Infineon Technologies AG is close to a deal to acquire Cypress Semiconductor Corp., according to people familiar with the matter.

The companies could announce an agreement valuing Cypress Semi at almost $10 billion, including debt, as soon as Monday, said the people, who asked not to be identified as the details aren’t public. Infineon will pay $23 to $24 per share for Cypress Semi, two of the people said, a premium of more than 50% over the stock price before Bloomberg reported last week that the chipmaker was considering a sale after receiving takeover interest.

Cypress Semi shares closed at $17.82 on Friday, giving the company a market value of $6.5 billion.

A representative for San Jose-based Cypress Semi declined to comment. A representative for Neubiberg, Germany-based Infineon didn’t immediately respond to a request for comment.

Infineon, with a market value of 18.2 billion euros ($20 billion) has mostly sat on the sidelines over the past five years as the semiconductor industry has been reshaped by dealmaking. In 2017, it terminated an agreement to acquire the Wolfspeed Power unit of LED and lighting maker Cree Inc. after a U.S. national security review.

Infineon’s shares have lost almost a third of their value over the past year, with the chipmaker twice revising its forecasts amid global economic uncertainties and a slowdown in car sales in China.

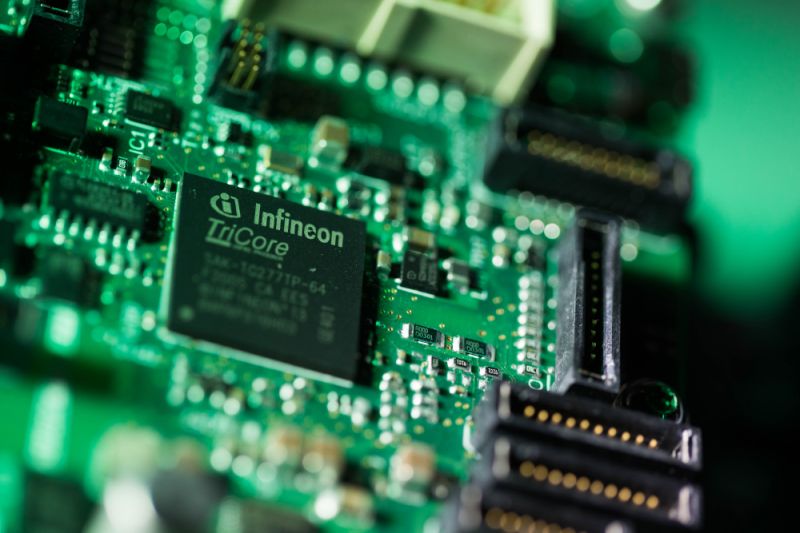

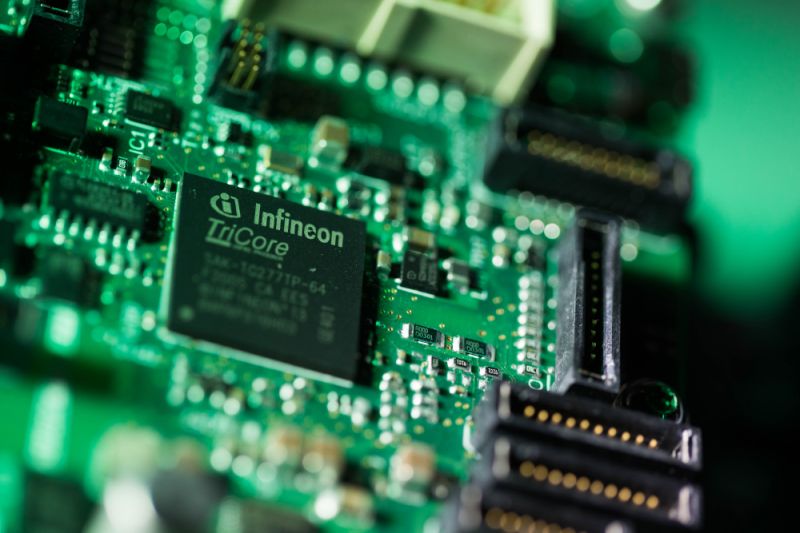

Cypress Semi designs and manufactures flash memory chips and microcontrollers, or chips used for powering small electronic devices.

The company has been trying to recast itself as a provider of chips for use in vehicles and the growing market for so-called internet of things, the push by the electronics industry to connect devices. It’s told investors it expects its automotive business to grow 8% to 12% over the next five years and its IoT unit to expand at as much as 14% in that period.

Annual revenue, helped by an acquisition, has more than doubled in five years to $2.5 billion in 2018. Analysts are predicting that sales growth will disappear this year, forecasting a contraction of about 11%, according to the average of analysts’ estimates from data compiled by Bloomberg.

What Bloomberg Intelligence Says

Infineon’s reported plans to acquire Cypress may result in some arduous integration work, with the buyer focused on power chips and the target on Internet of Things and specialty memory. Infineon makes about a quarter of its sales in China, which has turned into a headwind as the economy slows. It will need stronger 2H sales to meet its 8 billion-euro sales guidance.