Most of us have been told that when it comes to debt, it’s best to avoid it altogether You’ve heard it everywhere: Aside from a major purchase, like a home, if you can’t pay cash for something, then you can’t afford it. Of course, that’s easier said than done. Consumer debt rose to $4.05 trillion […]

Category: Personal Finance

Yet Another Study States That Americans Are Falling Down on Retirement Savings

Americans aren’t exactly known as strong savers, which explains why so many live paycheck to paycheck. But in a survey by the CFP Board released earlier this year, 48% of U.S. adults aren’t saving any money for retirement. And that’s disturbing, because while Social Security will provide some income for bill-paying purposes, those benefits aren’t […]

The most ‘valuable’ college majors

Your college major has a huge impact on the size of your paycheck later on. Pharmacy majors earn a median salary of $100,000, while music majors make $36,000. Flower fan? Botany majors typically earn $50,000. A new ranking by personal finance website Bankrate.com orders majors by the median income and unemployment rates they lead to. […]

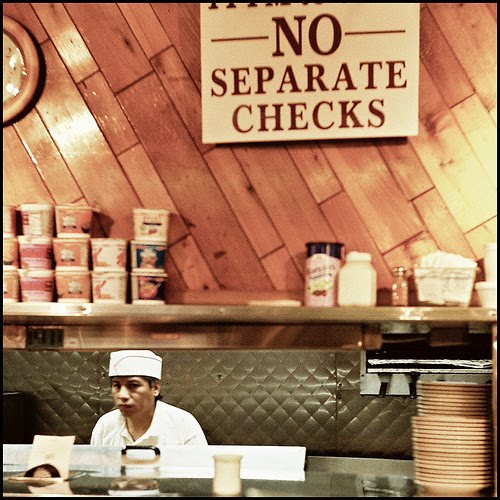

Separate checks and tipping decisions can set off distasteful round of judgment

Perhaps it’s time for a refresher on the financial etiquette of eating out. Yes, splitting a check is okay. No, you should not shame someone for how much he or she leaves as a tip. Let’s start with asking for separate checks. If I’m eating out with a large group, I always ask the server […]

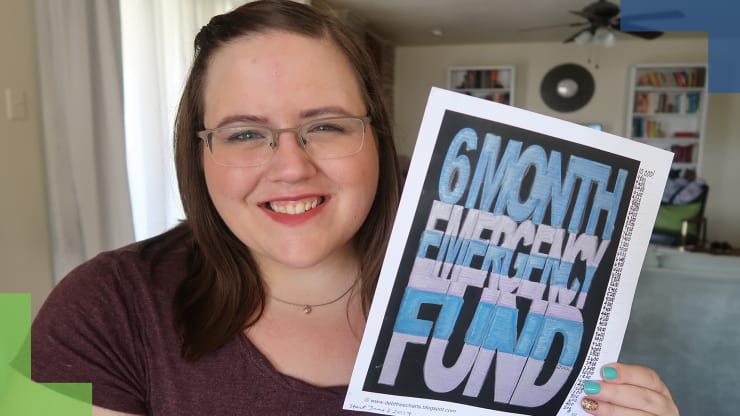

Do you think saving is hard? This trick could make it easier to stay motivated so you meet your goal

Just when you think you have it all figured out, life throws you a curve ball. Recently, Sarah Wilson, who lives in College Station, Texas, and blogs at GoBudgetGirl.com, hit the emergency trifecta: a computer repair, an unexpected $500 medical expense and the all-too-common pricey car repairs. Recalling the time when she still had debt […]

Foolproof tricks to save money on back-to-school shopping

As Labor Day nears, it’s inevitable that the lengthy list of school supplies your child needs for the first day will creep up on you — and back-to-school shopping can easily become one of the highest yearly expenses for some parents. Fortunately, Inside Edition recruited Miko Love — the Budget Mom — to break down […]

Whether married or single, this is how women are financially vulnerable in retirement

This isn’t your mother’s or grandmother’s retirement. If you’re a woman in your 50s, the chances are greater than ever that you’re not married, either because you’re divorced or because you’ve never walked down the aisle, according to a recent study from the Center for Retirement Research at Boston College. The research took a look […]

Millennials are the new face of the retirement crisis

You think you are facing a retirement finance crisis? Consider the millennial generation, those born between 1981 and 1996. Starting this year they became the largest living generation in the U.S. Compared with their dismal retirement finance prospects, those currently in or close to retirement would seem to be living on Easy Street. At least […]

The Debt Panel: ‘I consolidated my debts three years ago, then I built up more’

Debt panellist 1: Philip King, head of retail banking at Abu Dhabi Islamic Bank You have done well in closing your previous cards by securing a personal loan. Cards usually carry substantial financing rates that can become a burden to the borrower if the balance is not cleared each month. Your high debt burden ratio […]

Burns: It may be time to eat the rich

A few years ago, in one of my bolder proposals, I suggested that we eat the rich and take all their money. It was a surprisingly popular idea, immediately accepted by the vast majority of people who don’t consider themselves rich. The rich were surprisingly silent about the notion, perhaps because they were busy thinking […]

5 Things You Need to Know About Health Savings Accounts

With healthcare growing more expensive by the minute, many working Americans and retirees alike are grappling with costly medical bills. If that sounds like you, then it pays to learn more about health savings accounts, or HSAs. These accounts let you save and invest money that can be used to pay for qualified medical expenses, […]

A Recession Won’t Wreck Your Retirement…But This Will

Here is what matters if you’ve made it and want to keep it. Do the financial markets have your attention? I assume so. After all, Wednesday’s 800-point drop in the Dow was the worst day in the U.S. stock market this year. And while many investors missed it, the December 2018 plunge in stock prices […]