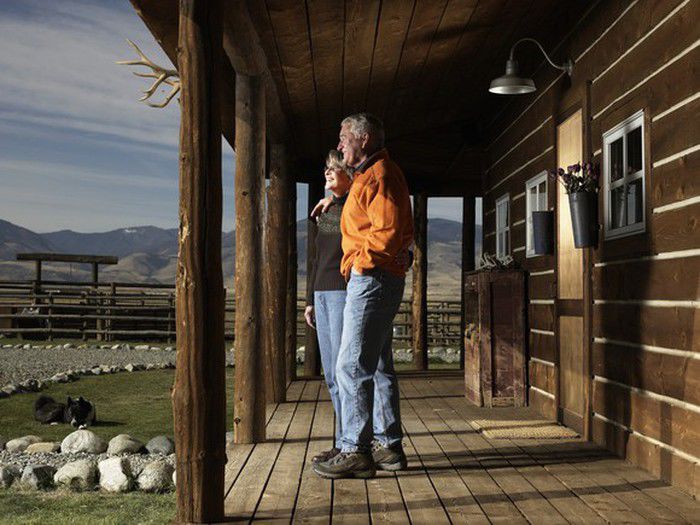

For many folks, retirement is an opportunity to pursue hobbies, travel, and enjoy spending time with family and friends. But apparently, it’s also the right time to own a second home. In fact, 41% of Americans would like to own a vacation home in retirement, according to data from GOBankingRates. And while that’s a neat […]

Category: Personal Finance

3 Ways to Make Your Money Work for You

Chances are, you work hard for your money and would like to make the most of it. Here are a few ways to ensure that the money you acquire is also working for you. 1. Save it You won’t grow a ton of wealth by housing money in a standard savings account, but whatever interest […]

4 Ways to Communicate Better With Your Boss

The relationship you have with your boss can dictate how pleasant your work experience is and how rapidly you advance at your company. As such, it’s worth sinking some time into improving the way you communicate with your manager. Here are a few ways to get started. 1. Understand what information your boss expects you […]

Forget what you think ‘retirement’ is supposed to be

A recent study of midlife Americans asked, “Which do you fear more, death or retirement?” I was blown away to read that 63% chose retirement. If you’re afraid of retirement, I have good news for you: you’re not alone and you don’t have to go the traditional route. Up until very recently I had a […]

Avoid These 3 Big Side Hustle Traps

A side hustle can, under the right circumstances, help you put your financial house in order. Taking on a gig-based second job gives you flexibility, extra money, and a responsible way to fill some free time. In theory, that extra cash can help pay off debt, build an emergency fund, or save for a major […]

These Are the Habits of Financially Secure People

Money does not always bring happiness, but it can. The amount of money people need to be happy came in at between $60,000 and $75,000 a year, according to researchers analyzing a Gallup World Poll survey of more than 1.7 million people from 164 countries. That’s probably less than you’d expect. In reality, how much […]

Even Higher Earners Could Use More Retirement Savings

Millions of workers risk retiring without enough money to keep up with their expenses, and the reason generally boils down to inadequate savings. But while it’s one thing for lower earners with limited income to fall behind on their retirement plan contributions, it’s another thing for higher earners to make that same mistake. Yet new […]

YES, YOU CAN SAVE TO BUY A HOUSE AND STILL LIVE YOUR BEST LIFE

Whether you’re currently scouring the market for your dream home or it’s still a few years down the road, saving up for your first real house can seem like an incredibly daunting task. Michelle A. Alvarado, a Home Lending Officer at Citi, understands the fear that oftentimes accompanies this important life moment, but points out […]

5 key retirement planning decisions for baby boomers

The vast majority of baby boomers haven’t accumulated enough savings to fully retire at age 65 with their preretirement standard of living. That’s the sobering conclusion of recent studies from both the Stanford Center on Longevity and HR consulting firm Aon. As a result, boomers will need to either work longer, reduce their standard of living in retirement […]

About 90 percent of American men are confident they can manage money

When it comes to managing money, a lot of Americans feel like they’re on the right track. More than half of U.S. adults, according to a recent Student Loan Hero survey of over 1,000 adults, mostly between the ages of 25 and 44, say they’re confident about meeting their financial goals. And nearly all American […]

Found a home listing that claims to be a ‘bargain’? It could be — depending on where you are

In Tuscon, Ariz., when a home listing is described as a “bargain,” that’s a pretty clear indication that the price is in fact a steal. But in Cape Coral, Fla. that’s far from the case. A new report from real-estate website Trulia examined how often listings advertised as a bargain were, indeed, bargains. The analysis […]

How Fintech Can Revolutionize Your Personal Finances

The rise of fintech exposure extends beyond corporate innovation and business technology developments. The future of fintech also consists of personal financing tools and platforms to allow for simplicity and efficiency in the space. MoneyLion CEO Dee Choubey, MyVest CEO Anton Honikman and Finicity Vice President of Strategic Programs, Lisa Kimball, discussed Wednesday at the […]