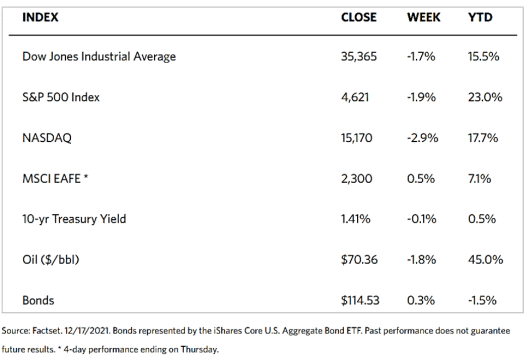

Stock Markets

Stock indexes headed south amid volatility over the past week due to investor reaction to two prevailing concerns: the possible spread of the omicron variant, and the prospect that the central bank will tighten monetary policy to counter the rising inflation. Growth stocks and technology-loaded Nasdaq Composite Index underperformed as longer-term interest rate expectations gained traction. On Friday, Nasdaq touched an intraday low that was slightly below its recent peak, still holding above the 10% threshold for a correction. Within the broad index S&P 500, technology and consumer discretionary shares were the worst performers, while the usually resilient consumer staples, health care, and utilities charted gains.

Partly causing the volatility that ended the week was the simultaneous expiration of three types of options and futures contracts. The Cboe Volatility Index (VIX) climbed during the week although it remained significantly below its early December levels. Front and center in investors’ sights were the Federal Reserve’s monetary policy meeting last Tuesday and Wednesday. Upon release last Tuesday of the report that producer prices rose 9.6% in November year-on-year, the highest increase since 2010 when data were first collected, the major stock indexes plummeted sharply. On Wednesday, the Fed’s quarterly survey of individual policymakers’ views was released, indicating that majority of officials now expected three quarter-point hikes rather than two were likely in 2022.

U.S. Economy

Despite worries of a possible slowdown in economic recovery, data points to a return to pre-pandemic output GDP in record time. This set the stage for unique conditions on the road to the normalization of monetary policies. This will likely create the shortest time between the end of the preceding recession and the first-rate hike thereafter. If the rate hike takes place by the next summer, the duration between recession and rate increase would have been cut in half; since 1985, the average time was four years. Furthermore, the 10-year Treasury rate is the lowest it has been approaching Fed tightening at below 1.5%. By comparison, the 10-year Treasury rates averaged 5.3% at the time of the first Fed hike, during the period since 1985. Liquidity is also the most abundant, as indicated by the Fed balance-sheet assets in proportion to GDP, which is at the highest level it has been since the last world war. Acceleration of the Fed’s taper appears appropriate since there is no longer any need for the emergency-level stimulus in the economy.

Metals and Mining

Gold prices are exhibiting some resilience as the metal descended to just above $1,750 an ounce but bounced off this major support. It then pushed up above the $1,800 level, indicating that investors may be gaining some interest in light of the rising inflation. Economists polled believe that inflation may range between 3% to 6% through the first semester of 2022 before dropping in the second half.

Last week, precious metals moved listlessly and ended mixed. Gold gained 0.86%, closing at $1,798.11 per troy ounce from its week-ago close at $1.782.84. Silver also rose slightly from its week-ago price at $22.20 per troy ounce to last week’s close at $22.37, gaining 0.77%. Platinum lost some ground, closing at $935.80 per troy ounce over the earlier week’s $945.66, dipping 1.04%. Palladium did somewhat better, gaining 1.38% from the previous week’s $1,764.32 per troy ounce to close at $1,788.73.

Week-on-week, the 3-month prices of the base metals also experienced little movement. Copper inched downward by 0.73%, from $9,506.50 per metric tonne to $9,437.50. Zinc gained 1.76%, rising from $3,328.50 per metric tonne to $3,387.00. Aluminum recorded a higher gain of 4.53%, from the previous week’s $2.606.50 per metric tonne to the recent close at $2,724.50. Tin ended the week lower by 2.51%, closing at $38.410.00 for the week compared to the earlier week’s $39,400.00.

Energy and Oil

In recent months, the oversupply of oil was the main concern in oil markets, something which may well materialize soon. This appears to be the direction in light of the softening of demand in Asia due to China’s zero-COVID measures. The continued clampdown by Beijing on independent refiners in Shandong has dampened the bullish sentiments of investors. In the meanwhile, Brent futures prices are rising above the spot price which is a signal of impending oversupply. Some factors on the upside remain, particularly the low level of global inventories which at present are approximately at their levels in March 2020. But European omicron cases are rising at a rate that threatens an oversupply situation way beyond the possible demand. The anticipated glut has caused ICE Brent price to descend to $73 per barrel. The U.S. benchmark WTI traded at about $70.5 per barrel.

Natural Gas

Over the past 10 months of 2021, China’s imports of liquefied natural gas (LNG) were the largest in the world, surpassing Japan as shown by data from Japan’s Ministry of Finance and China’s Administration of Customs. For 51 years prior to 2021, Japan held the distinction of being the world’s top LNG importer. China’s LNG imports averaged 10.3 billion cubic feet per day (Bcf/d), and increased by 2.0 Bcf/d or 24% over the corresponding period last year. Over the same period, Japan’s LNG imports averaged 9.6 Bcf/d.

For the report week, December 8 to December 15, 2021, natural gas spot prices fell at most locations. The Henry Hub spot price fell to $3.75 per million British thermal units (MMBtu) at the week’s end from the previous week’s $3.79/MMBtu. The January 2022 New York Mercantile Exchange (NYMEX) contract price descended $0.013 from the earlier week’s $3.815/MMBtu to the recent Wednesday’s $3.802/MMBtu. Natural gas futures prices for delivery through the end of the current heating season dropped $0.50 to $3.744/MMBtu, but futures for delivery during the coming summer months rose by $0.03 to $3.671/MMBtu, in effect flattening the futures curve. For delivery during the winter months, the premium for natural gas futures is presently $0.072/MMBtu above contract prices for summer delivery, a reduction from last week’s $0.108/MMBtu.

World Markets

European stock prices dipped over the past week as the governments moved to intensify pandemic restrictions in response to the spread of the omicron coronavirus variant. Simultaneously, central banks grew more hawkish in reaction to the continued rise in inflation, raising investors’ concerns about investing in risky markets. The pan-European STOXX Europe 600 Index concluded trading for the week with a 0.35% loss. Principal indexes followed suit, with Germany’s Xetra DAX Index sliding 0.59%, Italy’s FTSE MIB Index dropping 0.41%, and France’s CAC 40 Index losing 0.93%. The UK’s FTSE 100 Index slumped 0.30%. The core eurozone bond yields exhibited volatility this week, ending lower in the end. Initially, yields sharply dropped on fears that the omicron surge will seriously slow down the economic recovery. Thereafter, hawkish pronouncements by major central banks and the decision by the European Central Bank (ECB) to scale back its emergency bond-buying program caused yields to rebound from its deep dive. A subsequent announcement by ECB President Christine Lagarde that an interest rate increase was “very unlikely” next year brought pressure on bond yields. Overall, peripheral eurozone bond yields rose. UK gilt yields rose after the Bank of England, (BOE) unexpectedly increased short-term interest rates.

Over the week, Japanese stock prices advanced. The Nikkei 225 Index rose 0.38% and the broader TOPIX Index gained 0.46%. the U.S. Federal Reserve’s tapering decision accounted for investor sentiment being lifted and bringing the indexes to positive territory. It appears many feel that the Fed decision signals confidence in the directions of the post-COVID global economy to which the Japanese open market is highly leveraged. The yield on the 10-year Japanese government bond adjusted downward to 0.04% from 0.05% at the end of the preceding week. As to currencies, the yen moderately weakened from JPY 113.39 to JPY 113.56 against the U.S. dollar.

The resurgence in global coronavirus cases has caused the Chinese markets to fall for the week, even as tensions between the U.S. and China intensified. Washington imposed investment and export restrictions on dozens of Chinese companies allegedly due to repressing China’s Muslim minorities and supporting the Beijing military. The CSI 300 Index pulled back 1.9% while the Shanghai Composite Index gave up 0.9% on listless trading. The yields on the country’s 10-year government bonds climbed to 2.873% from 2.861% the week earlier. The yuan fell to CNY 6.3714 against the U.S. dollar, compared to the earlier week’s exchange rate of CNY 6.3672.

The Week Ahead

Leading economic indicators, personal income, and the PCE index are among the important economic data scheduled for release this coming week.

Key Topics to Watch

- Leading economic indicators

- Current account deficit

- GDP revision (SAAR)

- Consumer confidence index

- Existing home sales (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Nominal personal income

- Nominal consumer spending

- Core inflation (monthly)

- Core inflation (year-over-year)

- Real disposable income

- Real consumer spending

- Durable goods orders

- Core capital goods orders

- New home sales (SAAR)

- UMich consumer sentiment index (final)

- Five-year inflation expectations (final)