Stock Markets

Heading into the Christmas-holiday shortened trading week, stocks are set to finish the year strong. The S&P 500 has now posted 31 all-time highs in 2019, driven by sizable gains in the technology sector, progress on Brexit, the U.S./China trade front, and continued strength in the U.S. jobs market. Despite an impeachment vote in the House of Representatives, the S&P 500 finished 1.7% up on the week, a reminder that the political drama isn’t the primary driver of market performance over time. Positive economic and corporate performance news has been the driving force behind this year’s sizable gains.

U.S. Economy

When it comes to the market, swings are a normal part of the investment landscape. But the pendulum has swung in particularly notable fashion over the past year. Investors digested a full plate of data and news last week, including an impeachment vote and the passing of USMCA (NAFTA 2.0) in the House, an updated reading of third-quarter U.S. GDP (2.1%) that included upwardly revised consumer-spending growth, and housing-market readings that showed a modest uptick in activity. And with all of that, the stock market moved higher again on the week, reaching yet another record high.

But it was just one year ago that conditions were seemingly on a polar-opposite path. The S&P 500 was down sharply, and headlines were filled with projections of impending economic doom. That was then (December 2018), and this is now.

Metals and Mining

The gold price was relatively flat on Friday (December 20) after US Treasury Secretary Steven Mnuchin said that the US and China would sign phase one of the trade pact at the beginning of the new year, which sent investors away from the yellow metal to riskier assets. As part of an alleged first phase deal, Washington has agreed to offer Beijing some tariff relief as well as a pause on a tranche of new tariffs. Mnuchin added that the pact will not be subject to any renegotiations. In addition to the announcement from Washington, China’s finance ministry revealed a new list of import tariff exemptions for a duration of one year — which will start next Thursday (December 26) — for six chemical and oil products from the US. Over the course of the year, gold has been largely supported by the trade war, which has helped it gain over 15 percent. The dispute between two of the world’s largest economies has caused turmoil in the markets and has had investors concerned over a global economic slowdown.

Gold was also weighed down this week by the better-than-expected US economic data, as that gave a boost to the greenback, setting it up to make gains for the first time in four weeks. Silver was up slightly on Friday, not falling under the same pressure that the yellow metal faced throughout the week. Despite a slightly shaky month, silver remains stronger in 2019, as it is 9.7 percent higher on a year-to-date basis. As of 10:02 a.m. EST on Friday, silver was changing hands at US$17.17 per ounce. Platinum was down on Friday, but still managed to stay above the US$900 per ounce level. Going forward, FocusEconomics believes that prices are likely to pick up slightly on the back of a fall in global supply. Despite this, weak automotive demand — the result of a shift away from diesel vehicles in the European Union — is seen capping the metal’s gains. Palladium continued its climb on Friday, staying above the US$1,900 per ounce level that it broke records with last week. The metal pushed past the US$1,900 level last Tuesday (December 10) following a power outage in South Africa that stopped production at several mines and exacerbated concerns over a supply shortage. Since the outage, the metal has continued to climbed and is headed for its fifth straight week of gains. Since the beginning of the year, the metal has risen over 40 percent, with its large gains being attributed to stricter environmental regulations around car emissions. As demand increases from the automotive sector, supply shortfalls are beginning to emerge, giving the spot price a boost on the market.

Energy and Oil

Oil didn’t move a lot this week, but it may have consolidated gains achieved earlier this month. The trade talks continue on a positive trajectory, and economic sentiment is slightly upbeat. The U.S. reported a drawdown in crude inventories, although there was a surprising jump in refined product stocks. “A sense of cautious bullishness is developing as we head into 2020,” Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London, told Bloomberg. “Supply-side and demand-side factors are singing from the same supportive hymn sheet. Natural gas prices remain depressed. Natural gas prices could fall even further unless there is a serious cold snap in the U.S. this winter. Investors have staked out the most net-bearish position on gas futures in a decade. Natural gas spot prices rose at most locations this report week (Wednesday, December 11 to Wednesday, December 18). The Henry Hub spot price fell from $2.26 per million British thermal units (MMBtu) last Wednesday to $2.24/MMBtu yesterday. At the New York Mercantile Exchange (Nymex), the price of the January 2020 contract increased 4¢, from $2.243/MMBtu last Wednesday to $2.286/MMBtu yesterday. The price of the 12-month strip averaging January 2020 through December 2020 futures contracts climbed 2¢/MMBtu to $2.294/MMBtu.

World Markets

European stocks rose after UK Prime Minister Boris Johnson’s emphatic general election victory and the U.S. and China agreed to an interim limited trade deal. The pan-European STOXX Europe 600 Index ended the week 1.55% higher, and the UK’s FTSE 100 Index climbed 3.11%. Germany’s exporter-heavy DAX index gained 0.27%. The UK pound gave up its postelection gains against the euro and the U.S. dollar after Johnson revived fears of a no-deal Brexit. Johnson signaled that he would amend the Brexit bill to prevent any extension of the transition period for a new trading relationship with the European Union beyond the end of 2020, the current deadline. A failure of the negotiations would mean the economic relationship would default to World Trade Organization terms, with the likelihood of tariffs on imports and exports. (Click here for a more detailed perspective on the implications of the Conservative election victory for Brexit.)

Chinese stocks rose for the third straight week, as a partial trade deal between the U.S. and China offered a temporary respite in trade tensions. For the week, the benchmark Shanghai Composite Index rose 1.23%, and the large-cap CSI 300 Index, which tracks blue chips listed on the Shanghai and Shenzhen exchanges, added 1.2%. The weekly gains came one week after the U.S. and China announced that they had reached an agreement on a “phase one” trade deal that would lower some U.S. tariffs levied during the dispute and suspend planned duties that were scheduled to kick in on December 15.

The Week Ahead

Economic data will be light this week, with building permits, continuing jobless claims, and the Chicago Fed National Activity Index a few of the measures being released.

Key Topics to Watch

- Chicago Fed national index

- New home sales

- Durable goods orders

- Core capex orders

- Weekly jobless claims

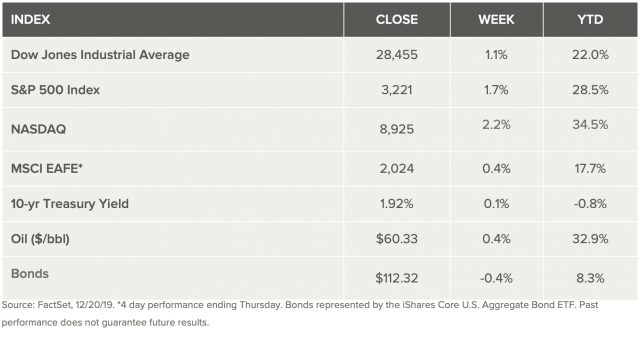

Markets Index Wrap Up