Women appear to be more selective in their job hunting than men. Women are 16% more successful than men at landing a job after applying, and 18% more likely than men to be hired when applying for more senior roles, according to LinkedIn’s new Gender Insights report. One explanation for this success: Women are more […]

Category: Personal Finance

West Coast real estate is now so expensive that married couples are moving in with multiple roommates

Married couples are making room for roommates. Sometimes, multiple roommates. Just ask Kelsey Riley Dixon. The 29-year-old business owner and her husband, a semi-pro kayaker, share a four-bedroom home with three male roommates “to reduce costs in the very expensive city of Seattle,” she says. “It allows us to have a home in a really […]

Where mortgage payments take the smallest bite out of people’s bank accounts

It’s getting tough to afford a place to live — but residents of the nation’s capital are better placed than their peers in other cities. People in Washington, D.C., have the most money left over in their bank account after paying their mortgage each month, according to a new report from Zillow ZG, -0.84% which […]

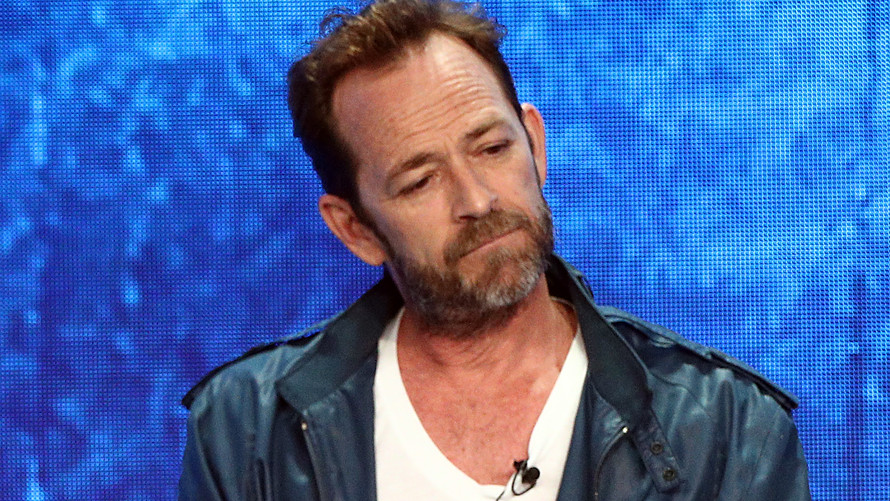

Luke Perry’s fatal stroke is a warning for younger adults

“Beverly Hills, 90210” star Luke Perry, just 52, died on Monday after suffering a massive stroke, which is a solemn reminder that a stroke can strike someone at any age. “Although stroke often affects older individuals, it is not only a disease of the elderly. Luke Perry’s tragic death highlights the fact that stroke can […]

These financial worries are probably preventing you from retiring early

Many people believe retiring early will help them live longer. But because of the uncertainty of expensive health-care costs, they do not pursue financial independence. That Catch-22 was one of the key findings of the latest online survey on retirement and health from TD Ameritrade. The poll included 1,503 adults ages 45 and up with […]

How to avoid racking up personal debt as an international student

While student loan debt is inevitable in many cases, there are other forms of debt that international students can easily avoid. It may be difficult to manage your personal finances initially. Many international students are leaving home for the first time and having to manage a large amount of funds they aren’t at all used […]

How Will Alienated America Save For Retirement?

Alienated America is the title of a new book out by Tim Carney, commentary editor at the Washington Examiner and American Enterprise Institute visiting fellow. Its core observation is this: while in the 2016 general election, Trump had the support of evangelicals and other pro-life Christians, because of the binary choice between Trump and Clinton […]

3 Dividend Stocks That Are Perfect for Retirement

When it comes to stock investing while in retirement, dividend stocks tend to be some of best investments you can make. Not only do they tend to be less volatile stocks that help you preserve your nest egg, but they also throw off cash you can use to supplement your income without having to draw […]

Lawmakers want to bring back these 3 tax breaks

Lawmakers are making a bipartisan push to grant filers some certainty on a package of tax breaks for the 2018 tax year. These breaks are known as “tax extenders, ” a series of temporary provisions in the code that have expired and must be reauthorized by Congress retroactively each year in order for filers to […]

What Is The Average Retirement Savings in 2019?

It costs over $1 million to retire at age 65. Are you expecting to be a millionaire in your mid-60s? If you’re like the average American, the answer is absolutely not. The Emptiness of the Average American Retirement Account The first thing to know is that the average American has nothing saved for retirement, or so […]

5 Essential Tips for Preparing Your Cryptocurrency Taxes

Paying taxes on Bitcoin and other cryptocurrencies is becoming a priority for individuals in the US after the IRS announced on July 2nd, 2018 that one of their core campaigns and focuses for the year is the taxation of virtual currencies. Because cryptocurrencies are treated as property in the eyes of the law, they are subject to capital […]

This Smart Investment Can Help You Avoid Taxes

Investing your money is a good way to grow it into an even larger sum over time. But if there’s one downside to investing, it’s having to pay taxes when your portfolio makes you money. There are several ways you might get taxed on investments. If you sell assets for more than what you paid […]