If you’re like most Americans, you might not have a ton of money saved or invested. And reading what you should have or should be saving—say, saving 20 percent each paycheck, or having your yearly salary saved by the time you’re 30—can be overwhelming. So much so, that you just might not start. But as […]

Category: Personal Finance

Are elite colleges really a ‘golden ticket’ to a successful life?

More than two dozen wealthy parents — among them high-powered CEOs and the actresses Felicity Huffman and Lori Loughlin — went to expensive and illegal lengths to secure attendance at elite colleges for their own children. The drastic measures the parents took indicate how much they coveted that symbol of success. But the federal case […]

Sorry, but that $1,100 standing desk won’t make you thinner

You might want to sit down for this. Standing desks won’t make you lose weight, and they also don’t make you significantly healthier or more productive, according to a new analysis of 53 sit-stand desk studies. Dr. April Chambers, a bioengineer and assistant professor at the University of Pittsburgh, collaborated with Dr. Nancy A. Baker, […]

Looking for a new job? Here’s what hiring managers want

Your greatest asset when applying for a job might be your social savvy. Four out of 5 employers polled by CareerBuilder say that soft skills, including communication abilities and critical thinking, are equal to or more important than hard skills — or specific technical abilities — when they’re hiring candidates. The employment website polled 1,021 […]

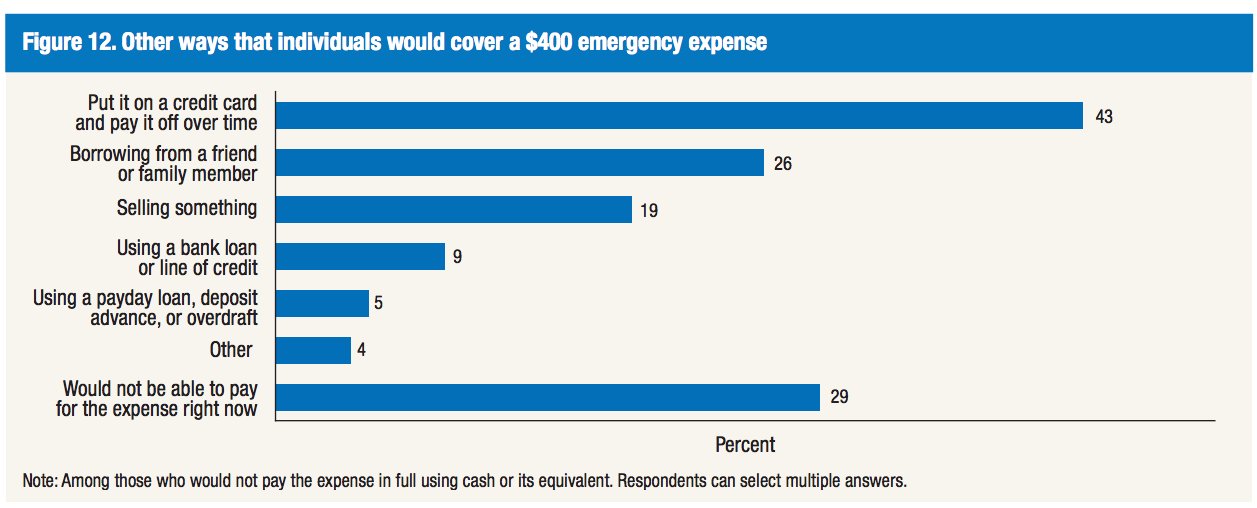

One-fifth of Americans say they have zero savings

About a fifth of Americans have no money tucked away for unexpected costs. About 21% of working Americans said they aren’t saving any money at all, Bankrate found in a survey. Among those who are saving, a majority are putting away less than 10% of their income. Over the past several decades, household savings in […]

Have Your Toast and Get Rich Too: A Realistic Guide to Personal Finance

It’s not a conversation anyone likes to have, especially in Portland. It’s bad enough to live in a city where the cost of living keeps rising while wages stagnate and the gap between rich and poor is widening to historic levels. Meanwhile, you can hardly scroll through Twitter without coming across some article mocking your […]

If You Work Full Time, Calculate Your ‘Hourly’ Wage

When you’re working full time, you can track your spending and make a budget using percentages of your income to try to get a handle on what you can truly afford. But thinking in terms of monthly or even weekly allotments of money isn’t necessarily the most effective way to think of your dollars. Calculating […]

Why Retirement Planning Must Start at the End (and Why Many Do It Backward)

Stephen Covey, the author of The 7 Habits of Highly Effective People, advises readers to begin with the end in mind. After all, how can someone progress toward a goal if the goal is undefined? Unfortunately, that’s exactly how many people approach the biggest goal of their lives: retirement. Some 70% of Americans feel they […]

Here’s how much the average person spends in a day

Between groceries, gas and going out, Americans cough up a lot of dough in a single day — $164.55, on average, in fact. That’s according to a recent report by GOBankingRates, which analyzed necessary and discretionary spending data from the Bureau of Labor Statistics to determine out how much the average person spends every day. […]

Is Your Teenager Learning Personal Finance In High School?

The sad but quick answer is…probably not. According to the 2018 Survey of the States: Economic and Personal Finance Education in Our Nation’s Schools, conducted by the Council for Economic Education (CEE), only 17 states require that high schoolers take a personal finance course. What’s worse is that while policy makers and the public have increased their focus […]

As debt climbs in US, the next financial crisis you should worry about is your own

We all seem to be on the lookout for clues that we’re on the verge of another widespread financial crisis. The memories from the debacle a decade ago are so bad that no one wants to be caught by surprise again. So many wonder: Is it a sign that a recession is looming because December’s […]

The 10 cities where seniors are the most prepared for retirement’s financial realities

Online personal finance portal SmartAsset and its SmartAdvisor Match service surveyed and compiled a list of the U.S.cities where seniors are most prepared for retirement. The company noted that Northwestern Mutual has found more than a fifth of Americans, overall, have nothing saved for their retirement, and that government analyses show that those families that […]