When Michael Bloch’s wife graduated from law school with more than $300,000 in student loans, the couple sat down to come up with a plan. After reading blogs and articles, drafting spreadsheets and consulting a financial advisor, they still didn’t have an answer. “We really struggled with what is the right way to pay those […]

Category: Personal Finance

How 401(k) savers can avoid a nasty surprise come retirement

Since its debut nearly 40 years ago, the 401(k) has emerged as one of the premier tools to save for retirement in America. In fact, when we poll 401(k) participants across the country, the majority of them consistently say it’s their largest — or only — source of retirement savings.* One of the main reasons […]

Buying a house? Here’s how to ensure your confidential financial details remain secure

Buying a home is a complicated process that involves sharing sensitive information with multiple people. And the latest major data leak highlights the risk consumers take on when they share that information. Roughly 885 million mortgage-related files stretching back over a decade were exposed by First American Financial Corp., one of the country’s largest title […]

Since 2009 every time stocks have 3-week losing streak, the market does this next

Since 2009 the stock market has suffered a three-week losing streak 18 times. A month later stocks bounce back, according to a CNBC analysis of Kensho, a data tool used by Wall Street banks and hedge funds to uncover profitable trades from market history, Stocks began the truncated trading week after Memorial Day on a […]

The House passed a bill that would allow more annuities in 401(k) plans — is that actually a good thing?

The SECURE Act is one step closer to becoming law, and with it, Americans would see a few tweaks to the way the retirement system works. As part of the SECURE Act, which the House of Representatives passed last week, individual retirement accounts’ age cap would be lifted, small businesses would have more avenues to […]

Health Savings Account Limits for 2020

For many people, health savings accounts (HSAs) offer a tax-friendly way to pay medical bills. You can deduct your contributions to an HSA (even if you don’t itemize), contributions made by your employer are excluded from gross income, earnings are tax free and distributions aren’t taxed if you use them to pay qualified medical expenses. […]

Six personal-finance hacks that aren’t easy but promise a big payoff

Hacks are hard because shortcuts rarely exist. Prizes take time and effort. The personal-finance industry — filled with advice that sounds and feels good without moving the needle — needs to recognize this. These aren’t fun hacks, but no one said this was easy. 1. Accepting that living below your means requires suppressing your ego […]

Social Security: What is the best age to begin collecting?

Have you ever wondered how the FICA tax information on your pay stub impacts your future retirement benefits? FICA is a payroll tax that funds both Social Security and Medicare, amounting to a 7.65 percent contribution from each paycheck, an amount which your employer matches. It gets deducted from your first paycheck all the way […]

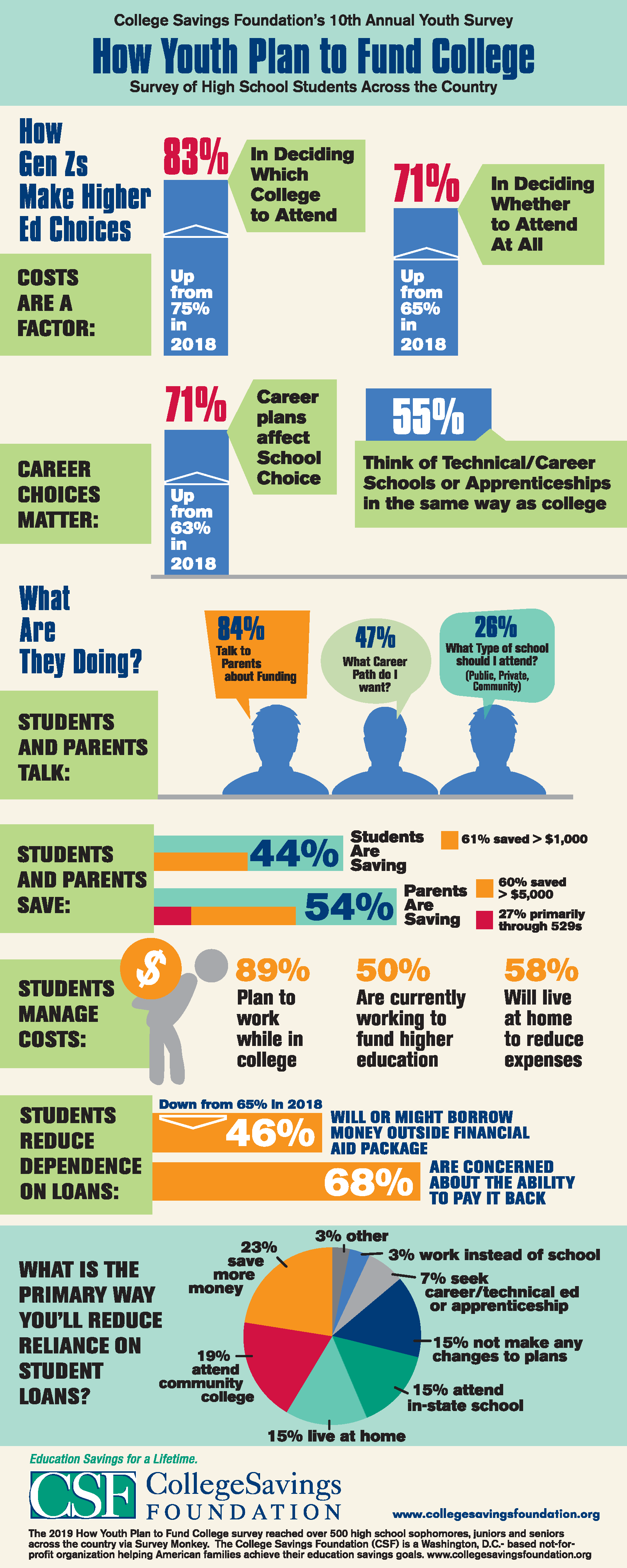

Kids are increasingly worried about paying for college

Parents, of course, worry about paying for college. Increasingly, their children share that concern. Over the last decade, tuition and fees jumped 44% at four-year, private colleges and by 55% at public four-year schools. As a result, student debt has reached record proportions, with $1.6 trillion in loans outstanding. Now, high school students are more […]

6 Steps to Snare Higher Yields in Retirement

Income investing is supposed to be like watching a predictable movie that you’ve seen a dozen times before. But lately, it has been full of plot twists. Over the past few years, most income investors settled back with their popcorn for a long period of rising interest rates, believing the Federal Reserve would slowly but […]

5 Money Mistakes That Recent Grads Make

Since most universities don’t provide financial literacy education, college graduates are left with little to no knowledge when it comes to managing their money. But conquering your financial life is just as important as landing your dream job. If you’re not keeping any of the money you’re making, snagging a sweet salary isn’t going to […]

What Happens When Social Security Goes Broke?

Americans are worried about Social Security. Whether it’s Transamerica’s annual retirement survey (44% of workers fear a reduction in or elimination of Social Security benefits), Gallup (67% of workers worry a “great deal” or “fair amount” about the Social Security system as of March 2019), or any of a variety of other surveys, the trend […]