Students across the country are heading back to school — some amid a heat wave. Recent research suggests that could make it more difficult for them to study. For many of us this time of year means weekends at the beach and evenings at the pool, but for America’s students, many of whom are still […]

Category: Personal Finance

What’s in Your Kid’s Wallet? Prepare Students to Live on Their Own

If you’re the parent of a college student, you’ve likely spent years concerned about saving enough for your kid’s education. But now that your child is officially heading off to college, you’re probably worrying about whether he or she can comfortably afford the day-to-day expenses of student living. You may also be wondering if your […]

Here’s why you shouldn’t retire super early — even if you can

Sam Dogen, a San Francisco-based blogger at the Financial Samurai, retired in 2012 when he was 34. Despite the many perks of early retirement — waking up whenever you want, for example — it wasn’t the easiest decision. Dogen said he suffered an identity crisis after giving up his title as executive director at an […]

30% of Employees Can’t Answer This Simple 401(k) Question

Imagine you’re retiring today. You’ve been contributing to your 401(k) for decades, and you’ve built up a strong nest egg. Now what do you do with it? Three in 10 employees don’t have an answer to that question, according to a new study from the Employee Benefit Research Institute. In other words, they’re heading into […]

You Need a Raise. How Do You Start the Conversation?

It’s Personal Finance 101: If you want to be good with money, you have to learn how to save it. But there are only so many slices of avocado toast you can refuse. At some point, being good with money requires something a bit more difficult: earning more of it. As awkward as the conversation […]

Our Favorite Tools to Stay on Top of Your Financial Life

Getting your finances in order isn’t a one-time task — it’s an ongoing process. Whether it’s budgeting, planning your debt payoff, or monitoring your credit, your financial life needs regular, reliable attention. The right set of tools can help. We’ve rounded up some of the best money apps and services to help you get on […]

One big reason people don’t pay off their credit cards every month

Many people are late on their credit-card payments because they simply don’t have the cash. But an even more shocking number don’t pay because they, well, forget. Some 448 of respondents in a survey of 2,000 people released Tuesday by personal-finance company NerdWallet said they had made a delinquent payment on their debt, meaning the […]

Facts About The Labor Force

The total civilian labor force is slightly over 162 million people, according to the July 2018 Employment Bulletin from the Bureau of Labor Statistics (BLS). 156.0 million of the labor force is currently employed, while 6.3 million are unemployed. 129.0 million of those employed are full-time workers. Hopefully, you are one of them. Do you […]

70% of Americans now support Medicare-for-all—here’s how single-payer could affect you

The vast majority of Americans, 70 percent, now support Medicare-for-all, otherwise known as single-payer health care, according to a new Reuters survey. That includes 85 percent of Democrats and 52 percent of Republicans. Only 20 percent of Americans say they outright oppose the idea. “Medicare is a very popular program, so the idea of expanding […]

Here’s how much money Americans have saved at every age

A new study finds the median American household has $4,830 in a savings account. That’s enough to cover minor emergencies and potentially even a few months of living expenses. Overall, between bank accounts and retirement savings, the median American household currently holds about $11,700, according to MagnifyMoney. Almost 30 percent of households have less than […]

Benefits of Incorporating Your Business

1. Protection for personal assets If you operate your company as a sole proprietor or you’re a general partner, the law doesn’t see any separation between you and the company. If your business is sued and there’s a judgment against you, personal assets are at risk. If your company gets deeply into debt, you may […]

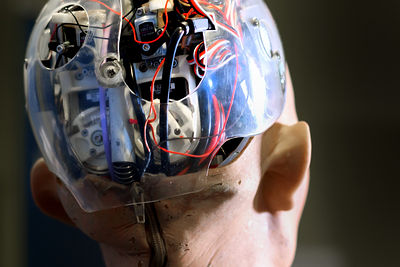

Do Financial Literacy Courses Work?

The classroom is where many Americans learn to read, write, perform arithmetic and speak a foreign language. So can it also be the place where they master important financial concepts such as how to manage debt, improve credit, take out student loans and plan for retirement? For many politicians, educators and financial literacy advocates, this […]