Buying a house is one of life’s most exciting milestones. You get to decorate, make the home your own, and set down roots — all while building equity and, ideally, increasing your net worth. But buying a house is also a really big financial decision, and if you don’t hit some money milestones before you […]

Category: Personal Finance

Who’s Pledging to Save More in the New Year? The Answer Might Surprise You

Given that 40% of U.S. adults don’t have enough savings to cover a mere $400 emergency, the need to ramp up savings efforts is clear across the board. And with a new year about to kick off, many folks are resolving to do better in the savings department once 2019 rolls around. But, perhaps unexpectedly, […]

3 Budgeting Mistakes You Probably Don’t Realize You’re Making

Anyone who wants to use their income wisely can benefit from learning how to build a budget and stick to it. Despite the importance of living on a budget, most Americans don’t even have a plan for their money. If you’re part of the minority, Americans who do actually have a budget, you’re already ahead […]

401(k) Contribution Limits Increase in 2019, but It Won’t Matter to the Average American

With retirement becoming increasingly expensive, saving independently is all the more crucial — especially since Social Security by itself won’t be enough to pay for retirement. Thankfully, there’s some good news in this regard: 401(k) contribution limits are increasing in 2019, which means workers will have a greater opportunity to pad their nest eggs. Currently, […]

Kiplinger’s Personal Finance: Four savvy credit card moves

Using credit cards wisely is more than just avoiding debt. You need to protect your credit from identity thieves and make sure you’re getting the most from a card’s rewards program. To help with that, consider these four savvy credit moves. Freeze your credit reports: A freeze is the best way to prevent identity thieves […]

3 Reasons You Shouldn’t Retire Early

Early retirement is a dream for many, but even if you think it’s a possibility for you, that doesn’t mean it’s your best option. In fact, financially speaking, you may be better off not retiring early. Here’s a few reasons waiting to retire may actually be the smart move. 1. You will boost your Social […]

Want to Become Wealthy? Do This One Thing

So you want to be wealthy? Welcome to the club. Now, how to get on the road to riches — especially if you’re living paycheck to paycheck. It’s not complicated to find a path to wealth, and nearly anyone can do it over time, with dedication and discipline. Here’s the task: Spend less than you […]

Pension vs. 401(k)

When you’re ready to retire, you’ll want to have more than Social Security savings to pay the bills, which typically only provide enough money to replace about 40 percent of average earnings. To live comfortably in retirement, you should have either a traditional pension plan or a defined contribution plan, like a 401(k) account. While […]

It’s OK to ignore your 401(k) balance right now — but make sure to ask these 3 questions about your investments

If you’re freaking out about your retirement account right now, you’re definitely not alone. The stock market took a dive this week after the Federal Reserve announced an interest-rate hike for 2019, and it left many investors looking through their fingers at their dwindling account balances. In fact, this could be the worst December for […]

Everything You Need to Know About Social Security Survivors Benefits

When most people think of Social Security, they think of retirement benefits, but there’s actually much more to the program than that. One of its most valuable features is the survivors benefits it offers to family members of workers who die. Social Security survivors benefits can help people who were dependent on the deceased person’s […]

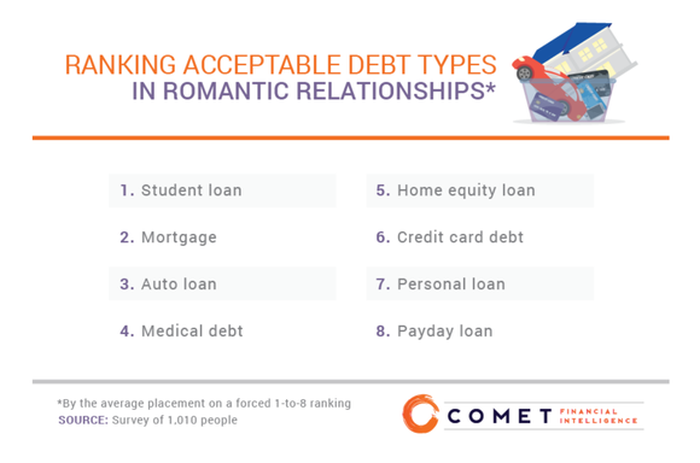

Dating and Debt: What You Owe Can Put Your Relationship in the Red

Most people won’t ask personal finance questions on a first date. Money is simply one of those topics that’s best left for when you know the person sitting across the table from you a little better — even though how someone handles their finances can offer you some key insights about whether they have relationship […]

Too Many People Make This Tax Planning Mistake

The Internal Revenue Service has issued a whopping $324 billion in tax refunds so far this year to nearly 112 million taxpayers, for an average refund of nearly $2,900. As good as it may feel to get that money, the reality is that it’s terrible news for those receiving a big refund. Indeed, angling for […]