With over 10,000 Americans turning 65 every day, the question of how to pay bills during retirement is on the minds of many. I have almost daily conversations with individuals planning for their next stage of life and surprisingly, while each situation is unique, the choices all dovetail into the same five ways that cash […]

Category: Personal Finance

This Surprising 401(k) Mistake Could Wreck Your Whole Retirement

When it comes to saving for retirement, it’s tough to tell whether you’re doing enough to prepare. Everyone has different retirement goals, and what one person is saving won’t necessarily match up to what you should be socking away. If you’re fortunate to have access to a 401(k) with matching contributions from your employer, it’s […]

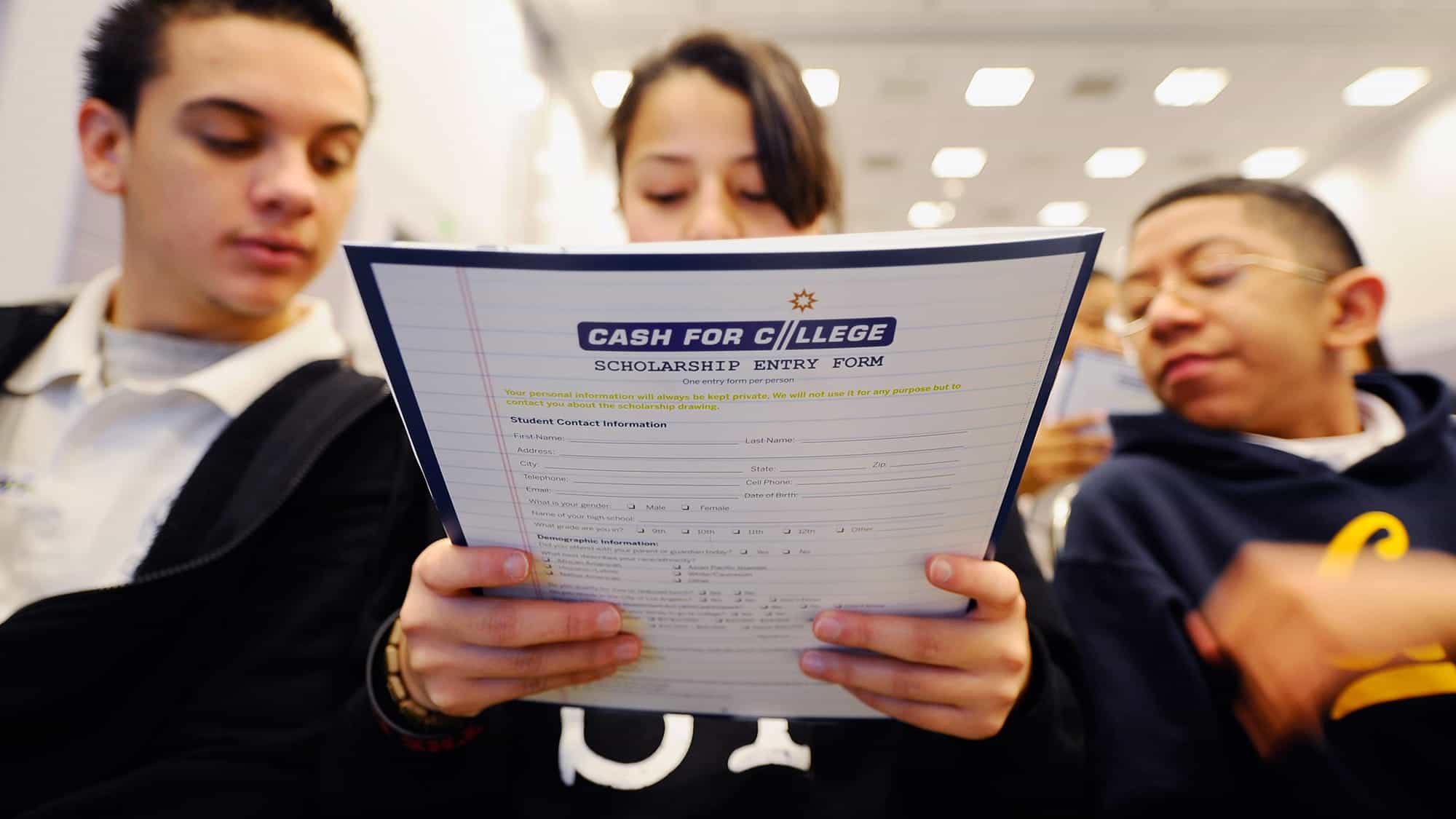

Here’s how to unlock that all important college financial aid

Today’s reality: Before you decide on which college to attend, you have to come up with a way to pay for it. To that end, families are relying on financial aid more than ever before to help cover the skyrocketing cost of tuition. More than 8 in 10 families tap scholarships and grants — money […]

3 Financial Habits That Can Help You Retire Rich

If you dream of retiring rich, you’re not alone. More than half (51%) of Americans believe they will be wealthy someday, according to a survey from personal finance website MagnifyMoney. Exactly what “wealthy” means depends on the individual. For some, it might mean retiring a millionaire. For others, it could be defined as being able […]

5 ways to build a million-dollar solo enterprise on a shoestring

Rajesh Srivastava always loved trading stocks and options. When he found a way to turn that passion into a software that helps traders analyze and respond to the market, he started a one-man business around it in 2015. He eventually left behind his career working for technology firms to run his company, priceSeries, in Sunnyvale, […]

3 Reasons You Won’t Retire Rich

Retiring comfortably takes a lot of money — often $1 million or more. You don’t need a six-figure income to save that much, but you do need a plan and the discipline to stick to it. Yet many people make shortsighted choices that dash any hopes of retiring with enough money. Here are three mistakes […]

The Most Reliable Ways To Generate Retirement Income

With over 10,000 Americans turning 65 every day, the question of how to pay bills during retirement is on the minds of many. I have almost daily conversations with individuals planning for their next stage of life and surprisingly, while each situation is unique, the choices all dovetail into the same five ways that cash […]

Here’s where you can retire nicely on just $30,000 a year … outside the US

If you’ve been racking your brain about where to retire on a budget, it might be time to think outside the U.S. A report by International Living, which publishes information about living abroad, lists destinations where you can coast on less than $30,000 a year. To be sure, retiring in a new country will require […]

Why the 4% Rule for Retirement Won’t Work Anymore

When planning for retirement, many people like to look for simple rules to follow. There are plenty out there — one of the most common is the 4% withdrawal rule. It states that you can comfortably withdraw 4% of your savings in your first year of retirement and then adjust that amount for inflation for […]

Wealthy households keep 27% of their assets in cash. A new checking account aims to help you make the most of it

If you want to know where the wealthy prefer to put their money, you might be surprised to find out it’s in cash. A Capgemini report found that cash surpassed equities for high-net-worth individuals as their No. 1 asset class in the first quarter of 2019. The reason: market uncertainty. In North America, those wealthy […]

The 1 Thing Most People Get Wrong About Retirement

Saving for retirement is complicated and confusing, and there are dozens of factors to consider when creating your retirement plan. How much should you save? What age do you plan to retire? How much will healthcare costs affect your budget? One factor in particular that can have a major impact on your retirement is Social […]

Women are struggling to find men who are financial equals

The marriage vow that usually involves a variation of “for richer or poorer” may no longer apply. Women may now want to add “as long as you make as much money as me.” It seems many men aren’t getting up to the income level that women prefer in a potential marriage partner, according to the […]