Sometimes fathers know best. That’s why FOX Business spoke with several money experts to find out what financial advice their dads have given them that they still use today in honor of Father’s Day. Here are nine personal finance tips from real-life dads that have a proven track record of success, according to experts in the field. […]

Category: Personal Finance

This Personal Finance App Helps You Get the Most Out of Your Money

Budgeting is an essential skill for anybody, but especially for entrepreneurs. When you’re juggling business expenses, it can be difficult to think critically about your personal expenses, as well. Before you know it, your budget has fallen by the wayside and you’ve spent $500 on pizza delivery in the past 30 days. Managing your personal […]

Why Searching for Cheap Stocks Is the Wrong Investing Strategy

Legendary investor Warren Buffett said, “It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.” You can read that to mean Buffett isn’t buying cheap stocks, and you shouldn’t either. Low-priced stocks have their appeal, for sure. An ultra-low share price or P/E ratio inspires your […]

Retirees Believe This Is the Key to Being Ready for Retirement

Preparing for retirement can be stressful and complicated for workers, but it’s a necessity. One way to make sure you’re as ready as you can be is to listen to the advice of current retirees regarding what’s important. To that end, recent research from Wells Fargo revealed those who have left the workforce largely agree […]

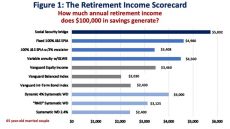

Learn About The Many Types Of Retirement Income Generators

There are many types of retirement income generators (RIGs) that each produce different amounts of retirement income. My Retirement Income Scorecard compares the amounts of retirement income that are possible for 10 different RIGs, which is one consideration for choosing a RIG or combination of RIGs to build your retirement income portfolio. This post describes […]

Follow these tips for saving money in best way

Everyone in the country desires to be rich. They have money and can enjoy all the comforts of the world. But for this, some small things have to be kept in mind that will help make you rich. Financial planner says that to get rich one should try in a planned way. Along with this, […]

Your money: What should you do if you lost or threw away your stimulus?

Did you pitch your much-awaited stimulus payment because it showed up on a plastic card that, frankly, looked like an unsolicited debit or credit card? Some people treated those envelopes like junk mail. After all, the card arrived in a plain envelope — marked Money Network Cardholder Services, not U.S. Treasury — and many people […]

3 unexpected sources of retirement income

Retirement is expensive and becoming more so all the time. Meanwhile, fewer jobs are offering pensions to help cover retirement costs, and some are even canceling 401(k) matching temporarily due to the strain this latest recession places on their finances. Some workers are also struggling to set aside money for their futures right now, and […]

This 35-year-old works 75-hour weeks and earns $280,000 a year as a real estate appraiser—here’s how he spends his money

At any given time, Terrence Bilodeau can tell you his exact net worth. The 35-year-old real estate appraiser based in Fort Worth, Texas, checks it monthly to see how far he is from his goal of $10 million. He’s well on his way: As of January 2020, when CNBC Make It reviewed his finances, he’s […]

IRS permits more Americans to tap retirement accounts without penalty

The IRS released new financial relief guidance related to the coronavirus pandemic on Friday, allowing more people to draw from their retirement accounts without penalty. In addition to people who lost their jobs during the pandemic, the tax agency now says individuals who experienced a reduction in pay or were supposed to start a job […]

Tips to save money, recession-proof your finances

Putting money away can be really tough. How much do you save? What are you saving for? Local personal finance professional, Layne McDaniel, breaks down how to better save money now for a future rainy day. “The biggest thing is to pay yourself first,” said McDaniel. Before you dole out your hard-earned cash, keep some […]

‘Stretching Your Dollar’ by saving money on insurance in minutes

INDIANAPOLIS — Every year, Americans lose out on millions of dollars by not doing one simple thing: shopping around for new insurance. That includes coverage for your home, car and whatever you have that’s valuable. It may sound time consuming and complicated, but it can take just a matter of minutes with a simple phone […]