Mike Bloomberg released plans to shore up Americans’ retirement on Sunday, promising to increase Social Security retirement benefits and create a government-backed savings plan for workers at all income levels. “Americans who have worked for decades deserve the opportunity to retire without facing constant financial pressure, and, as president, I will strengthen Social Security to […]

Category: Personal Finance

The Odds Are Heavily in Your Favor If You Claim Social Security at This Age

You may not realize it, but there’s a very good chance that you’ll be reliant on Social Security, to some degree, to make ends meet during retirement. According to Gallup’s April 2019 surveys, a record-tying 90% of current retirees lean on Social Security as a necessary part of their monthly income, while a near-record 83% […]

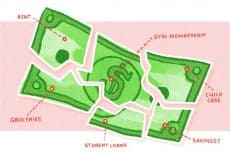

How Much of Your Paycheck Should You Save? Here’s the Deal at 4 Income Levels

You gotta live your life and pay your rent. But by this point, you’ve also (hopefully!) prioritized saving. But how much of your paycheck should you save? We checked in with Ashley Feinstein Gerstley, founder of the Fiscal Femme and author of The 30-Day Money Cleanse, to get her take. Her answer is that it varies. After all, […]

6 Tax Deductions You Can Claim Without Itemizing

You have two choices for claiming deductions on your tax return: You can go with the standard deduction the IRS allows you to take or itemize your deductions in the hope of scoring a higher tax break in the process. For your 2019 tax return (the return you’re filing this year), the standard deduction is: $12,200 […]

How to Retire on a $200,000 Inheritance

Getting a hefty chunk of change from an inheritance is a nice way to boost your retirement savings. But is it enough to live off of when the time comes for you to retire? If you’ve received about $200,000 and you’re wondering if your windfall will put you in the “I’m set” category for retirement, you might need […]

Worried About Retirement? 3 Moves That’ll Help You Change Your Mindset

Retirement is a scary prospect. Think about it: It’s basically several decades of unemployment, assuming you don’t work in some capacity during that time, coupled with a host of potentially unknown expenses, like repairs on your aging home or medical costs that come in higher than anticipated. If you have concerns heading into your senior […]

Why people with student debt are refusing to repay it

Sandy Nurse doesn’t see why she needs to be $120,000 in debt “just for trying to improve my understanding of the world.” And so, after a decade of struggling to repay her student loans, she plans to stop trying. She hopes others will join her, too, in a national strike against the country’s outstanding student […]

There’s now a record number of 401(k) and IRA millionaires, according to Fidelity

Thanks to record-breaking markets and more retirement savings, the number of 401(k) and IRA millionaires has reached a new record, according to Fidelity. Fidelity, the largest 401(k) provider in the United States, released its quarterly analysis Thursday. The report on retirement trends has become increasingly relevant as baby boomers retire in record numbers. The study […]

How much you should have in savings at each life stage

Spending can be a whole lot more enjoyable than saving. But when life throws a nasty curveball and you wind up in the hospital or your car dies on the interstate, you’ll definitely want a financial cushion to fall back on. At the most basic level, savings enable you and your family to enjoy the […]

Those annoying required withdrawals from your IRAs just got changed

It’s the bane of some older Americans. Once they hit a certain age, the government makes them take money out of their retirement accounts, even if they don’t need the cash. That is changing, albeit slowly. The recently passed Secure Act raises the age for when those required minimum withdrawals must begin — to 72 […]

HOW CRYPTO SAVINGS CAN EARN 250X MORE THAN A BANK ACCOUNT

The crypto industry is evolving into a decentralized financial landscape. This builds upon Satoshi’s original vision of becoming bankless, and some digital assets are yielding bank busting interest rates. DEFI IS THE FUTURE OF CRYPTO Banks are in trouble and that much is a fact. Global debt is escalating and commercial banks are feeding it […]

Most Older Americans Would Tell Their Younger Selves to Start Saving Sooner

Retirement can seem very far away when you’re young. Unfortunately, because of this, many people who are just starting out don’t save enough for it. Saving too little early on can make it much harder to catch up later as you lose out on years of compound interest. That’s likely why so many older Americans […]