Will You Outlive Your Retirement Savings?

Well, that’s a scary thought. Unfortunately, one that millions of people have to struggle with. No doubt, it keeps people up at night. In our imaginations, retirement is something we look forward to. The details might change, but I often hear people talk about things like the freedom of not having to work. The ability to travel to see grandkids or even see the world. People dream of doing everything they couldn’t do while working because they didn’t have the time.

Retiring frees up time. A lot of time. You might have worked 2,000-2,500 hours per year. That’s a few thousand hours that you need to fill up with something else. Great for those who want to travel. Yet it creates another challenge as well – money.

When they retire, most people make less income. Doing the things you want to do often costs money. Many retirees have the time to do what they want, but they lack the funds. Or rather, they lack the confidence to use their funds. That nagging fear speaks in the back of their head whenever they decide to spend money on a trip or that dream car. It says:

Will I outlive my savings?

It all comes down to one of the most destructive assumptions pervasive throughout the retirement industry. What is this assumption? Retirees should sell off their portfolios to fund their lifestyles.

“Probably” Isn’t Good Enough

Sure, you talked to a retirement advisor. You saved up $X that you invested, and you’ve seen models showing that there is a 99% chance that your retirement will be sufficient. Then the market falls 20%+, you see your retirement funds slipping away, and it is natural to become fearful, and you start thinking, “What if I am that 1%?”

As a result, it is very common for me to see retirees who are underspending. I’ve seen multi-millionaires who are afraid to spend money on the things that they enjoy in the sunset of their lives. They are so fearful that their retirement savings will not be sufficient that they deprive themselves even though they have plenty.

You don’t need to live in fear. You don’t need to turn your retirement years into decades of penny-pinching. There is a way you can know how much you can spend during your retirement without losing confidence in its ability to last if you live to 120+.

The Market As a Casino?

I’m sure you’ve heard people comparing the market to a “casino”. Maybe you have even made the comparison yourself. Many investors will try to swing big, trying to find “the next Amazon”. They will find themselves trading in and out frequently, trying to catch every swing. For these investors, the market is very much like a casino. They are trying to profit from swings that are never entirely predictable.

Other investors take a more passive approach, they own a diversified portfolio with extremely broad exposure, so they should expect to be around the “average” of the market. Over time, the market’s average is very good, so it is a practical solution.

If you’ve ever been to a financial advisor, odds are you’ve seen a “Monte Carlo” simulation. This is a tool that you can use to estimate the impacts of various withdrawal rates on a portfolio over decades. It uses historical records to estimate various probabilities for the future.

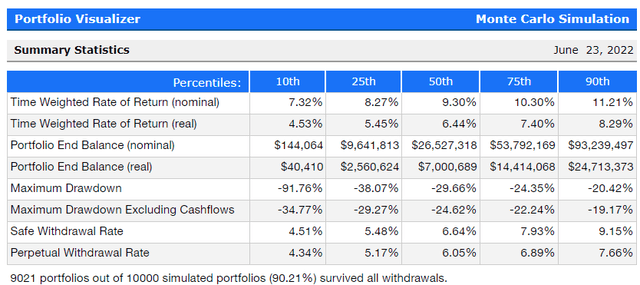

Here is an example, assuming a $1 million starting portfolio, making annual withdrawals beginning with $45,000 the first year, and then adjusting for inflation each year for 50 years. This portfolio is invested in the commonly recommended 60% equity and 40% bond allocation.

Note that after 50 years, the portfolio could have anywhere from $0 to over $93 million, completely dependent on how the market goes. 9021 out of 10,000 simulations survived, so this model estimates a 90.21% chance that this portfolio will last 50 years.

I don’t know about you, but a roughly 1 in 10 chance of going broke by the time I’m 105 is enough to keep me up at night. I can work more now – but when I’m 100, I don’t want to be filling out an application at McDonald’s. Worse, even if the portfolio survives, many of the simulations ran low. Someone in the 10th percentile with $40k left (after factoring for inflation), which is less than one year of income, isn’t going to feel comfortable.

Considering the consequences, even a 1% chance of failure is terrifying. This is why many retirement advisors recommend withdrawing only 4% or even less.

Sequence of Returns

But wait, it gets worse. An often-overlooked risk is the “sequence of returns” risk. When withdrawing from your portfolio, performance early in your withdrawal period is more impactful than performance later. It isn’t a huge deal if the market crashes 50% after your portfolio has already tripled. If your portfolio crashes 50% the year after you retire, it can cripple your entire future.

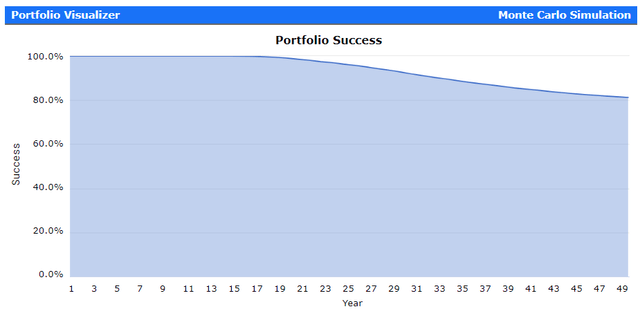

Using the same Monte Carlo simulation, but assuming that the worst year is the first year of withdrawals, the failure rate doubles and is 20% after 50 years. Note how the failures start occurring around 20 years in; if you retired at 65, that would be around 85 years old. Do you want to be forced back to work at 85? Or have to start living on government assistance?

It is even more painful if you have a couple of bad years back to back. The reason is the assumption that you are selling shares to fund your income. If you are selling when prices are low, you have to sell more shares. When the price rebounds, you have fewer shares to benefit from it.

The Other Risk

Running out of money in our retirement might be the main risk retirees worry about, but it isn’t the only risk. Remember the range of outcomes from above? The top 10% had over $24 million (inflation-adjusted). If your portfolio is that successful, it’s a bit silly to be withdrawing only $45k/year.

In fact, half the time, the portfolio will survive just fine, withdrawing $65,000/year, which can be a rather significant difference in lifestyle. Unfortunately, many retirees find their spending restrained by a fear that they won’t have enough even when they have plenty. This is especially true in years when the market is down like it is now.

Now, if you want to leave a legacy for your children or grandchildren, great, but you shouldn’t sacrifice your comfort in your retirement, pinching pennies that don’t need to be pinched. Scraping pennies when you’re in your 20’s builds character. When you retire, your character has been built up plenty over the years. It should be a time to enjoy the fruits of your labor.

This One False Assumption Is Destroying Your Retirement

The one assumption that destroys more retirements is that you should sell shares or bonds to fund your retirement. You shouldn’t. Over your working years, you did something that many fail to do. You saved up money, and you invested it in a portfolio.

Why? Because you know that the U.S. economy is the single greatest wealth-generating engine ever experienced by mankind. Every share you own represents an ownership interest in a business. Ultimately, your gains come from those businesses doing what they do. They generate goods, products, and services for a profit. You invested because you knew that your wealth would grow as the companies you invested in were growing.

Then you retire. You have a collection of ownership interests in companies that you bought because they were growing your wealth. And the common advice is to start selling?!?!?

Why would you sell? The companies are still operating, they are still growing, and they are still making profits from providing goods or services every single day. They are still valuable assets.

There is a ton of advice on what to buy, but what to sell? Do you sell your portfolio “losers”? Tempting, but often today’s losers are tomorrow’s winners. You’re selling at a bad price and increasing the risk that your portfolio will not survive.

Do you sell off your “winners”? If a company is great and has a lot of success, don’t you want to keep owning it?

Why would you sell something that will make you wealthier in the future? You shouldn’t. If it doesn’t make sense, don’t do it.

The Alternative

For decades, I’ve seen my peers worry about the prices daily. Constantly trying to guess what the price will be tomorrow, next week, and next month—frantically trading in and out and selling this company to buy that company. They were spinning their wheels and going nowhere fast. They become more obsessed with public opinion on a stock than with its actual earnings. They try to run ahead of public opinion, getting in early and then selling before popularity wanes. This is why we sometimes see companies that aren’t making a penny in profit trade at nosebleed valuations and then come crashing back to earth as retail “bagholders” get stuck holding the shares.

Yet these one-hit wonders aren’t what drive long-term wealth creation. You don’t have to find the next big thing to succeed in the market. You don’t have to sell a fad before its popularity fades. In the long run, the most successful investors are those who pay a good price for great companies that make profits.

This is why I created the Income Method. My focus is not on flipping stocks. The goal is not about selling at a higher price than the stock is bought for. That might happen, and it is nice if it does, but selling is not the goal.

I focus on buying companies that distribute a share of their profits every quarter or month. The company does its thing, has positive cash flow, and sends that cash to investors. My concern is not what someone else is willing to pay me for my ownership. My concern is how much income the company will pay me and whether that amount is sustainable.

Never Be Forced To Sell

Don’t sell your assets. Make your assets pay you. There are thousands of stocks that pay a dividend. I’ve invested in hundreds of them over the years. I’ve never sold a share to fund my life. Instead, I’ve focused on building an income stream. When I sell, it is because I have identified an investment opportunity that I believe is better. I am not forced to sell when prices are temporarily low. I sell on my terms, and only when selling makes my portfolio better – when I can buy something that is higher-yielding, lower risk, and/or has better upside.

Never Run Out Of Money

Since I never sell to fund my life, I don’t have to worry about my retirement running out. My ownership in the economy is not reducing, it is growing.

Now, let’s be real, dividends are not guaranteed. Companies can change them, and some companies will stop paying them altogether. While good due diligence can help you avoid some pitfalls, if you’ve been investing in dividend stocks long enough, you have been caught by unexpected cuts. Yet, even with that reality, you will not have to worry about outliving your retirement.

Here are a few rules to help you ensure that.

1. Build Reinvestment Into Your Plan

You have an income stream, and you know what it is. Treat it exactly like you treated your salary when you were working. When you worked, what did you do? You created a budget, lived within that budget, and earmarked some funds for investing in your retirement. If you didn’t do that, you wouldn’t have a portfolio today!

Income investing doesn’t magically create infinite money. You’ll still need to budget, and you’ll still need to live within that budget. You don’t need me to tell you how to do that. The important thing is to keep reinvesting a priority for a portion of your income. You want your portfolio to buy more shares every quarter.

How much should you reinvest? I like 25%. That gives you ample cushion to ensure that your income is growing every year and that you have enough income to cover your essentials even if there are dividend cuts. But just like your working years, the more you set aside for the future, the more funds you will have in the future.

2. Maintain Flexibility In Your Budget

When planning your retirement, you should have different baskets for your income needs. You’ll have your non-negotiable expenses, like those associated with your housing. You’ll have your variable expenses like food that you have some limited control over, like choosing to eat steak or choosing hamburger. Then you’ll have discretionary expenses like cable TV, traveling, etc. The things you want but could live without if you had to.

Before retiring, you want to get the non-negotiable expenses as minimal as possible. Own your house free and clear, choose a location to retire that is appropriate for your income, and ensure your debts are paid off. Paying off debt is much easier when you are working than when you are retired.

The lower your non-negotiable expenses are, the more freedom you will have in your budget to spend on the discretionary items you want.

3. Identify Problems, Deal With Them Early

One comment I often get is, “but what if I don’t have enough to reinvest?” The HDO Model Portfolio yields 8-10% at any given time. If you need to withdraw all of those dividends, that’s a problem. If you do a Monte Carlo simulation assuming an 8% withdrawal rate, a full 75% of portfolios fail.

Fortunately, with income investing, it is a problem you can identify right away. If you don’t have a 25% cushion that you can reinvest, now is the time to take action and build up that cushion. Focus on growing your income.

If your income is lower than you would like, you can strap down on your budget and reinvest more aggressively to get your income back on track. It might not be fun to work on a tight budget, but it’s a lot better to do it now than it is to do it in 30-40 years.

In some cases, maybe you do have to get a part-time job. Better to do it while you are still able. It’s better to do it now than in the future when you might not be able to. The earlier you deal with any shortfalls in your retirement, the easier it is and the less you need to sacrifice.

If you can’t reinvest, that is a warning sign you should not ignore. Dealing with it might be unpleasant, but it is much better than running out of money in 20+ years.

You should be buying more shares and growing your income every year. If you aren’t, deal with that problem today either through growing your income, reducing your spending, or a combination of the two.

4. Don’t Be Afraid To Enjoy Your Retirement

If you’ve followed 1-3, you will find that your income is growing over the years. Often the companies you buy will raise their dividends, and your reinvestments will cause your income to go up yearly. Your income will usually grow faster than inflation.

This means that your purchasing power is increasing each year. You aren’t limited to increasing your budget only by the inflation rate, you can match your budget with your actual income growth.

Ironically, you will often find that your income grows faster in a bear market than in a bull market. When other retirees fear their retirements are at risk and are struggling with guessing how much they can afford to sell, your income will keep coming in. You already have reinvestment in your budget, so you are buying when others are selling at low prices. When the market gets around to rebounding, as it always does, you will own more shares than you did before it fell.

Keep following the same budget, reinvesting 25%, and the rest is yours. If your income is more than you need, maybe you want to reinvest a bit more for a better future, or maybe you want to splurge.

That is the main benefit of the Income Method in retirement. You know what your income is, and you can adapt your budget to changes as you go along. Just like you did when you were working.

After all, I’m sure your income wasn’t the same every year in your working life! Your income went up, it might have gone down a time or two, you had unexpected expenses, and your income might even have disappeared entirely if you were laid-off or quit. You dealt with the challenges, you saved for retirement, and your lifestyle likely improved over the years.

Retirement isn’t different, except your income comes from your ownership interest in businesses.

Conclusion

There is no magic investing bullet that is going to make you have infinite money. There is no real mystery to retirement. You lived your whole life dealing with a budget. Whether you made $500,000 or $50,000/year, you had a budget and lived within your means. In retirement, you simply need to keep the same good habits and budget practices you already have.

The Income Method helps you do this because it provides an income that isn’t so different. Funds are deposited into your brokerage account on a regular basis. You have a good idea of how much it will be, and you can plan your budget accordingly. Set aside a little for the future, ensure your essential expenses are low enough to be comfortably covered, and the rest is yours to spend on whatever luxuries make you happy.

When your income changes, you’ll know about it, and you can make relatively small adjustments to your budget if necessary to ensure that you are still a net buyer of stocks. Every year, you will own more shares and have more income.

This is a benefit that selling strategies don’t have. If the market falls 30%, how much should they cut their budget? Do they need to cut it at all? Should they sell now before prices fall more? Should they sit back and wait in the hopes of selling at a higher price? These decisions will greatly impact the future of their portfolio and whether or not it survives.

With the Income Method, those fears can be in the past. You know how much your income is this year, you’ll know the moment it changes, and you can deal with it when it is just a small problem. You’ll know when you can splurge and when it might be necessary to tighten the belt.

Your portfolio will last indefinitely because you aren’t selling. You are buying a little more every year. You’ll own more shares, receive more dividends, and your income will grow.

Selling your ownership of the U.S. economy is the exact opposite of what you should be doing. Don’t buy into anyone who suggests that you should. Keep your focus on owning more, not on cannibalizing your ownership for cash today.

If you want full access to our Model Portfolio and our current Top Picks, feel free to join us at High Dividend Opportunities.

We are the largest income investor and retiree community on Seeking Alpha with over 6000 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +8%, you can supercharge your retirement portfolio right away.

We are currently holding a limited-time sale with 25% off your first year!