Stock Markets

The S&P 500 suffered its biggest decline in more than 14 months due to fears of rising interest rates and worries of economic growth challenges. Market closures on Monday in observance of the Martin Luther King, Jr. holiday truncated the trading week to four days. The Nasdaq Composite Index lost 7.5% by Friday, which is its deepest weekly plunge since the pandemic began. Technology stocks were weighed down by weakness in semiconductor shares. Similarly, the consumer discretionary sector was impacted by losses in the automakers and home improvement retailer stocks. Financial services shares were also dragged down by declines in financial heavyweights JPMorgan Chase and Goldman Sachs. Netflix shares plunged by more than 20% subsequent to its fourth-quarter earnings report.

Technical factors, rather than fundamentals, contributed to much of the week’s volatility in the exchanges. Many investors were trading equities as an overall asset class rather than trading on their earnings reports, as evident in the heavy flows in and out of index-focused exchange-traded funds or ETFs. Investors feared that more aggressive action might be taken by the Federal Reserve. Wall Street speculates that the Fed may announce at its March meeting that the federal fund’s target rate will be increased by 50-basis point (0.50%) instead of the incremental 25-basis point adjustments that have been the usual Fed action in the past. The increasing interest rate expectations have also tended to weaken growth forecasts.

U.S. Economy

The broader path in 2022 appears to still be a positive one as the profit cycle does not seem to be at an exhaustion point. Corporate earnings will eventually become the main driver of stock market activity as the new interest rate regime will be discounted by investors, enabling equities to chalk moderate gains later in the year. The prospects of the 10-year Treasury rate rising to 2% is not seen to be a choke point for economic growth, since there has been no bear market in stocks that began with a 10-year Treasury rate below 4%, excluding the 2020 pandemic downturn. While eventually, a tighter monetary policy may precipitate the next economic and stock-market downturn, this is far from likely to occur in the short term. While sentiment may occasionally drive market activity, historically, earnings growth is a more powerful driver and reliable guide in the long term.

Possibly the most likely adverse impact of higher interest rates will be a reduced expansion on valuations for equities, in the form of the price-to-equities (P/R) ratio. The prospects are not necessarily disastrous, however. A flat to slightly lower P/R ratio coupled with a tempered earnings growth rate could still yield modest dividends will be the likely scenario for 2022. Presently, corporate profit margins are treading record highs. Moving forward, profit margins may move slightly lower as a result of rising wage costs, but profit growth will continue to remain robust. It is critical, however, to pay attention to an unexpected slowdown in revenue gains or an accelerated pressure on expense growth resulting from continued inflation. These may pose threats to the current positive earnings-growth scenario.

Metals and Mining

Oil prices are a key driver of inflation, which also in turn has an inverse relationship to metals. Therefore, as we monitor the price direction of metals, we must also keep a close eye on oil and energy. Oil prices have already increased by 10% this year, following a 55% surge in 2021. This is largely influenced by a downtrend in production and rising political uncertainty. While inflation, currently at its highest level in 40 years, is not a new development, investors are beginning to take it more seriously and factor it in as more than a temporary situation. This makes gold’s rise to above $1,830 per ounce as significant. In the past year, gold prices fell precipitously as real rates fell to record lows. Presently, investors are beginning to realize that the U.S. monetary policies will tighten with rising inflation, causing liquidity to dry up in the marketplace and earnings expectations to be driven down.

Over the past week, all precious and base metals prices ascended. Gold rose 0.96%, from the previous week’s close at $1,817.94 to the latest close at $1,835.38 per troy ounce. Silver climbed from $22.96 to $24.30 per troy ounce, a gain of 5.84%. Platinum rose week-on-week by 6.05%, from $974.53 to $1,033.49 per troy ounce. Palladium ascended from the earlier close at $1,881.50 to last week’s close at $2,111.19 per troy ounce for a gain of 12.21%. Among the base metals, copper gained 2.28% between the intraweek closes from $9,719.50 to $9,941.00 per metric tonne. Zinc increased by 3.24%, from $3,521.00 to $3,635.00 per metric tonne. Aluminum rose from $2,976.50 to $3,040.50 per metric tonne, a gain of 2.15%. Finally, tin surged from $40,351.00 to $43,955.00 per metric tonne for an intraweek gain of 8.93%.

Energy and Oil

In their outlooks for 2022, Morgan Stanley and Goldman Sachs forecasted crude oil prices to ascend to $100 per barrel this year, on the back of falling oil inventories and OPEC+ spare capacity erosion. The reports caused Brent to increase this week past the $90 per barrel level for the first time since 2014. The oil rally lost steam on Friday, though, as the geopolitical premium that was priced-in was discounted. Although forecasts of an expected oil shortage continue to recur, more crude supply is expected in the market in the coming weeks, particularly from Libya and Ecuador (after a month-long supply disruption, Libya will aim to maximize its output for 2022 at an average annual production level of 1.2 million barrels per day). In the futures markets, with the Brent M1-M12 spread at $8 per barrel, fundamentals in the oil market point to a drop from current prices rather than the resumption of the rally. By the end of last week’s trading, the global benchmark Brent came down to $88 from its earlier high, and WTI trended at $85 per barrel.

Natural Gas

During this report week from January 12 to January 19, natural gas spot price movements were mixed. The Henry Hub spot price increased from $4.59 per million British thermal units (MMBtu) at the start of the week to $4.74/MMBtu by the week’s end. International gas prices rose during this week, while the price of the February 2022 NYMEX contract decreased. Prices held steady along the Gulf Coast and the flows out of the region were moderate. In the Midwest, prices increased ahead of the anticipated winter storms. In the California market, reduced consumption and moderate temperatures resulted in lower prices, while prices in the Northeast are rising in response to the higher demand driven by the weather and tight supply to meet the heightened demand. U.S. liquefied natural gas (LNG) is down by five vessels this past week compared to the week earlier.

World Markets

Share prices in the European bourses closed lower this past week on the back of investor expectations that the European Central Bank (ECB) would raise interest rates in 2022, and that the Bank of England (BoE) may likewise adopt tighter monetary policies. The pan-European STOXX Europe 600 Index lost 1.40% in local currency terms. The major indexes mirrored this trend, with France’s CAC 40 Index weakening by 1.04%, Italy’s FTSE MIB Index sliding 1.75%, and Germany’s Xetra DAX Index giving up 1.76%. The UK’s FTSE 100 Index dipped 0.65%. Core eurozone bond yields slid lower as ECB President Christine Lagarde quelled concerns that interest rates will be increased this year. Intensified geopolitical tensions over Ukraine also influenced yields. Peripheral eurozone bond yields followed core markets, but in the end, only moved sideways. UK gilt yields bucked the trend and rose slightly, as markets priced in the likelihood of a February BoE rate hike. This possibility firmed up as inflation recorded a 30-year high.

Japanese stocks ended negative for the week. The Nikkei 225 fell 2.14% and the TOPIX Index lost 2.62%. Weighing down investor sentiment was the new coronavirus spike nationwide, as a result of which Tokyo and 12 other prefectures were placed under a quasi-state of emergency by the government. The yield on the 10-year Japanese government bond dipped to 0.13% from 0.15% week-on-week. The yen gained strength, ending the week at JPY 113.96 compared to the previous week’s JPY 114.22 against the U.S. dollar. Japan kept its short- and long-term interest rates unchanged as the central bank maintained its quantitative and qualitative monetary easing with yield curve control. The bank will continue to pursue supportive monetary policies and will veer away from more restrictive measures.

Chinese markets posted gains for the week in response to the government’s stepping up monetary easing measures and signaled support for the troubled property sector. The Shanghai Composite Index inched up 0.1% while the CSI 300 chalked up a gain of 1.1%. At the start of the week, the People’s Bank of China (PBOC), without any prior announcement, reduced the interest rate on one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points to 2.85%. This is the first reduction by the central bank since April 2020. Chinese banks responded by cutting their loan prime rates for one- and five-year loans. The MLF rate is set by the central bank of China, which in turn is the de facto benchmark by which domestic lenders adjust their loan prime rates for new loans. The yuan ended the week unchanged at 6.34 per U.S. dollar after it ascended to its highest level since May 2018 earlier in the week. China’s recent currency strength is due to inflows from bond investors positioning for further rate cuts.

The Week Ahead

Inflation and housing data are among the important economic reports to be released in the coming week.

Key Topics to Watch

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- S&P Case-Shiller national home price index (year-over-year change)

- FHFA national home price index (year-over-year change)

- Consumer confidence index

- Advance report on trade in goods

- New home sales starts (SAAR)

- FOMC statement

- Fed Chair Jerome Powell news conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Gross domestic product (SAAR)

- Final sales of domestic product (SAAR)

- Durable goods orders

- Core capital equipment orders

- Pending home sales index

- Real disposable incomes

- Real consumer spending

- PCE inflation (month-to-month change)

- Core PCE inflation (month-to-month change)

- PCE inflation (year-over-year change)

- Core PCE inflation (year-over-year change)

- Personal income (nominal)

- Consumer spending (nominal)

- Employment cost index

- UMich consumer sentiment index

- UMich 5-year inflation expectations

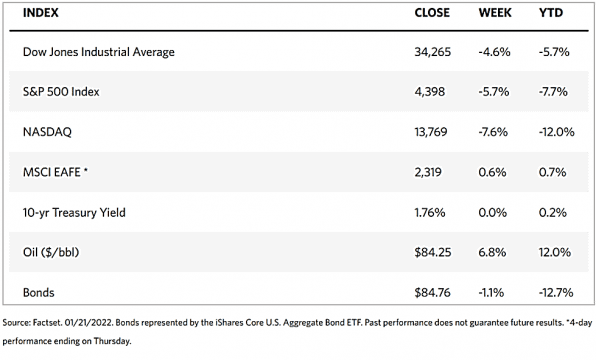

Markets Index Wrap Up