About 44 million U.S. households held at least one individual retirement account as of 2017, with a whopping $9 trillion in total assets, according to the Investment Company Institute. That amount is greater than the total annual GDP of Japan, the United Kingdom and France combined. Given the ubiquity of IRA accounts, the odds are […]

Category: Personal Finance

How Living Together Before Marriage Impacts Your Finances

Today, it’s common for unmarried romantic partners to live together. Some people even insist that this “trial run” is the best way to get to know a potential life partner before committing for the long haul. In fact, the number of American adults living with their unmarried partner is on the rise, increasing by 29 […]

The best way to boost retirement income

Running out of money in retirement is a huge concern. And given that a large number of workers in their 50s and 60s are behind on savings, it’s a clear source of stress for those who don’t feel adequately prepared. The good news is that there are several tactics you might employ to boost your […]

How women can trim the retirement savings gap

Women put in a lot of free labor in the form of caring for loved ones — and that is costing them in retirement. A recent survey by the MassMutual insurance company found that women expect they’ll have a five-year income shortfall in retirement. Men, on the other hand, believe that their income will be […]

5 Signs You Shouldn’t Work From Home

Working from home certainly comes with its share of benefits. Not only does it allow you to avoid what could otherwise be a terrible commute, but it affords you an opportunity to save money on travel costs and other expenses associated with working in an office. Still, working from home isn’t for everyone, and here […]

How Often Should You Update Your Resume?

Whether you’ve been in the workforce for a couple of years or a couple of decades, you’re probably aware that a strong resume could spell the difference between getting hired at your dream job or getting passed over. You’re also most likely aware that as your skills and responsibilities change at work, it’s crucial to […]

Your Open Office Is Killing Collaboration

Want your business to be a success? Most top companies will tell you that facilitating effective collaboration is key to achieving big things. In fact, businesses across all industries continually strive to improve communication among workers so new ideas can be born. In recent years, this worthy goal of improving information exchange has led to […]

Here’s what economic growth means for your investments

The U.S. economy just got its best report card in nearly four years. If growth truly is ratcheting upward on a sustained basis, as the White House suggests, then that could alter the outlook for stocks, bonds, housing and other investments. The higher-growth scenario becomes more likely after a second-quarter rise in U.S. Gross Domestic […]

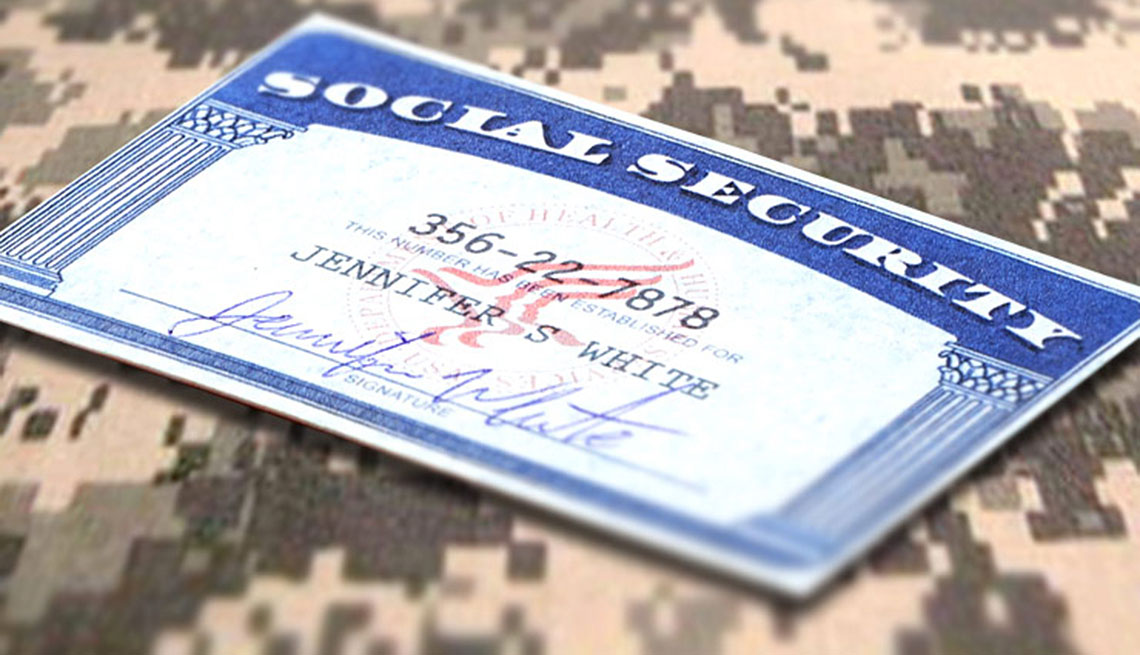

Why Social Security’s COLAs Almost Don’t Matter

Recently, my colleague Sean Williams reported that come 2019, Social Security recipients might see their highest cost-of-living adjustment, or COLA, in nearly a decade. For those who rely on Social Security for the bulk of their retirement income, that’s clearly a much-needed dose of positive news, especially since over the past 10 years, beneficiaries were […]

5 Proven Ways to Boost Your Retirement Income

Running out of money in retirement is a major concern for those approaching that milestone, and that includes folks who have saved substantially. If you’re concerned about depleting your nest egg too quickly, you should know that there are several steps you can take to boost your retirement income and buy yourself some much-needed peace […]

I paid off my mortgage with a credit card—here’s how

Earlier this year, my husband and I dropped a major debt we had been carrying around for years — our home mortgage. We decided many years ago that we wanted to be entirely debt-free by the age of 40, and we made it with a few years to spare, as we’re both 38 now. But, […]

Most U.S. Colleges’ Costs Exceed Federal Loan Limits

With college growing more and more expensive by the day, many students have no choice but to take on debt to finance their education. And unfortunately, today’s federal loan limits keep many students from accessing the financing they need to obtain their degrees. An estimated 70% of U.S. colleges charge tuition and fees that exceed […]