Does your business have good credit? Companies get a credit score, just as individuals do, and your company’s score affects whether it can borrow and the interest you’ll pay. Figuring out your score can be complicated, especially since your company doesn’t have just one. Different reporting agencies — including Experian, Equifax, Dun & Bradstreet, and […]

Category: Personal Finance

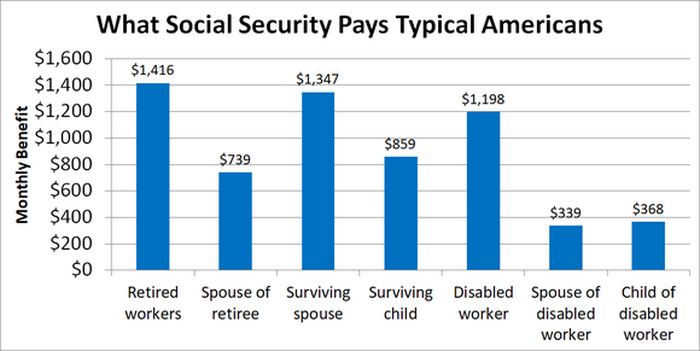

A Foolish Take: How Much Does Social Security Pay?

Social Security plays a key role in the financial security of American workers and their families. More than 60 million people receive Social Security benefits, and more than half of all retired workers who get Social Security count on it for the majority of their income during their retired years. As you plan for your […]

5 Tips for Finding a Side Hustle

Maybe you need extra money to pay down some debt. Or maybe you’re hoping to take a sweet vacation that your regular paychecks alone can’t cover. There are plenty of good reasons for getting a side hustle, and these days, an estimated 44 million Americans have one. But side hustles can be tricky to come […]

Even Wealthy Older Americans Worry About Long-Term Care

Retirement can be a financially daunting prospect, especially when the notion of long-term care is thrown into the mix. In fact, managing and paying for long-term care needs is something that has even wealthy older Americans concerned. In a recent Nationwide survey of well-off older adults (defined as age 50 or older with a household […]

How Universal Savings Accounts Could Change the Way You Save

Tax reform will dramatically change your taxes when you file your returns early next year. With new rules covering tax rates, deductions, and other tax breaks, there’s a lot of planning that smart taxpayers are doing to take advantage of new opportunities to reduce how much they pay the IRS. Yet some lawmakers aren’t satisfied […]

How to make the most of your side business

It can be personally and financially rewarding to earn extra cash doing something you enjoy. If you are one of the many Americans supplementing your paycheck by running a small business, here are some tips to help you profitably manage your side gig: Make your business official Consider running your side job like a real […]

Start Saving Today for This Major Expense

We all know we’re supposed to set aside money for things like emergencies, retirement, and college. But while these are all relatively high-profile categories, there are smaller yet significant items we need to save for along the way, one of which will be here before you know it: the holidays. While many folks don’t currently […]

How to Plan an Amazing Honeymoon That Won’t Break the Bank

AMERICANS SPEND AN average of $4,000 on their honeymoons, according to WeddingWire’s 2018 Newlywed Report. That often follows an engagement ring purchase, ceremony and reception that cost $32,000, on average, according to the report. Starting off your married life with a $36,000 expense is going to have financial ramifications for years to come. While there […]

How to Make Money on YouTube

FOR CHRIS PREKSTA, co-launching the now-popular YouTube show “Pittsburgh Dad” was a “happy accident.” In 2011, Preksta filmed his co-creator Curt Wootton performing an amusing impression of his father’s Pittsburgh-inflected accent, and the pair edited it to look like a family sitcom. They uploaded it to YouTube, primarily to share with their own families. But […]

Are You Too Broke to Be a Parent?

IN THE UNITED STATES, fertility rates are declining. One of the key reasons young people are opting not to reproduce: Kids are too expensive. That conclusion comes from a survey conducted by Morning Consult for the New York Times, which found that, among respondents who had or expected to have fewer children than desired, the […]

Never pay checked baggage fees again with these travel hacks

It’s getting more expensive to bring bags on planes, but these simple tips can help you avoid those costs The bad news? Airline baggage fees are going up. The good news? If you read this, you won’t have to pay them. That’s because, with a few rare exceptions, you should never have to check your […]

The Best Streaming Services for Busy Professionals

LIFE FOR A BUSY professional is complicated. It can be hard to carve out time in the evenings to watch TV, especially in real-time. Luckily, streaming services make it a lot easier to watch TV on your own schedule, especially with features such as on-demand content and digital video recorders to help you have more control over when […]