Big companies that offer 401(k) plans might seem to be putting their employees on the fast track to savings, but small-business owners and employees don’t have to be derailed by their size. John Keown, a private wealth adviser for Ameriprise Financial Services, said small companies — those with fewer than 100 employees — typically find […]

Category: Personal Finance

Four Tips for Remodeling Your Basement

A finished basement can be a valuable addition to your home. It can be a playroom for your kids, a place for family to stay during visits, a media room the whole family can use, or even a space to rent out for some extra income. However, depending on the current condition of your basement, […]

Tips for buying, selling and saving on the Facebook Marketplace

Looking for a safer way to shop using social media? Maybe you’ve heard of the Facebook Marketplace, which lets users connect to buy and sell products online. It’s a great way to save – and make some extra cash. Right off the bat, you’re connecting to neighbors or friends, or friends of friends, so that’s […]

How to save more money in 2018

Research says if you want to save, you have to use one of two tactics: be more mindful — or completely mindless. New year, same sad savings scenario. According to a new Bankrate survey, one-third of households had a major unexpected expense last year costing at least $2,500. Yet only 39 percent of Americans say […]

Personal finance: Is there such a thing as a debtor’s prison?

In this modern world that we live in, consumers are protected and have certain rights when it comes to debt collection. The practices of debt collection agencies have to abide by rules through the Fair Debt Collection Practices Act (FDCPA) as enforced by the Federal Trade Commission (FTC). According to the FTC, consumers are to […]

5 personal finance tips from Warren Buffett

There are a whole lot of things that can be learnt from one of the richest men in the world, Warren Buffett, who is also a force to reckon with in the investment world. The business mogul has some personal finance tips which he follows that can also adapt to your daily life. Here are […]

Budgeting Tips for First Time Homeowners: Preparing for Your First Year

Congratulations on the purchase of your first home. Though the journey was likely one of ups and downs, you’ve finally found a place where you can start a new life. As one might imagine, it was no easy feat to pinch pennies and save every dime towards buying the home of your dreams, and you […]

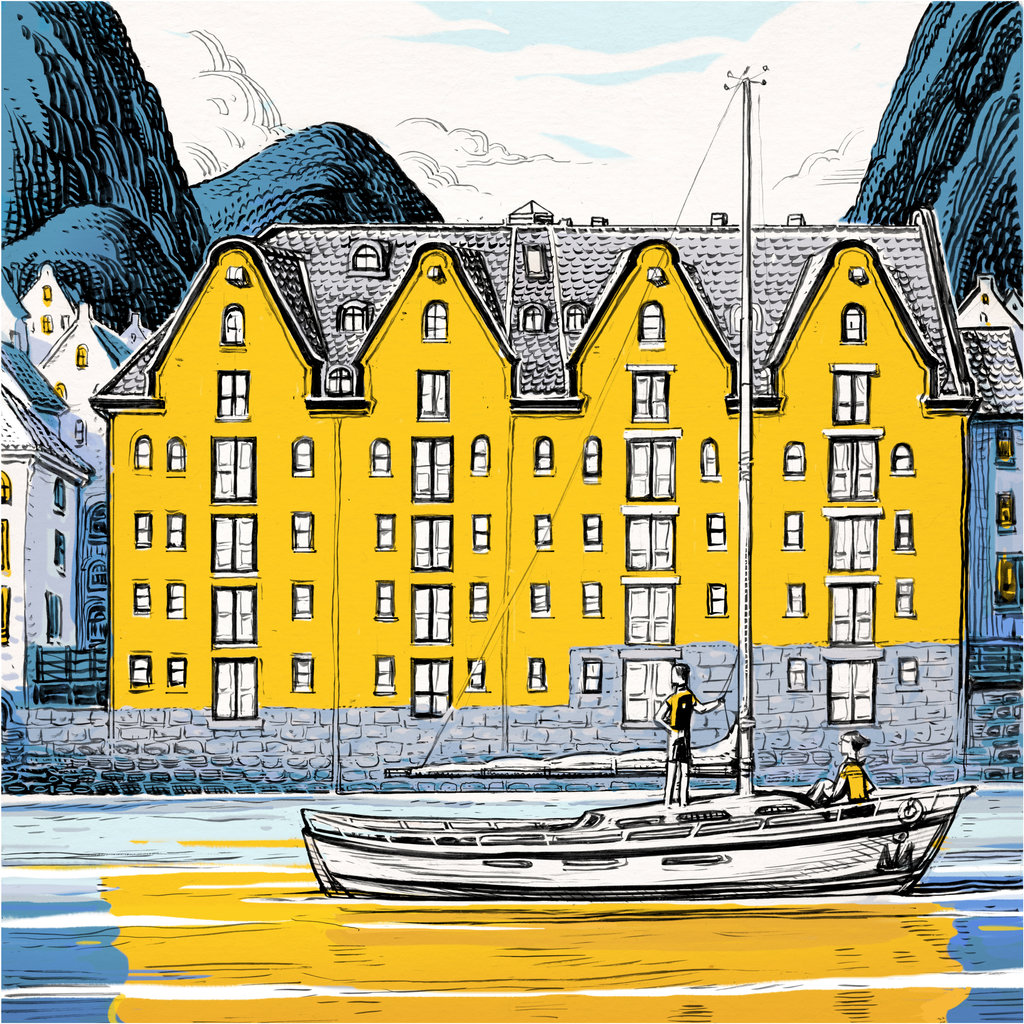

How to Have a Luxury Vacation in Norway for Less

Norway is an affordable destination for budget travelers eager to score luxurious digs and once-in-a-lifetime experiences without breaking the bank. Scandinavia can be one of the most expensive regions in the world to visit, according to Kelly Brennan, a travel adviser at the New York City travel company Indagare. However, Norway — a country with […]

Tips for a spend-savvy Valentine’s Day

We are now exactly three weeks away from Valentine’s Day – but don’t panic. If you’re planning to surprise your significant other with a nice Valentine’s Day treat, we’ve got some tips to help you keep costs in check. The cost of Valentine’s Day Research from American Express has found that 56% of Brits bought […]

Tips for saving cash on the road

Let’s assume you have plenty of vacation time, or are retired with lots of time — and desire to travel extensively. Here are suggestions for cheap travel allowing maximization of your travel explorations. First suggestion: Focus first upon your region, state, the U.S. and Canada. I’ve always been somewhat aghast at friends who notch their […]

11 Tips For Saving Money You Might Not Have Thought Of

Saving money for something Big, like a car, house, or Fuck Off Fund, doesn’t necessarily mean cutting yourself off from avocado toast and lattes — but it does mean spending more (or, uh, at least a little) time looking over your bank statements. If your palms are getting sweaty just thinking about finances, you’re in […]

Three tips to beat your December debt

STRUGGLING to recover from your December debt? You are not alone. In fact, you wouldn’t believe the number of people who get themselves into trouble over December. “Holiday debt is the gift that keeps on taking away large chunks of money from your pocket. And this debt can be with you the whole year, or […]