The U.S. economy officially peaked in February and has since entered a recession, ending the longest expansion on record, the National Bureau of Economic Research declared Monday. This recession — spurred by the coronavirus pandemic and subsequent public health response — is an unusual one, NBER’s Business Cycle Dating Committee said in a statement. However, “the unprecedented magnitude of […]

Category: Personal Finance

4 reasons to save for retirement outside of your 401(k)

401(k)s offer tax advantages, employer funded matching contributions, and convenient, automated deposits. Plus, the IRS discourages 401(k) withdrawals prior to retirement age — a good thing for anyone who has trouble saving. Still, there’s a case to be made for investing outside your 401(k) once you’ve maxed out your company match. And that case is […]

Simple Steps Toward Retirement Certainty in Uncertain Times

While the coronavirus pandemic has put the retirement security of all Americans at risk, there are actions they can take to put themselves in a better position, retirement plan experts say. Catherine Collinson, chief executive officer and president of the Transamerica Institute, says the first thing people should do is formulate a financial strategy for […]

4 Reasons to Save for Retirement Outside of Your 401(k)

401(k)s offer tax advantages, employer funded matching contributions, and convenient, automated deposits. Plus, the IRS discourages 401(k) withdrawals prior to retirement age — a good thing for anyone who has trouble saving. Still, there’s a case to be made for investing outside your 401(k) once you’ve maxed out your company match. And that case is […]

Why CDs Might Be a Great Place for Your Money Right Now

Collectively, Americans are saving more money than they have in many years. Unfortunately, at the same time, interest rates on savings accounts are bottoming out. Money expert Clark Howard says that the combination of these two things presents a dilemma for savers: Where to stash money you’re not ready to invest but also don’t expect to touch for […]

Here’s What the Average 60-Something Lost in Retirement Plan Value Due to COVID-19

When cases of COVID-19 first started multiplying rapidly in the U.S., the stock market reacted, so much so that it plunged into bear-market territory in mid-March. Since then, stocks have managed to recover some of their value, but the toll on retirement plans is still pretty evident. And while it’s disheartening to see a loss […]

Retirement Myth Busting

There are some widely held beliefs about federal retirement that simply aren’t true. These ideas can lead federal employees down a dangerous path when it comes to making key retirement planning decisions. Sometimes there’s enough fact in a myth to make it believable, or it may have been passed around so much that it appears […]

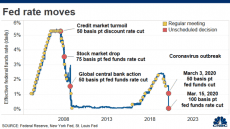

Here’s what negative interest rates from Fed would mean for you

The economic shock from Covid-19 may call for drastic measures, but negative interest rates are not one of them — at least not yet. The Federal Reserve has never brought its benchmark rate into negative territory and, according to Fed Chairman Jerome Powell, the central bank is not considering going to negative interest rates now. […]

Mortgage demand from homebuyers amazes again, now up 13% annually despite rising rates

Rising interest rates did nothing to deter an onslaught of mortgage demand from homebuyers. Applications for loans to purchase a home rose 5% last week from the previous week and were 13% higher than a year ago, according to the Mortgage Bankers Association’s seasonally adjusted index. Mortgage rates started the week near a record low […]

Some seniors can supplement retirement benefits with this extra source of Social Security income

Social Security has long been an important source of income for retirees, and it could become even more so due to the coronavirus. Many workers will be forced to claim benefits earlier than planned if the recession caused by COVID-19 leads to long-term job losses and unexpected early retirement. And other retirees may reduce their […]

Almost 70% of Americans Worry They Won’t Have Enough to Retire

For most Americans, retirement isn’t necessarily something to look forward to. Instead, it’s a source of financial concern, with a recent survey from Capital One showing that 68% of Americans think they won’t have enough money in their later years. And this was before the coronavirus, which has caused even more concern about retirement readiness […]

3 great reasons to take Social Security benefits at 62

Your standard Social Security benefit is based on your working history over your 35 highest-earning years. To get the standard benefit amount, you need to retire at a specific age called your full retirement age (FRA). Depending on the year you were born, you’d need to retire between the ages of 66 and 67. Many […]