Stock Markets

The benchmark stock indexes ended mostly positively, most notably the large-cap S&P 500 Index which reached its highest level since February 10 at the week’s end. The market rally was led by information technology stocks as Apple surged on news that analysts expect iPhone13 to bring in stronger sales. Many commodity prices continued to rise, helping the energy and materials sectors outperform. On the other extreme, health care shares underperformed, pulled down by a decline in the stock prices of big pharmaceutical Pfizer. Market activity was generally passive, although there was a perceived buy-on-the-close strategy taking place through most of the trading week, suggesting a gradual accumulation of fundamentally sound stocks. According to a report by Bloomberg, the S&P 500 experienced a gain of 0.33% during the last trading hour for five straight days. This is significant because it represented the longest streak in 20 years.

The sentiment of stock investors appeared to be weighed down early in the week by concerns that the Federal Reserve may take a hawkish turn in its policy ahead of expectations. The same worries also caused a sell-off in the bond market as Fed Chair Jerome Powell announced on Wednesday the possibility that the central bank may raise rates by more than 25 basis points (0.25 percentage points) in future meetings if it became necessary to control inflation. A contrary signal was sounded off by Atlanta Fed President Raphael Bostic earlier in the day when he announced that “elevated levels of uncertainty” has modified his previous stance that “an extremely aggressive rate path” is the proper step for the Fed to take. Investors likewise were cautious of the uncertainty about how the Russian war into Ukraine was developing.

U.S. Economy

Despite the continued uncertainties brought by the Russian-Ukraine conflict and the toll it would take on both warring countries, the economic data released in the U.S. shows an underlying resiliency with some of the indicators seemingly improving. IHS Markit’s gauge of manufacturing activity climbed much higher than expected, to its highest level since September 2020. Its service gauge also showed the most activity since July 2021. Weekly jobless claims also dropped significantly more than anticipated and descended to levels last encountered in September 1969. Nevertheless, there were also negative signals among the data. Durable goods orders fell 2,2% in February. This is the first time the measure fell in the last five months, and by a magnitude significantly exceeding the consensus drop of approximately 0.5%. New home sales declined 2.0% despite inventories rising to levels not seen since 2008. February pending home sales that were reported on Friday declined by 4.1%, a far cry from expectations that the indicator will rise by about 1%.

Probably impacting the housing industry is the jump in mortgage rates, now amounting to a full 1% since 2022 began. This may not necessarily sink the robust housing market, but it may curb the current level of price appreciation. The housing market may even do well to encounter a healthy breather for the meantime, as the S&P CoreLogic Case Shiller index points to housing prices rising at 18-20% year-over-year based on its recent pace, exceeding the increase from 2004-2006. There is still no sign of a bubble since current housing inventories for sale are still the lowest they have been in the last three decades, and below 20% of the inventory levels preceding the financial crisis. Thus, while mortgage costs are rising, leading housing indicators such as the anticipated new home sales surveys and building permits continue to be elevated and suggesting that the housing market continues to remain strong.

Metals and Mining

Gold prices are ending the week just slightly north of $1,950 per ounce, higher than the 1% gain from the previous Friday. Enticing as the market is, investors must look beyond the raw numbers and the kind of environment in which gold is being traded. As the U.S. dollar index is maintained at a level near its two-year high, gold prices are expected to tread a new range above $1,900. It is also remarkable that gold prices remain firm even as bond yields continue to move higher. Last Friday, the yield on 10-year notes surged to its highest level in three years at 2.5%. Even as bond yields have room to move higher, the gold market is not taking heed of these threats. It appears that in addition to monetary policy, another force driving the gold demand is the Russian war in Ukraine which, if it continues to be prolonged, will continue to support safe-haven demand.

Precious metals were mixed, as gold spot price began the week at $1,921.62 and ended at $1,958.29 per troy ounce for a gain of 1.91% for the week. Silver began at $24.96 and closed the week at $25.53 per troy ounce, a rise of 2.28%. Platinum price began the week at $1,026.97 and ended at $1,005.41 per troy ounce, a decline of 2.10%. Palladium started at $2,496.71 and descended to close at $2,327.14 per troy ounce, a loss in value of 6.79%. Among basic metals, 3-month prices were also mixed. Copper began at $10,331.00 and closed at $10,267.00 per metric tonne, representing a correction of 0.62%. Zinc started the week at $3,826.00 and ended at $4,066.50 per metric tonne, gaining 6.29% for the week. Aluminum commenced at $3,381.00 and ended at $3,605.00 per metric tonne for a weekly gain of 6.63%. Finally, tin slid from $42,305.00 to $42,283.00 per metric tonne at the week’s end, losing 0.05% of its value.

Energy and Oil

The past week proved the unpredictability of the oil market, quickly responding to stories that develop during the trading week. The week’s major development was that storms damaged export facilities of Kazakhstan’s flagship 1.2 million barrel-per-day CPC grade, which was expected to weigh down on oil prices by Friday as reloading began. The natural expectation is for the price of oil to move lower, but rather than Brent moving down from $120 per barrel, an oil storage facility presumably took a missile hit in Jeddah from Yemen’s Houthi militias, and the possibility of a disruption in the Saudi supply again loomed large. Other issues that continued to cloud the market were the dormant Iranian nuclear deal and the continued lack of consensus in Europe about how Russia should be sanctioned, as apparently the countries could not even agree on a coal embargo. The movement of global oil prices has become more difficult to forecast.

Natural Gas

At most locations, natural gas spot prices went up this report week March 16 to March 23. The Henry Hub spot price rose to $5.26 per million British thermal units (MMBtu) from $4.67/MMBtu. On the contrary, the international natural gas spot prices came down during the same report week, but remain elevated since the start of Russia’s further invasion into Ukraine on February 24. The mixed signals have increased the uncertainty surrounding the European natural gas markets.

In the United States, prices along the Gulf Coast rose as weather rapidly cooled. In the Midwest, prices rose together with the Henry Hub. So did prices in the West, which reflected the overall trend of prices for natural gas across the United States. The same uptrend was seen in the Northeast ahead of below-normal temperatures as the weekend approached. A decrease in imports from Canada offset the increase in U.S. natural gas production. The residential and commercial sectors led the decline in U.S. natural gas consumption. LNG exports from the U.S. increased by one vessel during the recent week compared to the week before.

World Markets

Share prices in Europe during the past week receded in response to the continued conflict between Russia and Ukraine, with the prospect of tighter monetary policy becoming more likely. The pan-European STOXX Europe 600 Index closed 0.23% lower over the past week, while the main market indexes ended mixed. France’s CAC 40 Index declined by 1.01% and Germany’s Xetra DAX Index slid by 0.74%, while Italy’s FTSE MIB Index climbed 1.39% and the UK’s FTSE 100 Index gained 1.06%. Core eurozone bond yields followed U.S. Treasuries higher after the Federal Reserve announced the possibility of more aggressive rate hikes. Yields were pressured higher by stronger-than-expected eurozone purchasing managers’ surveys. The yield on the German 10-year bund increased to its highest level since 2018. The UK gilt yields also ended higher as it tracked U.S. Treasuries, although this trend was mitigated by news of a lower gilt supply for the next fiscal year.

Stocks in Japan were elevated for the week as the Nikkei 225 Index gained 4.93% and the broader TOPIX Index climbed 3.78%. Expectations of further economic stimulus as well as reassurances from the Bank of Japan that it will maintain accommodative monetary policies provided heightened investor sentiment in the markets. The yield on the 10-year Japanese government bond ascended to 0.24% which exceeded its six-year highs, compared to 0.21%, the yield over the previous week. This occurred in the midst of a global bond sell-off triggered by the increase in interest rates by major central banks. Regarding currencies, the yen lost ground and plummeted to levels beyond six-year lows, to JPY 121.58 per U.S. dollar from the earlier week’s JPY 119.23. due mainly to the divergent monetary policy outlooks of the U.S. and Japan.

In China, shares fell amid speculation that U.S.-listed Chinese companies may delist, as a result of continued bilateral disagreements concerning auditing standards. During the week, the large-cap CSI 300 Index dropped 2.1% and the Shanghai Composite Index lost 1.2%. Worries about the fate of dual-listed Chinese stocks have continued to cause jitters among investors. According to reports, Chinese regulators have instructed the U.S.-listed Chinese companies to prepare audit documents for financial year 2021. Among the companies involved are China’s top search engine Baidu, e-commerce platforms Alibaba and JD.com, and social media company Weibo. Rumors of these developments appear to suggest some willingness on the part of Beijing to agree to Washington’s demands to resolve once and for all the long-standing discrepancy over auditing standards.

The Week Ahead

Inflation, hourly earnings growth, and unemployment are among the important economic data expected to be released in the coming week.

Key Topics to Watch

- Trade in goods advance report

- Case-Shiller national house price index (year-on-year)

- FHFA national house prices index (year-on-year)

- Consumer confidence index

- Job openings

- Quits

- ADP employment report

- GDP revision (SAAR)

- Gross domestic income (SAAR)

- Corporate profits (year-on-year)

- Initial jobless claims

- Continuing jobless claims

- Nominal personal income

- Nominal consumer spending

- PCE price index

- Core PCE price index

- PCE price index (year-on-year)

- Core PCE price index (year-on-year)

- Real disposable income

- Real consumer spending

- Chicago PMI

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Labor-force participation rate ages 25-54

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales

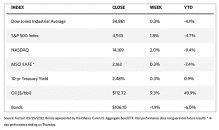

Markets Index Wrap Up