One of the most common and significant mistakes people make when it comes to managing money during retirement is relying on “average returns.”

Many individuals assume that if their portfolio earns an average return of 6% and they withdraw 5% of income in their first year of retirement and continue withdrawing the same dollar amount of income every year thereafter, they will not lose any of their principle or risk running out of money.

Nothing could be further from the truth. This false assumption is one of the biggest reasons many retirees are at risk of prematurely depleting their savings.

Managing money for retirement is not the same as managing money during retirement. When you are managing money for retirement, the order or sequence in which you achieve your returns doesn’t affect your portfolio’s ending value.

Regardless of whether the annual returns on a $100,000 portfolio over a five-year period are -5%, 20%, 20%, -10%, -10% or in completely reverse order — -10%, -10%, 20%, 20%, -5% — the portfolio will have the same ending value of $110,808.

However, that is not the case when it comes to managing money in retirement. When you start withdrawing money during retirement, the order in which your portfolio earns its annual returns can have a large negative impact on investment performance.

This is known as sequence risk. Numerous studies show that losses during the early years of retirement can have a devastating impact on the sustainability of an income stream.

The reason is that negative returns coupled with withdrawals during the first few years means smaller savings balances will compound, thereby increasing the likelihood that your retirement funds run out before the end of your retirement.

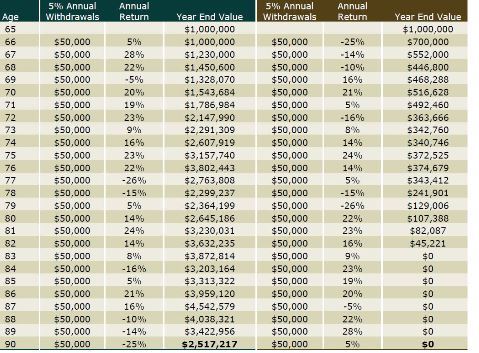

The accompanying chart demonstrates the significant negative impact of sequence risk.

Two individuals retire at age 65 with the same amount of money ($1 million), earn the same average return (6%), and withdraw the same amount of income ($50,000) each year.

The only difference is that the annual returns in their portfolios are in the exact reverse order. During the first three years, the first portfolio earned annual returns of 5%, 28%, and 22%, withdrew a total of $150,000 of income, and had an ending value of $1,450,600.

The second portfolio, however, suffered annual losses of -25%, -14%, and -10% withdrew a total of $150,000 of income and had an ending value of just $446,800.

After three years, the second portfolio was already worth $1 million less than the first portfolio. At age 83, the first portfolio was worth over $3.8 million, while the second portfolio was totally depleted. At age 90, the retiree with the first portfolio still had over $2.5 million in savings.

When it comes to managing money during retirement, it is essential to have an investment strategy in place to help manage sequence risk.

Designing a portfolio that seeks to provide more consistent returns, and that preserves capital by managing downside risk (especially during the early years of retirement), is critical to reducing the risk of prematurely depleting your retirement savings.