During the pandemic, most tech companies matched growth with lots of hiring. Now as things have cooled off, many are cutting thousands of jobs to try and reign in spending. Apple has so far been one of the few to avoid slashing jobs. And a new report from Bloomberg looks at what Apple did differently over the last few years that set it up for weathering the challenging macro environment without resorting to firing staff.

A different hiring approach

One of the critical choices was how Apple hired new employees during the pandemic. While companies like Amazon, Meta, and Salesforce roughly doubled their workforces from 2019 to 2022 with ~100% headcount growth, Apple only increased its staff by 20%.

Even Google parent Alphabet’s hiring growth of 60% has proven unsustainable. As mentioned by Bloomberg, combined Alphabet and Amazon have laid off around 30,000 employees recently. Meanwhile, Zoom just announced it’s cutting 15% of its global staff.

At the end of 2022, Apple did slow down on hiring, with some considering it a hiring freeze. But again, it’s been able to avoid layoffs.

Revenue per additional headcount

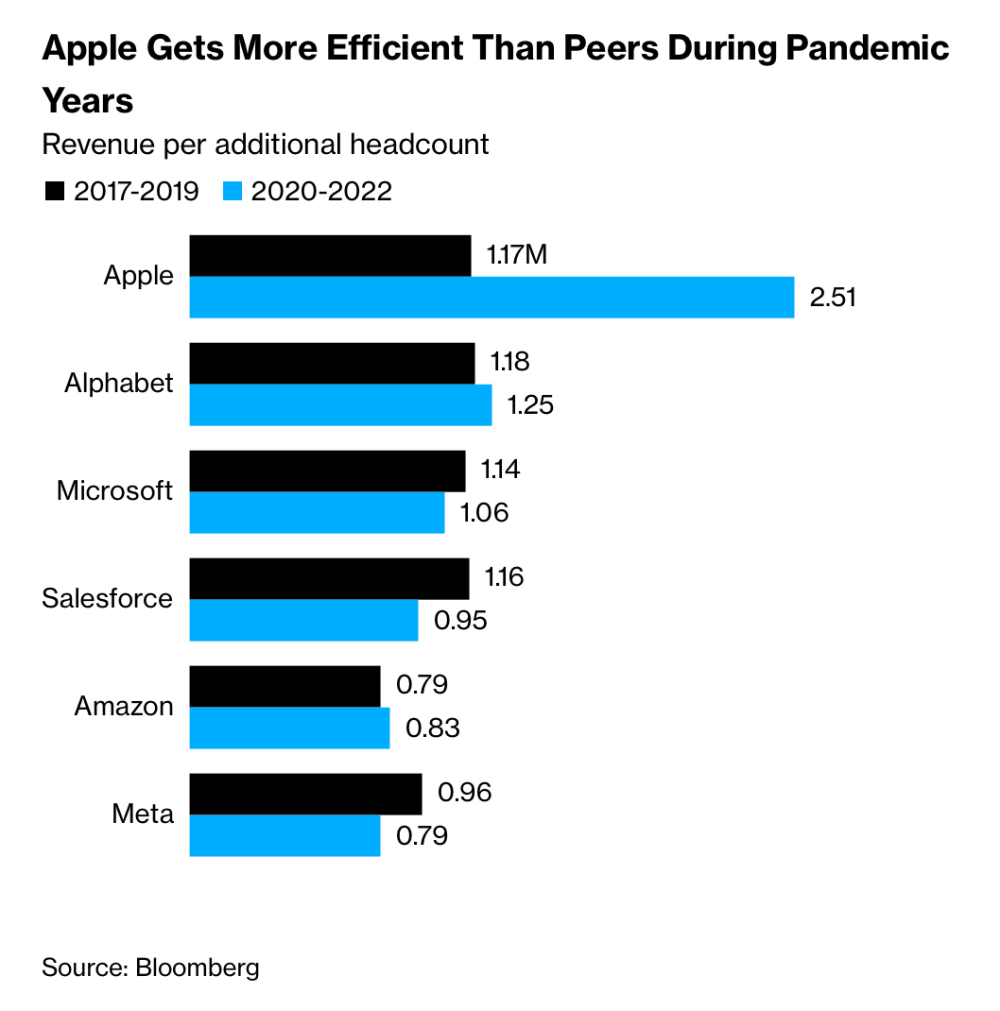

The second piece of why Apple has been able to avoid layoffs speaks to how efficient and profitable the company is across all areas of its business. According to Bloomberg’s data, Apple has more than doubled its revenue per additional headcount over the last six years which is an incredible feat.

When looking at 2017-2019, Apple had $1.17M in revenue per additional headcount, which was comparable to Alphabet and Microsoft.

Then from 2020-2022, that number more than doubled to $2.51 million as it was more cautious with hiring while increasing profit. Meanwhile, most of the major tech companies saw that metric either drop or barely increase.

Apple’s robust underlying business and efficiency are of course a critical part of the amazing increase in revenue per additional headcount. But combining that super profitable business with a much lower increase in hiring over the past years is what makes the above metric stand out when compared to the other tech giants.

Speaking to Bloomberg, Credit Suisse Group AG analyst Shannon Cross described the bigger Apple picture like this: “It comes down to the management’s stewardship of shareholder dollars and a tight focus on what growth opportunities to invest in.”

Even though Apple had a miss for its holiday earnings with lower iPhone sales than expected, Apple’s quarterly misses are incredible performance by any other company’s standards. $117 billion in revenue with almost $30 billion in profit… in 3 months!

Apple also celebrated surpassing 2 billion active Apple devices and a new record for its Services revenue.