There’s no universal numerical answer to the question, “How much does it cost to have a baby?” But it goes without saying that “a lot” covers the situation fairly well.

Entirely ignoring the bills you’ll face related to giving birth, as The Motley Fool’s Christy Bieber noted in a recent article, “the U.S. Department of Agriculture estimates child-rearing expenses total around $12,680 during the first year of a baby’s life.” That’s only an average, of course: Your costs will vary based on a host of factors.

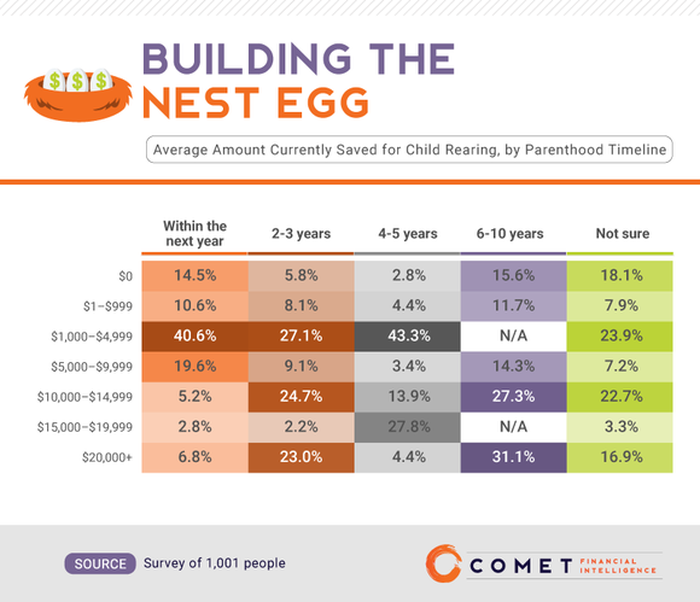

What’s certain, though, is that even if you have a helpful family, a flexible, generous employer, and other advantages, the costs associated will be considerable. Yet despite that certainty, many people planning to having babies have set aside very little money to cover the related expenses, according to a new survey from Comet.

Are you financially prepared for parenthood?

More than 65% of respondents who said they plan to have a child within in the next year have less than $5,000 in savings, according to the survey of 1,001 American adults. But as the chart above shows, those who intend to wait somewhat longer were significantly better prepared financially. For example, among the group that planned to have a child in two to three years, about half had set aside in excess of $10,000 to cover their higher expenses, and 23% had set aside more than $20,000.

What makes these numbers more interesting is that survey respondents also overestimated the cost of every single child product they were asked about. For example, their average perceived cost of a box of disposable diapers was $30, while the actual cost is $26. They were also off on the cost of a high chair by $64, and guessed that the average monthly cost of child care was $932 when it actually comes in at $836.

What’s the total cost?

The costs, of course, don’t end after the child’s first year. A middle-income couple can expect to spend $233,610 on their child between birth and age 18, according to federal government estimates — and that doesn’t include the costs of sending them to college. Many parents and would-be parents surveyed were way off in their estimates of that number as well.

“Nearly 3 in 10 parents guessed raising a child costs $500,000 or more, whereas 22.7% of non-parents said the same,” according to the Comet report. “In fact, current parents typically spend less money on their next child compared to first-time parents, likely because hand-me-downs cut costs.”

What can you do?

While it’s impossible to predict the exact financial impact a newborn will have on your life, it’s not hard to come up with a good estimate. Visit stores and websites to start pricing out the items you’ll need. Ask other parents how much food and how many diapers they tend to go through. Research your child care options, if you are going to need it — the costs will vary widely depending on what provider you pick, and odds are, it’s a choice that you won’t be making strictly based on price. And don’t forget to factor in lost income.

Given all the costs involved, those intending to become parents should start saving for their future children well before they have a due date. If it’s already too late for that degree of advance planning, then at the very least, it’s time to do some math: Start figuring out if your income and assets will be enough to cover your expenses, or if you need to start taking steps to adjust your financial lives before Junior arrives.