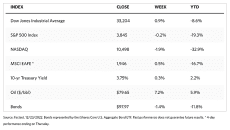

Stock Markets

Trading during the week was light ahead of the Christmas weekend and typically light holiday season market activity before the New Year. The major indexes were mixed, with the Dow Jones Industrial Average chalking up a 0.86% gain and the total stock market down by 0.26%. The Nasdaq Stock Market Composite dipped 1.94%, despite recording its best daily gain since November on Wednesday. The S&P 500 Index slid by 0.20% and the NYSE Composite rose by 1.13%. CBOE Volatility came down by 7.74%. Over the past week, hawkish comments from the Federal Reserve and other global central banks appear to weigh heavily on the markets. Jitters of an impending recession ran through the equities market after former New York Fed President William Dudley commented on Monday that optimistic markets could end in more aggressive central bank tightening.

As U.S. oil inventories came in well below consensus expectations, energy stocks outperformed other sectors. Underperforming all sectors were consumer discretionary shares, plummeting as a result of a steep decline in Tesla following that company’s announcement of increased price discounts. On Thursday, chipmaker Micron Technology reported falling global demand, triggering a sell-down of semiconductor stocks. Bond trading ended early on Friday. Next week’s trading week will be shortened as both the equity and bond markets will be closed on Monday in observance of the Christmas holiday.

U.S. Economy

Positive economic growth signals during the week may have set off new fears of future interest rate hikes. On Thursday, the Commerce Department raised its third-quarter economic growth estimate from 2.9% to 3.2% due to increased revenues in healthcare spending and investment in equipment and intellectual property. Simultaneously, weekly jobless claims modestly fell while continuing claims recorded their first weekly drop since October. Personal incomes rose by 0.4% since October which is slightly above expectations. Spending, however, increased by only 0.1%, which is relatively flat when adjusted for inflation, indicating that Americans cut back on purchases of autos and other goods. The personal consumption expenditure (PCE) price index also inched up by 0.1% in November, for a year-over-year increase of 5.5%, the lowest since October 2021. This probably contributed to a Friday mid-morning rally in the markets. The 12-month rise in the core PCE index (excluding food and energy) fell to a four-month low of 4.7%. The core PCE index is considered the Fed’s preferred inflation gauge.

Housing data was mixed as existing home sales fell slightly less than expected in November, although new home sales rose 5.8% in contrast to consensus expectations of a roughly 4.7% drop. Forward-looking data were less encouraging, as building permits slumped to 10.6% and hit their lowest levels since June 2020. Durable goods orders came down by 2.1% in November, their biggest decline since April 2020. The reduction was, however, caused by an unexpected plunge in highly volatile aircraft orders. The Conference Board’s index of consumer confidence reversed two months of declines and registered 108.3, indicative of consumer resilience. The reading was much higher than expected and its best level since April. It was noted, however, that the expectations index remained around 80 which is typical of recession levels.

Metals and Mining

One week before the start of the new year, gold is down by just 1% year-to-date after a highly volatile year that saw gold prices rise higher than $2.000 per ounce in the spring and touch lows slightly above $1,630 per ounce in the fall. February Comex gold futures closed Friday at approximately $1,809 per ounce, an increase of 0.5% on the week. Gold may have established a robust price bottom in 2022 at the $1,800 level, and looks primed to be a top performer in 2023 when it could move to challenge or exceed $2,000.

This week, gold closed at $1,798.20 per troy ounce, 0.29% higher than the week-ago price of $1,793.08. Silver, which was $23.22 one week ago, ended at $23.73 per troy ounce this week, for an increase of 2.20%. Platinum rose by 3.27% from its price last week of $994.53 to this week’s price of $1,027.01 per troy ounce. Palladium came from $1,720.75 to end this week at $1,754.28 per troy ounce for a gain of 1.95%. The three-month LME prices of the base metals ended sideways. Copper rose by 1.00% from the previous week’s price of $8,266.50 to this week’s price of $8,349.50 per metric tonne. Zinc began at $3,018.00 and closed at $2,965.00 per metric tonne for a loss of 1.76%. Aluminum, which was priced at $2,375.00 one week ago, ended this week at $2,389.50 per metric tonne for a slight increase of 0.61%. Tin rose 1.70% from its week-ago price of $23,535.00 to this week’s close at $23,934.00 per metric tonne.

Energy and Oil

Oil prices pushed higher this week due to a supportive weekly report from the Energy Information Administration (EIA) and worries about the big freeze likely to force production shut-ins. News of better-than-expected third-quarter economic performance in the U.S. has, however, raised prospects of further monetary policy tightening through interest rate hikes. Concerns about a possible economic slowdown weighed on oil prices, both the WTI and Brent rallied on Friday morning with the return of more bullish sentiment before the Christmas holidays.

Natural Gas

For the report week starting Wednesday, December 14, and ending Wednesday, December 21, 2022, the Henry Hub spot price fell by $0.46 from $6.60 per million British thermal units (MMBtu) at the start of the week to $6.14/MMBtu at the end of the week. The price of the January 2023 New York Mercantile Exchange (NYMEX) contract decreased by $1.098, from $6.430/MMBtu at the beginning of the week to $5.332/MMBtu at the week’s end. The price of the 12-month strip averaging January 2023 through December 2023 futures contracts declined $0.618 to $4.872/MMBtu. International natural gas futures price movements were mixed for the report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.96 to a weekly average of $34.42/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $7.47 to a weekly average of $34.99/MMBtu.

World Markets

European share prices rose amid signs of slowing inflation and more positive consumer confidence. The pan-European STOXX Europe 600 Index closed higher by 0.64%, together with major European indexes. France’s CAC 40 Index rose by 0.81%, Italy’s FTSE MIB Index gained 0.80%, and Germany’s DAX Index ticked up by 0.34%. The UK’s FTSE 100 Index ascended by 1.92%, partly supported by the depreciation of the British pound against the U.S. dollar. Weakness in the pound provides some strength to equities since many of the listed companies are multinationals that generate significant revenues overseas. Business and consumer confidence in Germany and Italy improved in December, In the U.K., the economy contracted more than initially estimated in the third quarter, for which September growth figures were revised lower.

In Japan, stock markets fell over the week. The Nikkei 225 Index came down by 4.69% while the broader TOPIX Index descended by 2.68%. The Bank of Japan (BoJ) announced that it would revise its policy of yield curve control (YCC), allowing 10-year Japanese government bond yields to rise as high as 0.50% which is double its previous implicit cap of 0.25%. The timing of this announcement was a surprise, as most market participants had not expected a shift in the BoJ’s YCC until next year. In light of this move, the JGB yield ended the week at approximately 0.40%, sharply up from 0.25% one week earlier. The policy adjustment by the BoJ impacted currencies, with the yen strengthening to JPY 132.55 against the U.S. dollar, from the previous week’s exchange rate of JPY 136.71 to the greenback.

In China, the coronavirus once again reared its head as new cases weighed on the country’s growth forecasts. The Shanghai Composite Index plummeted by 3.85% while the blue-chip CSI 300 sank by 3.19%. In Hong Kong, the benchmark Hang Seng Index inched up by 0.7%. The resurgence of COVID-19 and China’s ongoing property market slump prompted the World Bank to cut its China economic growth forecast for this year and the next, The Bank projected China’s economy to grow by 2.7% this year and 4.3% next year, compared to its previous forecast of 2.8% and 4.5% for 2022 and 2023 respectively. The World Bank released its report China: Domestic and External Conditions are Leading to a Weakened Economic Outlook dated December 20, 2022. In it, the Bank noted that China’s economy remains “subject to significant risks, stemming from the uncertain trajectory of the pandemic, of how policies evolve in response to the COVID-19 situation and the behavioral responses of households and businesses.”

The Week Ahead

Economic reports scheduled in the coming week include the home price index and jobless claims.

Key Topics to Watch

- Trade in goods, advance report

- S&P Case-Shiller U.S. home price index (SAAR)

- FHFA U.S. home price index (SAAR)

- Pending home sales index

- Initial jobless claims

- Continuing jobless claims

- Chicago PMI

Markets Index Wrap Up