Retiring wealthy is on everyone’s mind, yet there are very few people who actually manage to save and grow their money well enough to retire with an easy mind. As expats, this can be harder, especially if you’re supporting family back home. Expats in the UAE have a prime opportunity to earn and save tax-free […]

Category: Personal Finance

The ridiculously simple way to save money: envelopes

Have extra cash? Put it in an envelope. In fact, put it in several. That’s the “cash hack” that helped “Broke Millennial” author Erin Lowry save $500 in one year on a $25,000 salary. The theater major moved to New York City in her early 20s after landing a job as a page on The […]

Employers Cutting 401(k) Matching Contributions

The pandemic, which has changed the way millions of people work, is also starting to change the way they save — and not in a good way. Some 12% of employers have suspended matching contributions to their 401(k) plans, and an additional 23% were planning to cut their match or were considering it, according to […]

Don’t Claim Social Security Benefits if You Can’t Answer These 3 Questions

Deciding when to claim Social Security benefits is one of the most important choices you’ll make. If you’re considering starting your checks now because you’re ready to retire or because the coronavirus has interfered with your ability to keep working, you need to make sure you’re really ready. And to do that, you need to […]

40% of Americans expect to keep working in retirement. Is that right for you?

For many people, retirement is a lifelong goal, and you’ll need to save consistently for decades to achieve it. But for more and more workers, retirement is becoming unreachable, no matter how hard they work for it. Roughly 40% of people believe they’ll never be able to retire at all, according to a recent survey […]

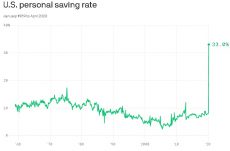

U.S. savings rate skyrocketed in April

A major reason banks were rolling in so much dough last quarter is the explosive growth of the U.S. personal savings rate, which hit the highest mark since the 1980s in March and a historic 33% rate in April. By the numbers: The rate of savings as a percentage of disposable income was by far the […]

Here’s how much you need to put in a 529 savings plan every month to send your kid to Harvard debt-free

Many parents dream about giving their children an Ivy League education but not everyone does the math to see how much the degree will cost them. CNBC ran the numbers, and we can tell you how much money you would need to save to send your child to Harvard. First, some assumptions. For saving, we […]

What is a universal savings account?

President Trump has proposed creating universal savings accounts for Americans to help households save, a policy that is already available to residents in some other countries. Universal savings accounts, or USAs, are tax-free investment vehicles that have fewer limits and restrictions than other traditional savings methods. For example, people could withdraw funds whenever they pleased, […]

TaxProper raises $2M to automate getting your property taxes lowered

If you own your home, how much do you pay for property taxes? Does it seem like too much? If you disagree with how much you’re paying in property taxes, you can appeal the assessment. Most people don’t, though — perhaps because they are unaware they can, or because they just don’t have the time […]

Good news for small businesses as Senate passes PPP reform bill

Business owners who received a forgivable loan through the Paycheck Protection Program are likely getting more leeway on how to spend those funds. The Senate passed legislation Wednesday night that restructures how entrepreneurs can use loans issued through a new federal relief program for small businesses ailing from the economic contagion unleashed by the coronavirus […]

3 Tricks to Help You Save on Your Taxes for Next Year

I know: You probably have a lot on your mind and don’t want to think about taxes until you absolutely have to. But it’s actually to your benefit to start thinking about your 2020 taxes now, even if you have months until you need to file them. The decisions you’re making right now and over […]

Great Jobs for Retirees

Chanda Torrey found retirement wonderful for the first two weeks. Then, not so much. Torrey, 50, of West Palm Beach, Fla., retired in mid 2019 as a Red Cross regional chief development officer. At first, she thought retirement was “paradise,” she says. “But after a few months, I didn’t know who I was. Not having […]