People often say that one of the reasons why they don’t save money is because they find it difficult to keep track of what they’re spending.

Fortunately, there are lots of money apps out there that can help with this.

We round up the best, which are all available on iOS and Android.

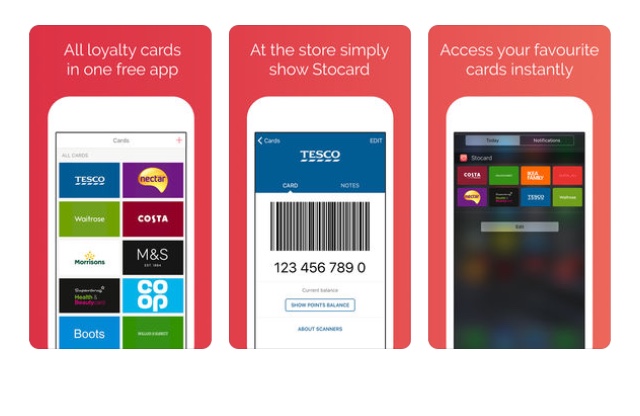

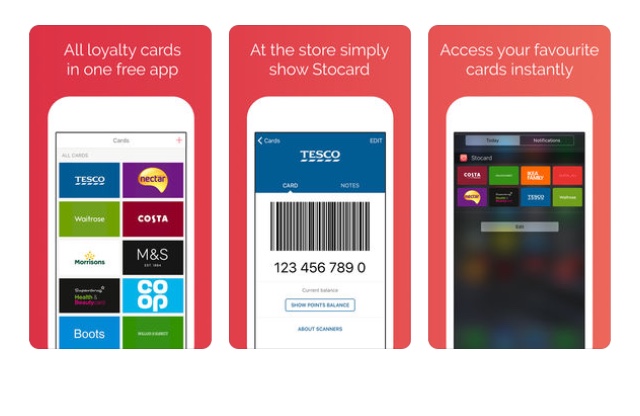

Stocard

This is a chance to bin the plastic and keep all your loyalty cards in a single app. The app works with scores of retailers including Tesco, Boots and Lego. You can also link your Avios account. It’s easy to use – simply tap to add your card and then scan the barcode or enter your card number. The app will tell you how many points you have on each card and whether there are any products on offer you may be interested in. Stocard is available in more than 40 countries and claims to have 15 million users.

When you shop, just select the relevant card and place the barcode under the scanner at the checkout.

Price: Free

Spend Tracker

There are various apps out there that allow you to track what you spend. One of the best in terms of functionality (in my opinion) is Spend Tracker, by MH Riley. The app allows you to log all your income and expenses, and breaks down where you are spending the most amount of money each month. The app has tailor-made categories and you can also create your own. As the month goes on, it will show you how much money you are saving.

Price: Free. You can also pay £2.99 to upgrade to the Pro Version, which removes adverts.

Monzo

The Monzo bank app is a good way of keeping track of your day-to-day spending throughout the month, without you having to input the data yourself. It comes with a contactless, prepaid debit card, which you top up from your normal bank account. Every time you spend on the card, the app automatically categorises your transaction with similar spends (transport, eating out, groceries or shopping, for example). You can then see where you are spending the most amount of money.

Monzo sends notifications to your phone every time you spend and an alert if you’re spending too much to meet your monthly target.

Price: Free

Squirrel

Squirrel is essentially a bank account controlled by an app.

After joining, add your monthly bills, expenses and saving goals. This could be money for a holiday, your monthly gym subscription or a deposit for a new house. You arrange for your wages to be paid into the Squirrel bank account, which works with Barclays.

The app will then hold back money for savings and budgeting. The rest of your pay goes into your bank account as normal. When bills are due, Squirrel will put the necessary money in the bank account.

Price: Free for 3 months, then £3.99 a month

Chip

Chip, which launched less than two years ago, is similar to Squirrel.

Give Chip read-only access to your current account (your details are encrypted). The app’s algorithm then calculates how much you can afford to save, and puts it away for you automatically.

Unlike Squirrel, which doesn’t pay interest on savings, you can earn interest on savings through Chip. Each friend you recommend will earn you 1 per cent interest on your savings. The maximum that can be earned is 5 per cent.

Chip’s savings account is provided by Prepaid Financial Services (PFS), which is regulated by the Financial Conduct Authority.

Price: Free

Money Dashboard

Money Dashboard brings together all your online financial accounts, including current accounts, savings accounts and credit cards.

You’ll have to put all your login details for each bank into the app, but Money Dashboard does not directly store your credentials.

Price: Free

Moneybox

Moneybox aims to encourage people to save for the long term without them even noticing. The app rounds up your spending to the nearest pound, and invests the spare change. For example, if you spend £2.40 on a coffee, the app will invest the remaining 60p.

The money is put into one of three funds depending on your chosen risk level.

Moneybox believes that saving little and often is more appealing to younger savers.

However, be aware the cost of using the service will eat into small amounts of money. If you’re willing to invest more than £25 a month, a stocks and shares Isamay be a better option.

Price: £1 a month, plus platform and investment fees of 0.65 per cent.