A robo advisor is a digital platform-based financial advisor who uses data algorithms to come up with an automated financial plan for investors with little or no human interaction. A robo advisor will provide a list of basic finance and investment questions, based on your age and current assets, accumulated debt, investment-risk tolerance and long-term […]

Category: Personal Finance

Aim to Get to $10,000

It can feel daunting to start from zero when you’re a newbie saver or investor. You have financial professionals advising you to put away 20 percent of your income and save double your salary by the time you’re 35, while you’re struggling to pay rent and make your student loan payments on time. Saving anything […]

Catch the refinance train before it pulls away from the station

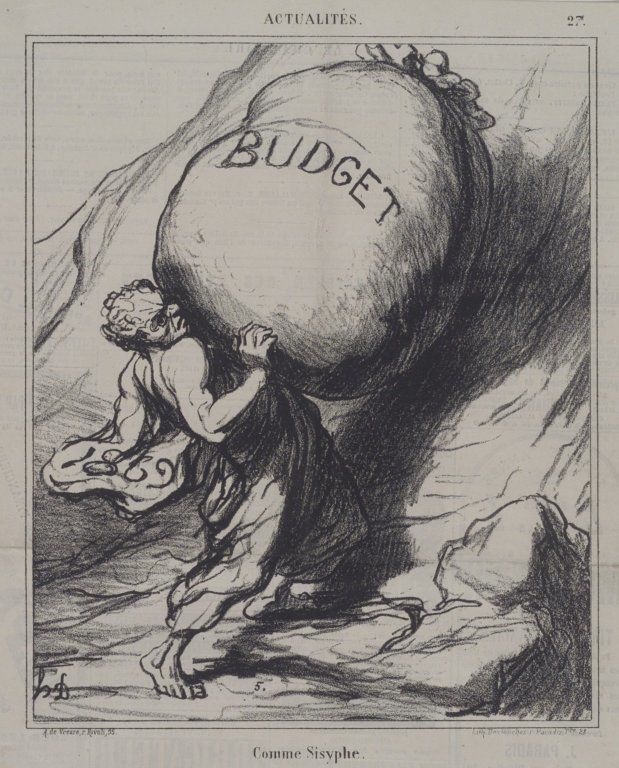

For most families, a home mortgage represents both their largest single expenditure and their biggest monthly obligation. According to credit bureau Experian, the national average mortgage loan balance in 2017 was $201,000. Tennesseans carried an average of $150,000, while in Georgia the mean loan balance was $170,000. Obligations of this magnitude carried into retirement are […]

The best travel credit card if you want cash back

If you want a credit card that rewards travel and offers cash back at a good rate, we’ve got you covered. In a recent analysis of the best travel credit cards, CNBC Make It reviewed 35 of the most popular travel cards in the U.S. Using a sample budget based on data from the Bureau […]

5 money moves to make if you’re starting your career

Financial literacy is a skill that’s often honed and improved with time, not something that necessarily comes naturally to those just embarking on their careers. In fact, research from the National Endowment for Financial Education and George Washington University found that only 24% of 23 to 35-year-olds showed basic financial literacy and a mere 8% […]

Should You Raid Your Retirement Account to Buy a House?

Watch Out for Fees and Penalties This is a common enough personal finance question, Jack, and as with everything, it’s really dependent on your personal situation. As a rule, though, raiding your retirement accounts should be your absolute last resort. The key distinction that needs to be made regarding your question is whether you mean […]

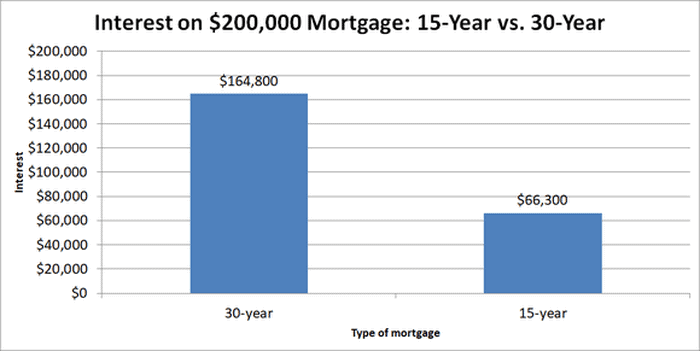

A Foolish Take: 2 Ways to Save With 15-Year Mortgages

For those looking to buy homes, the most popular way to finance a home purchase is to take out a 30-year mortgage. With mortgage rates having been exceptionally low for years, it’s been possible to get extremely attractive monthly payments even on relatively large mortgage loans, and the 30-year term gives homeowners a long time […]

Overtime Rules Employers Need to Know

If you have employees working for you, hopefully you already know you’re required to pay them at least minimum wage. But while most employers understand some of the basics of laws regulating wages, one particular category of law gets a little confusing: overtime rules. Your staff may want to work long hours to help make […]

Four strategies for saving money during the summer

You may be earning money over the summer from an internship, job or any other form of employment. If you’re making some bank this summer, remember that fall semester is approaching faster than we think, and as college kids we always need money. We need textbook money, emergency money, rent money and, of course, some […]

How to save money on your next vacation

Planning a vacation doesn’t mean you have to break the bank on airfare or hotels. By setting up loyalty accounts, picking the right credit cards and redeeming your points for travel, you book a getaway on the cheap. Here’s our guide to saving money on your time off — so your bank account can take […]

Holidaymakers share five money-saving tips for travelling abroad

With the summer holiday season upon us, consumers using HotUKDeals , the UK’s biggest deal-sharing community, have been sharing tips on how to save money when holidaying abroad. Make sure your credit/debit card is abroad friendly or use a pre-paid card Don’t just rely on your usual credit and debit cards that you would use […]

Living Paycheck To Paycheck? Here’s How To Start Saving Your Hard-Earned Cash

Saving money when you live paycheck to paycheck feels completely unrealistic, especially when you’re already on a pretty tight budget (and there’s rent to pay, bills to fork out for and uber eats deliveries that ain’t going to eat themselves). We also know, however, that a savings account that contains an emergency fund should be […]