Starting your own landscaping business is difficult on many levels, but it becomes almost impossible to do when your credit is terrible or you’re under piles of debt. For aspiring landscape company owners looking to start their own venture but suffering from crushing debt and a plummeting credit score, take a look at a few […]

Category: Personal Finance

This Is Becoming Millennials’ Favorite Investment

Everyone seems to have an opinion about the investing behavior of millennials. Like most other investors, millennials want convenient, simple ways to invest that will help them achieve their financial goals. Based on what these young workers are doing with their retirement plans, millennials seem to be gravitating toward what many see as the perfect […]

3 Money Milestones Everyone Should Reach by 30

Like it or not, by the time you turn 30, you’re basically a full-fledged adult, and with that comes certain financial responsibilities you’ll need to get a handle on. Here are three money-related goals you should aim to achieve by age 30. 1. Have a fully loaded emergency fund Life has a way of surprising […]

Stressed By Home Buying? Don’t Be

A Stressful Experience What’s the most stressful event you’ve had in your life? Applying for college? Going on a job interview? Hosting Thanksgiving dinner for your entire family? According to a recent survey by Homes.com, buying a home tops all of those events as “the most stressful event in modern life.” One-third of respondents said […]

What You Need to Know About Cheap Insurance

When it comes to selecting an insurance plan, you have a tricky financial choice to make: Purchase the most expensive insurance policy or pass up a high-priced policy in favor of more affordable coverage and rock-bottom annual premiums? You don’t want to rush through the decision because in terms of coverage, you generally get what […]

When’s the Next Financial Crisis Coming – and How Do You Prepare?

A decade has passed since the height of the last major financial crisis. And if you have a pessimistic – or practical – mindset, you know that Americans are due for another money meltdown in the future. Today’s economy looks different than it did 10 years ago. The U.S. stock market has experienced the longest […]

5 Habits That Will Prevent You From Being Financially Secure

What does financial security mean to you? Does it mean not lying awake at night worrying about bills? Does it mean knowing that if an unplanned expense comes your way, you’ll have a means of handling it? If you’re hoping to become financially secure, you’ll need to avoid certain habits that will stop you from […]

These 4 money chores are faster to do than you think

Sometimes money is like technology. Getting stuff done, whether it’s updating an operating system or moving a bank account, takes longer than it should. There are some money chores, though, that can be done a lot faster than you may think. The following financial tasks, which could save you a lot of cash and stress […]

Here’s how much you need to save each month to be a millionaire in 40 years

A record number of Americans are becoming millionaires. As of 2016, there were 10.8 million millionaires nationwide, according to a 2017 report from Spectrem Group. Could you become one of them? Reaching that milestone isn’t the challenge it once was, after all. If you’re at the beginning of your career, you still have decades left to save. And even […]

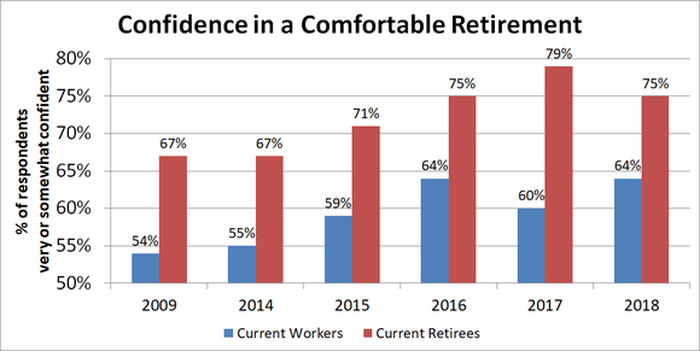

A Foolish Take: Will You Have Enough Money to Retire?

Saving toward retirement is challenging for many Americans. Given all of the competing demands on your paycheck, it can be hard to set aside money that you won’t need for years, or even decades. But even though many people aren’t as diligent as they should be about retirement saving, they’ve still done a good enough […]

Give more, keep more — embracing tax law changes

Are you charitably inclined and want to do it with moxie and momentum? We are headed into the fourth quarter and understanding how the new tax laws impact you will help you enhance your charitable decisions. Standard deductions have gone up — for individuals $12,000 and couples $24,000. If you are over 65, you each […]

Want a Six-Figure Salary? Here Are the 5 Most Valuable College Majors of 2018

There are well over 100 different majors college students can potentially choose, and it’s no big secret that graduating college will generally boost your earnings power. Having said that, there’s a huge difference in earning power among the choices. Not only do some earn dramatically more than others, but many fields have minuscule unemployment rates […]