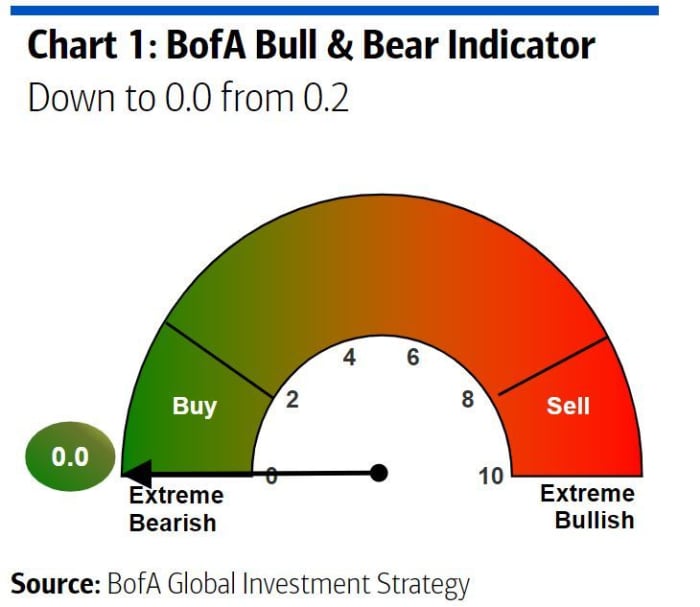

Meanwhile, another week saw the bank’s own bull-and-bear indicator (below) fall as far as it can into “contrarian bullish” territory.

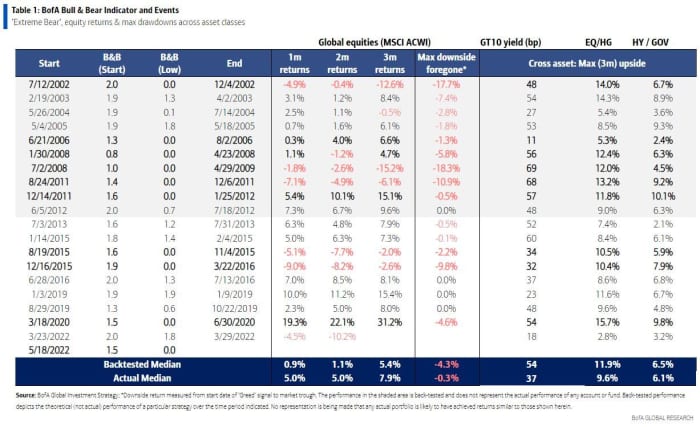

That indicator previously fell to 0 in August 2002, July 2008, September 2011, September 2015, January 2016 and March 2020, observed Hartnett. When it has previously zeroed out, except in the case of a double-dip recession such as 2002 or in the event of systemic events, as in 2008 and 2011, three-month returns have been strong, as the table below shows.

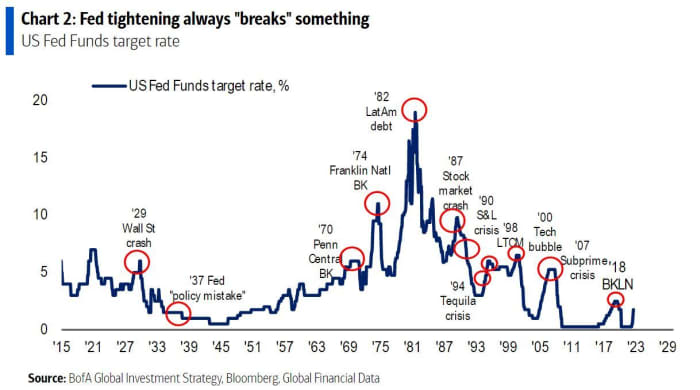

“Positioning dire, but profits/policy say nibble at [an S&P 500 level of 3,600], bite at [3,300], gorge at [3,000],” added Hartnett. That’s even as B. of A. clearly doesn’t think the selloff is over. The chart below presents a reminder from B. of A. that the Federal Reserve tends to “break something” in its tightening cycles.

More data from the bank showed $16.6 billion flowed into stocks in the most recent week, $18.5 billion from bonds and $50.1 billion from cash. Also, the data showed the first week of inflows to emerging-market equities in the past six weeks, at $1.3 billion; the biggest inflow to U.S. small-cap stocks since December 2021, at $6.6 billion; the largest influx to U.S. value stocks in 13 weeks, at $5.8 billion; and biggest flow toward tech in nine weeks, at $800 million.