Stock Markets

Following a sharp rally at year-end and a new record high on the first trading day of the year, U.S. stocks declined modestly on the week, which many expected. New concerns over tensions between the U.S. and Iran popped up on Friday after a U.S. airstrike in Iraq killed an Iranian general who is believed to have been planning US attacks. The rise in geopolitical risk in the Middle East pushed crude oil prices up by 3% on the news. Analysts were quick to react that a combination of some complacency in the market and rising geopolitical uncertainties could drive volatility and a short-term pullback. They contend that economic fundamentals and monetary policy still support a bull market to continue well into in 2020 without abatement.

U.S. Economy

Early trading in the 2020 year showcased what we can likely expect over the coming year. The first trading day of the year saw all three major indexes – Dow, NASDAQ and the S&P 500, closing at record highs – which is not new. Again, bonds also rallied, along with gold and that helped to support similar moves in international indexes. On the second day, markets opened to news of the U.S. airstrike in Iraq which upped tensions throughout the Middle East. It also placed market attention on geopolitical uncertainty in the Middle East and around the world once again. Analysts 2020 outlook calls for equities to outperform bonds again this year, supported by solid economic and corporate fundamentals. They also anticipate a return to normal levels of market volatility in the later stages of the bull market, making the gains for equities bit of a tough ride.

Metals and Mining

The heightened tensions between the US and Iran sent gold close to its highest price in nearly six years, as well as silver moving above the important US$18 per ounce level. President Donald Trump ordered an airstrike that killed Qassem Soleimani, leader of the Quds Force, a unit of Iran’s Revolutionary Guards. The Pentagon called the airstrike a “decisive defensive” action designed to protect Americans in Iraq. The gold price opened the new year at US$1,516.80 per ounce, but the news sent it to nearly $1,550 and reaching US$1,549.90, its highest point of the day. Gold is now close to its highest point since April 2013. In comparison, last year as it reached that point gold had been on a run and was up substantially from its mid-May price of US$1,275. Silver also peaked high on Friday at US$18.23 in the early hours of trading. It then fell off slightly, but was still above US$18 later in the day. Unlike gold, silver is not yet close to its highest point of 2019, which was US$19.57 in the first week of September. Certain well-known analysts suggested that while concerns about retaliation from Iran may keep the price of gold high initially, it will likely fall back if no events take place. Platinum and palladium also recorded small gains this week. Platinum was trading at US$982 per ounce as of 1:39 p.m. EST on Friday, while palladium, last year’s metals favorite was at US$1,954 per ounce at 1:40 p.m. EST.

Energy and Oil

As expected, oil prices spiked immediately after the U.S. strike on Iraq resulted in the death of Iranian General Qassem Soleimani on Thursday. Soleimani, as head of the Quds force of the Revolutionary Guard, was powerful Iranian official. Iran promised “severe retaliation,” which had many analysts forecasting a broader regional war. Attacks on U.S. military installations in the Middle East are anticipated. Brent prices spiked by more than 3 percent. The fallout has begun as dozens of workers in the southern oil fields in Iraq began leaving the country. The American embassy urged all U.S. citizens to leave the country immediately. According to the Iraqi officials, production would not be affected by this incident. However, the question at this point remains as to just how Iran might respond. Energy companies in the region said that vessels and oil facilities are both at risk, giving it a 50% chance of retaliation. The equity markets fell after the attack on Soleimani, interrupting the bullish mood for stocks. It’s expected that a conflict could “dash market hopes for a rebound of the global economy that is still to emerge from under the cloud of the U.S.-China trade war,” said Valentin Marinov, head of G-10 currency research at Credit Agricole SA. “Risk sentiment should remain fragile also because central banks may be slow to respond or simply no longer have the arsenal to respond in an adequate way.” Natural gas spot prices rose at most locations this week. The Henry Hub spot price fell from $2.26 per million British thermal units (MMBtu) last week to $2.24/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the January 2020 contract increased 4¢, from $2.243/MMBtu last week to $2.286/MMBtu this week. The price of the 12-month strip averaging January 2020 through December 2020 futures contracts climbed 2¢/MMBtu to $2.294/MMBtu.

World Markets

European markets fell slightly this week. The pan-European STOXX Europe 600 Index fell for the week after the U.S. airstrike that killed an Iranian general raised geopolitical fears. Germany’s DAX index, France’s CAC 40, and the UK’s FTSE 100 Index all were in decline. Overall, the trading remained light due to the fact that most European markets closed early on Tuesday and remained closed on Wednesday for New Year’s. The STOXX 600 ended 2019 up 24.5%. That is its best calendar year result since just after the economic crash of 2008 and ending 2009. A purchasing managers’ survey showed that the downturn in eurozone manufacturing deepened in December, especially in Germany. The index data of 46.3 was slightly better than the preliminary 45.9 figure. However, expectations about output strengthened to a six-month high in December. The UK manufacturing sector declined in 2019. The IHS Markit/CIPS Manufacturing Purchasing Managers’ Index landed at 47.5 in December from 48.9 in November. That was slightly higher than the initial expectation.

The Chinese stock exchanges recorded their fifth weekly gain following the central bank lowing the amount of cash that lenders must hold in reserve. That gave reassurance to investors that Beijing was taking steps to ensure liquidity even as the country has a wider slowdown. For the week, the benchmark Shanghai Composite Index added 2.6%, while the large-cap CSI 300 Index rose 3.1%. The People’s Bank of China (PBOC) said that it would cut the reserve requirement ratio (RRR) for financial institutions by a half-point, effective January 6. The reduction in the RRR would release roughly 800 billion yuan ($115 billion) into the financial system. The bank claims that the reserve requirement cut was a hedge against higher demand for cash ahead of the upcoming Lunar New Year holidays, not a stimulus measure. The move marked the eighth time that the PBOC has cut the RRR since early 2018 China’s official manufacturing PMI data held steady in. December and marked a second month of expansion.

The Week Ahead

Important economic data being released include the ISM non-manufacturing PMI on Tuesday and the December jobs report on Friday.

Key Topics to Watch

- Markit services PMI

- Trade deficit

- ISM nonmanufacturing index

- Factory orders Nov.

- ADP employment

- Consumer credit

- Weekly jobless claims

- Philly Fed annual revision

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Wholesale inventories

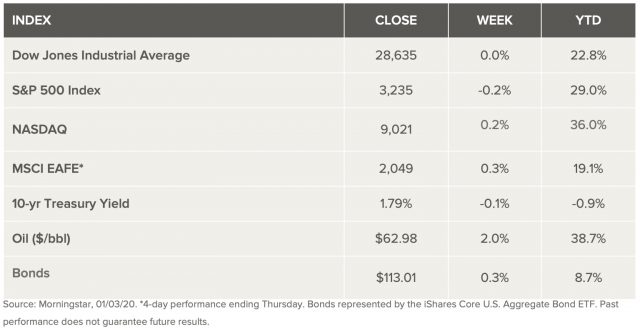

Markets Index Wrap Up