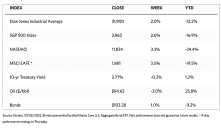

Stock Markets

Most indexes were up this past trading week. The Dow Jones Industrial Average (DJIA) was up 1.95% and the total stock market rose 2.76%, although the utility sector underperformed, sliding 0.23%. The S&P 500 Index gained 2.55%, while the Nasdaq Stock Market Composite, the benchmark for technology stocks, rose faster at 3.33%. The NYSE Composite also climbed 2.36%. This constitutes a short-term market rally that added to a run that pushed the S&P 500 up by 9% over last month’s levels. For the year, equities are still 17%, but this week’s rally is a breath of fresh air in a continuing bear market. It is, at best, a brief respite, however, as the economy is not yet out of the woods.

There appears to be a turnaround in sentiment as investors welcome signs that the economy is slowing and inflation concerns may be gradually alleviating. The rise this week shows shares carrying over the momentum from last week. Consumer discretionary shares performed best within the S&P 500 Index as share prices rebounded in Amazon.com and Tesla. Some weaknesses weighed in on Verizon and Alphabet, the parent company of Google, dragging communication services shares down. Aside from a shift in sentiment, investors also were heartened by several prominent second-quarter earnings reports. They indicate that the economy may be slowing, but companies also exhibited a greater resilience in profits and outlooks than analysts have expected. Much of the rally occurred on Tuesday, but later in the week, the indexes pulled back after social media shares fell sharply resulting from a flat increase in advertising revenue in the second quarter.

U.S. Economy

Weak economic data that came out this week briefly pushed the yield on the benchmark 10-year U.S. Treasury note down to 2.73% last Friday, the lowest level it has been in months. The upcoming second-quarter GDP report will give investors and analysts the latest situation on the state of the economy. Although a recession is not assured at present, the risk of a mild contraction appears to have risen appreciably, according to analysts’ readings. There are signs that inflation is peaking, as commodity prices have fallen sharply in recent weeks, providing much-needed relief. Oil prices are down 20% from their recent peak, while copper and lumber prices have receded 32% and 60%, respectively.

Also substantially down are prices of agricultural commodities including wheat, corn, and soybeans. Part of this is due to a UN-supported deal signed by Ukraine and Russia that will allow Ukraine to continue exporting its grain through the Black Sea. This will potentially increase the global food supply since Ukraine is one of the largest agricultural exporters in the world. Wage growth is still healthy but has moderated, possibly influencing inflation levels. Supply chain measures are also showing further improvement through signs of loosening bottlenecks, while PMI readings have slowed to levels consistent with lower cost pressures.

Metals and Mining

The gold market continues its struggle in recent months as the U.S. dollar has continued to rise. Although in the past week, the U.S. currency has retraced from its 20-year high and achieved parity with the euro, there is a strong consensus that it will remain at elevated levels at least for the foreseeable future. But what is good news for gold investors is that despite the strength of the U.S. dollar, it may eventually lose its relevance in global financial markets. There is a genuine fear of recession in the U.S., which threatens to create a stagflationary environment while high inflation persists. In periods of extreme uncertainty, such as this scenario suggests, both gold and the U.S. dollar can rally in tandem as investors look for safe-haven assets to protect their capital. The last time that speculative interest was this low was in May 2019, just preceding a months-long rally that gold embarked upon and which led it to record highs in August 2020.

This past week, gold gained 1.14% from its close in the preceding week at $1,708.17 to its close this week at $1,727.64 per troy ounce. Silver fell 0.59%, from $18.71 the week before to this week’s $18.60 per troy ounce. Platinum began at $851.31 and closed at $876.84 per troy ounce for an increase of 3.00%. Palladium gained 11.40% from $1,830.37 to $2,039.00 per troy ounce. The three-mo prices for base metals generally ended higher for the week. Copper prices moved from $7,190.50 to $7,452.50 per metric tonne for a gain of 3.64% week-on-week. Zinc closed one week prior at $2,915.00 and this week at $2,992.50 per metric tonne, higher by 2.66%. Aluminum gained 5.66% from the earlier week’s close at $2,343.00 to this week’s close at $2,475.50 per metric tonne. Tin slightly gained by 0.39%, from the close one week before at $24,850.00 to the recent close at $24,947.00 per metric tonne.

Energy and Oil

In contrast to the volatility of recent weeks, oil price movements this week were limited. ICE Brent hovered steadily within the $100-$105 per barrel price range. This did not happen merely due to the absence of big stories; it was quite the reverse. Libya returned to the market and the ECB hiked interest rates for the first time in many years. These moves provided significant downside risks for crude. However, prompt crude supply continues to lag demand, with the front months of the Brent and WTI curves exhibiting backwardation that remains as steep as ever. Curiously, this has created a balancing mechanism wherein neither the upside nor the downside is sufficiently strong to pull prices in either direction. In the meantime, oil majors operating in the Permian Basin risk slowing down drilling activity in the area. This is likely due to the Biden government’s proposal to cut smog limits in drilling hotbeds in Texas and New Mexico, above the Federal ozone threshold of 70 ppb.

Natural Gas

Spot prices of natural gas rose at most locations during the report week from July 13 to July 20. Henry Hub spot price rose from $6.63 per million British thermal units (MMBtu) to $7.56/MMBtu for the week. Price increases at major pricing hobs ranged from $0.87 at PG&E Citygate in Northern California to $17.86 at Algonquin Citygate in the Northeast. International natural gas futures prices decreased during the same week. The weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia descended by $1.02 to a weekly average of $38.11/MMBtu, and natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherland, the most liquid natural gas spot market in Europe, came down by $4.29 to a weekly average of $47.59/MMBtu.

World Markets

European stocks ascended on the strength of positive market sentiment, despite a string of discouraging economic data releases and the decision of the European Central Bank (ECB) to raise interest rates for the first time in more than ten years. The pan-European STOXX Europe 600 Index closed the week higher by 2.88% in local currency terms. Italy’s FTSE MIB Index closed up 1.33%, while France’s CAC 40 Index gained 3.00% while Germany’s Xetra DAX Index did slightly better, rising 3.02%. The UK’s FTSE 100 Index rose 1.64%, chalking in a good performance for the week. Core eurozone bond yields fell as economic growth concerns drove demand. The trend gained strength upon the release eurozone Purchasing Managers’ Index (PMI) data suggesting that economic activity contracted in July. UK gilt broadly followed core markets, while peripheral eurozone bond yields moved sideways. Following Prime Minister Mario Draghi’s resignation, the Italian 10-year government bond yield rose but eventually retreated by the end of the week.

Japan’s stock markets climbed during the week. The Nikkei 225 Index surged 4.20% while the broader TOPIX Index gained 3.35%. Consistent with expectations, the Bank of Japan (BoJ) continued to implement its ultra-accommodative monetary policy to support the country’s fragile monetary economy. In so doing, it proceeded to further diverge from the tightening policies of other major central banks. The yield on the 10-year Japanese government bond ended the week at 0.22% which is slightly lower than the previous week’s 0.23%. The yen strengthened to JPY 137.4 against the U.S. dollar, from, JPY 138.5 per dollar the week earlier. The yen continued to remain at close to 24-year lows. BoJ Governor Haruhiko Kuroda attributed this weakness to the rise of the greenback against major and emerging market currencies, rather than the BoJ’s loose policy stance.

China’s bourses were mixed after Premier Li Keqiang moderated expectations of excessive stimulus and indicated flexibility on China’s annual growth target. The broad, capitalization-weighted Shanghai Composite Index gained 1.3%, while the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, slid 0.2%. Li told world business leaders at a meeting hosted by the World Economic Forum that slightly higher or lower growth rates are both acceptable as long as employment is relatively sufficient, household income continued to grow, and prices are stable. China announced a growth target of about 5.5% for the current year during a Politburo meeting in April, a goal most economists agree will be difficult for China to meet. The yuan eased to CNY 6.764 per U.S. dollar from CNY 6.75 the week before. The 10-year Chinese government bond yield was flat. Outflows from China’s bond market totaled USD 14 billion in June as the surging U.S. Treasury yields reduced the relative attractiveness of Chinese bonds.

The Week Ahead

The Federal Reserve rate decision, real disposable income, and real consumer spending are among the important economic data to be released in the coming week.

Key Topics to Watch

- Chicago Fed national activity index

- S&P Case-Shiller national home price index (year-over-year)

- Consumer confidence index

- New home sales (SAAR)

- Durable goods orders

- Core capital equipment orders

- Advance report on trade in goods

- Pending home sales index

- Fed funds target rate

- Fed Chair Jerome Powell press conference

- Gross domestic product, first release (SAAR)

- Final sales to domestic purchasers (SAAR)

- Initial jobless claims

- Continuing jobless claims

- PCE inflation index

- Core PCE price index

- PCE price index (year-over-year)

- Core PCE price index (year-over-year)

- Real disposable income

- Real consumer spending

- Nominal personal income

- Nominal consumer spending

- Employment cost index

- Chicago PMI

- UMich consumer sentiment index (final)

- UMich 5-year inflation expectations (final)

Markets Index Wrap Up