A secure financial future is what most Americans hope to get with their college degree. More than 80% of freshmen students say they pursued higher education “to be able to get a better job.” Another popular reason? “To make more money.” Many college students, then, are likely to be disappointed. That’s because half of the […]

Category: Personal Finance

The New Realities Of Work And Retirement

Bob Orozco barks out instructions like a drill sergeant. The 40 or so older adults in this class follow his lead, stretching and bending and marching in place. It goes like this for nearly an hour, with 89-year-old Orozco doing every move he asks of his class. He does that in each of the 11 […]

IU chooses Fidelity as its new retirement plan recordkeeper

Indiana University has selected Fidelity as the sole provider of administrative recordkeeping services to the IU retirement plans. In addition, a new, simplified investment menu was introduced. Information about the changes and enhancements has been sent to active IU employees, retirees and people who no longer work for the university but were fully vested before […]

These cities have the highest job and wage growth in America

The U.S. job market is still strong, but some cities appear to have more pep than others. The top three cities for job growth are Boston (up 8.4% year over year in September with 152,683 open jobs), Philadelphia (up 6.4% over the same period with 112,692 open jobs) and Atlanta (up 5.5% with 192,889 open […]

People who live on the coast are typically happier than those who don’t

Living by the ocean blue can help keep you from feeling … well, blue. A new U.K. study of almost 26,000 people finds that those who reside about half a mile from the beach have better mental health than those who live more than 30 miles away. Researchers from the University of Exeter analyzed data […]

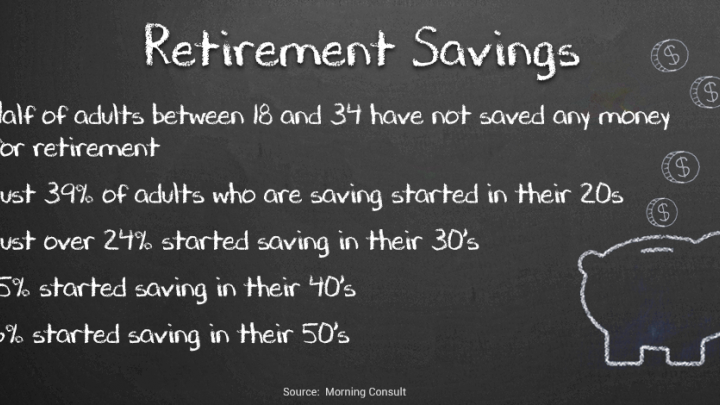

Here’s how much you should have in your 401k to reach retirement goals

Save now so you can spend later. That’s the simple money advice that’s easier said than done for most Americans when it comes to saving for retirement. Half of adults between 18 and 34 have not saved any money for retirement, according to a new report from Morning Consult. Just 39 percent of adults surveyed […]

If your company offers a 401(k), does it make sense to have a Roth IRA, too?

Roth IRAs and 401(k) plans are essential tools for building up your retirement savings. They’re both tax-advantaged, which means they are designed to minimize a person’s tax burden (aka the amount you owe the IRS at the end of the year). They also offer some of the simplest and quickest ways to diversify your investments […]

Is Your Retirement Budget Realistic?

When it comes to something as important as calculating your retirement expenses, the worst thing you can do is take a shot in the dark. But unfortunately, that seems to be the favored strategy among most Americans. If you figure too high, you could end up saving more than you need and working longer than […]

62% of Americans Need to Catch Up on Retirement Savings: Here’s How Each Age Group Can Do Just That

If you’re lucky, you’ll have several distinct sources of retirement income that will come together to buy you a comfortable lifestyle. One such source will likely be Social Security, assuming you worked long enough to pay into it. Another source could be earnings from a part-time job you hold down during your golden years. And, […]

3 Dividend Stocks That Are Perfect for Retirement

Investors in retirement or close to it often look to dividend stocks to provide a steady source of income without having to sell shares when the market is on a downswing. But retirees should be planning an investment strategy that will support them into their 90s, which means that the plan will need to include […]

Behind on Your Savings? You’re Not Alone

When you’re decades away from retirement, saving may not be your biggest priority. With a laundry list of bills and other financial responsibilities, it may be tempting to focus more on those than retirement planning. However, the longer you put it off, the harder it will be to catch up. Eventually, it may even become […]

What Happens to Your Debt When You Die?

Knowing what happens to your debt when you die likely won’t be a top dinner table conversation tonight. After all, death and money are taboo subjects on their own, let alone together. That’s the takeaway from a U.K.-based study which concludes the absence of a candid talk about a breadwinner’s death leads directly to financial problems after he […]