Stock Markets

The bottoming out of the stock market due to the pandemic shutdown marked its first anniversary on March 23. The plunge marked the shortest bear market in history; ever since, the markets including stocks, long-term bond yields, and commodities have rebounded decisively. Driving its continued uptrend are the prospects of a successful vaccine deployment program and the impending return to normalcy. The Dow briefly traded above the 33,000-level last week as a result of three major forces: the graduate reopening of the economy, fiscal spending at historic levels, and broad accommodation by the central bank. The bull market is likely to continue onto its second year, as policymakers affirmed that they foresee no interest rate hikes until 2023 and that the upward trend of the inflation rate will be short-lived. A disciplined strategy and investing for the long-term is bound to be rewarded during the bull run’s second year.

U.S. Economy

The economy faces a bright future as full recovery is anticipated following the successful roll-out of the covid vaccine. Until the present, however, recovery has impacted only selected sectors while others continue to lag. At the current pace and with the prospect of an accelerated vaccine distribution scenario, the economy’s reopening may bring it to exceed its 2019 peak at the second quarter’s end. By the middle of 2022, the country would have returned to its pre-pandemic status and be poised to resume its interrupted expansion before the pandemic.

- Unemployment is expected to decline as the economy gradually reopens, but there will remain significant slack in the labor market resulting from the exodus of people from the labor force. The services sector of the economy, which accounts for 70% of employment, will remain soft as this will be the last sector of the economy to fully reopen. Eventually, consumer spending in services will drive employment in this sector, further fueling the next leg of the economic recovery.

- The easing of pandemic restrictions and pick-up in job openings are expected to result in the improvement of the level of consumer confidence. Also, there is more than $2 trillion of excess savings households have currently accumulated after multiple government check issuances, indicative of a pent-up demand that may be released with the eventual return to normalcy. Consumer spending accounts for 70% of the U.S. GDP which is poised to accelerate at its fastest pace since 1984.

Metals and Mining

Gold rose during the week’s trading, touching a monthly high of $1,764 per ounce and reversing three weeks of steady losses that brought the price down to slightly above $1,700. Furthering the metal’s rise was the slight decline in the US dollar and treasury yields, encouraging a flight to value. On March 19, Friday, the US central bank declared that it was unlikely to extend last year’s alteration to the supplementary leverage ratio. This change was adopted in April 2020 to address the pandemic’s impact by allowing banks their holding capital against treasuries and receipts. This dovish stance signaled that it was unlikely that the Feds would take aggressive action in monetary policy, giving enough impetus for gold to move up from the $1,722 price range. Aside from this, the anticipation for stimulus spending and economic growth have spurred the price of gold higher. Gold ended the week trading at $1,735,69.

Silver also rallied after two weeks of market softness, reaching an intraweek high of $26,60 per ounce as of Wednesday. It then corrected to just below $26 per ounce on Thursday. By week’s end, the Fed’s announcement spurred silver to rise to $26.20. It traded at P26.17 by Friday. Platinum, on the other hand, shed 3.7% for the week, with prices descending to their early February levels, a breakdown from its month-long support of $1,200 per ounce. Palladium reversed course to rally to $2,644 from its price of $2,292 per ounce on Monday. The 15% increase resulted from supply challenges following the flooding of two mines under Nornickel. As of Friday, Platinum was selling at $1,179 while Palladium was trading at $2,539 per ounce.

Base metal prices descended for the week, with copper dropping below $9,000 by midweek after starting Monday at $9,147.50 per tonne. This is a steep drop from its price of $9,614 earlier this month. By week’s end, copper returned to just above $9,000. Zinc declined slightly to $2,801 from $2,815 per tonne, while lead closed the week at $1,896, declining 2% from its Monday trade at $1,936 per tonne.

Energy and Oil

Crude oil ended weeks of steady increase with the largest single-day loss since April of last year. It plunged 7% on Thursday, largely due to several bearish factors among which are a stronger dollar, profit-taking by long speculators, and the dashed hopes that the vaccines will quickly end the lockdowns in Europe. Distribution delays and increased hesitancy about the vaccines’ acceptability leading to a longer European vaccine campaign may set back oil demand for this year by 1 million barrels per day (m/bd).

China is increasingly relying on Iran and Venezuela for its oil supply. It is expected to import 918,000 bpd of oil from Iran in March, the greatest volume since the U.S. applied sanctions two years ago. The result served as a disincentive for Iran to negotiate with the U.S. As for the latter, the refining capacity of the U.S. has not yet been fully restored, holding at about 80%, a level last seen before February’s Texas grid crisis. It is estimated that 1.2 mb/d of refining capacity remains offline due to ongoing repairs and spring maintenance.

Natural Gas

For the report week March 19 to March 17, natural gas spot prices were mixed, with the Hendry Hub sport price falling from $2.60 per million British thermal units (MMBtu). It ended the week at $2.51/MMBtu. The price of the April 2021 contract decreased at the New York Mercantile Exchange (NYMEX), losing $0.16/MMBtu to end at $2.528/MMBtu from $2.692/MMBtu. For the week ending March 12, the net withdrawals from working gas summed up to 11 Bcf. Working natural gas stocks amounted to 1.782 Bcf. This represents a 12% reduction year-on-year. It is also 5% below the five-year (2016-2021) average for this week.

World Markets

European shares were little changed from last week, due to concerns surrounding the resurgence of coronavirus infections in certain European countries. Central bank dovish policies intended to support the recovering economy did little to encourage investor buying, thus limiting the bourse’s upside. The pan-European STOXX Europe 600 Index closed the week mostly unchanged while major indexes were mixed. Italy’s FTSE MIB Index rose 0.36% and Germany’s Xetra DAX Index advanced 0,82%. At the other end, France’s CAC 40 Index dropped 0.80% while the UK’s FTSE 100 Index fell 0,61%.

Correspondingly, Core eurozone bond yields climbed slightly as Germany’s 10-year bond yield rose midweek in line with U.S. Treasuries, mostly due to an anticipated higher inflation rate. Yields gave way slightly on Friday, weighed by concerns about Europe’s rising coronavirus infections. The core markets set the pace for peripheral eurozone yields. UK gilt yields climbed on the back of the optimism set by the Bank of England’s economic outlook and its decision to maintain interest rates unchanged. Policymakers at the BOE voted unanimously to retain the benchmark interest rate at its all-time low of 0.1% as well as to proceed with the bond-buying program.

In Japan, stock markets were also mixed over the week as the Bank of Japan announced that it will limit purchases of exchange-traded funds (ETFs) to those linked to the TOPIX. This drove a 3.13% gain in that index while the Nikkei 225 Stock Average underperformed, sliding by 0.25%. The yen rose slightly to close just below JPY109 to the dollar, and the 10-year Japanese government bond yield ended at 0.11% for the week. Prime Minister Yoshihide Suga formally announced the end of the coronavirus state of emergency in Tokyo and three other prefectures on March 21, citing the significant decline in infections and the drop in hospital bed occupancy.

In China, the Shanghai Composite Index fell 1.4% while the large-cap CSI 300 Index slipped 2.7%. Negative headlines concerning the first day of diplomatic talks between China and the U.S. caused stocks to underperform the rest of Asia. Following the release of strong economic data for January and February, the yield on China’s sovereign 10-year bond rose, but the gains were given back on Friday, ending the week unchanged from last week at 3.26%. On the economy, the National Bureau of Statistics announced that retail sales for January and February rose 33.8% year-on-year. The strong performance was attributed to last year’s pandemic lockdowns.

The Week Ahead

Among the important economic data expected this week are the Final GDP growth figure, the PMI composite, and PCE deflator.

Key Topics to Watch

- Existing home sales (SAAR)

- Current account deficit

- New home sales (SAAR)

- Durable goods orders

- Core capital goods orders

- Markit manufacturing PMI (preliminary)

- Markit services PMI (preliminary)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Gross domestic product (SAAR)

- Personal income

- Consumer spending

- Core inflation

- Trade in goods, advance report

- Consumer sentiment index (final)

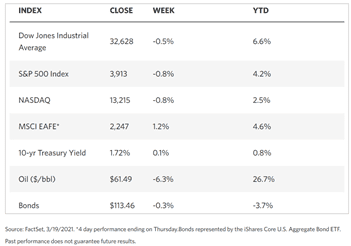

Markets Index Wrap Up