QuantumScape’s San Jose campus in the heart of Silicon Valley is abuzz with confidence. The battery-technology company’s “QS Campus,” which includes QS-0, QuantumScape’s pre-pilot production line, and three adjacent buildings, is largely dedicated to manufacturing space. The scale of the campus itself and the company’s investment—each building is under a confirmed 10-year lease as of November 2021—signals QuantumScape’s assurance that it will be the first company to market with a solid-state battery for electric vehicles.

QuantumScape claims that you will be able to buy an Audi or Volkswagen with its batteries as soon as 2024, a vehicle that can go nearly 400 miles on a single charge, then recharge in 15 minutes. That capability would grant solid-state EVs a huge advantage over their competitors, which rely on the ubiquitous—but weaker—lithium-ion (Li-on) batteries. All-solid-state batteries (ASSBs) promise prolonged life, faster charge times, and safer chemistry compared to Li-on options, but producing them on the scale needed to power millions of vehicles won’t be easy, despite the billions of dollars already invested in the tech. Companies like QuantumScape are racing to reach the market ahead of other battery-focused outfits like Solid Power in Colorado and ProLogium Technology in Taiwan, as well as giant auto makers like Nissan. The competition begets, maybe even necessitates, bold claims, and QuantumScape isn’t short on those.

The all-solid-state battery at QuantumScape has reportedly weathered what chief marketing officer Asim Hussain calls, by the company’s own measure, “gold standard” testing. The ASSBs have fast-charged their cells (going from 10 to 80 percent in 15 minutes) 400 times consecutively, and some have gone through a total discharge and charge cycle almost 1,000 times. “Traditional lithium-ion cells, or any other solid-state effort to date, couldn’t even come close to that,” Hussain says.

QuantumScape boasts that it could deliver early prototype battery cells (what they call “A-samples”) to Volkswagen, its largest shareholder, as soon as this year. By the end of 2023, it plans to build a pre-production line and deliver ASSBs to Volkswagen for integration in a test car scheduled for 2024 or 2025. By that time, QuantumScape hopes to have solid-state batteries leaving its first gigafactory—a Silicon Valley term originally used by Tesla to describe a large-footprint, machine-building plant.

It’s an ambitious timeline that positions the company to beat its strongest competitors to market by a thin margin. SES, a battery maker in Singapore, says it’s on track to deliver an alternative lithium-metal battery that can rival ASSBs in 2025. Nissan says it will have its own version of solid-state batteries in vehicles by 2028. The checkered flag for solid state battery-powered Toyotas, Nissans, Volkswagens, and more appears to be around the corner. But as the race becomes crowded with innovators, how soon will the tech actually be available to car shoppers?

For the millions of potential EV buyers in the U.S. over the next few years, solid-state batteries promise three advantages over current electric power packs: longer driving range, faster recharging, and safer chemistry. EV sales reached 487,460 units in 2021—almost 10 percent of all new vehicles sold—and Q4 sales jumped 72 percent year-over-year. Despite the surge, the battery tech powering all those electric motors still lags behind what’s capable with gas-fueled internal combustion engines.

Nearly all EVs rely on lithium-ion batteries for power. According to EPA stats, these deliver an average combined-range of 235 miles—barely half the distance of most gas-powered vehicles before they require a fill-up. To win over customers, EVs need to match or exceed the performance of their internal-combustion counterparts since they can’t yet compete on price. That’s where ASSBs provide an advantage. Compared to current Li-on power packs, they promise much greater energy density— the amount of power they produce proportional to their weight or volume. Leading lithium-ion batteries boast an energy density of about 600 watt-hours per liter, but QuantumScape expects its ASSB to achieve an average energy density of 1,000 watt-hours per liter. That could extend the average EV range to between 375 and 400 miles, Hussain says, nearly equaling the average range of internal-combustion engines.

The crucial difference between ASSBs and Li-on batteries is the material they use between the electrodes. Both types of batteries work by sending ions from one electrode, called the cathode, to another, the anode. Lithium-ion batteries use a liquid between the two, which makes them relatively easy to produce. Solid-state batteries use a solid electrolyte material. The specific chemical makeup of that solid varies from company to company and it is often kept secret—the battery industry’s equivalent to the Coca-Cola or Pepsi recipe. Common solid electrolytes include crystalline ceramics, glass ceramics, and organic-based polymers. Using a solid as this pathway is more effective than using a liquid given the right material—the tighter-packed molecules in a solid can simply house more energy in the same amount of space.

QuantumScape is developing its batteries with a ceramic electrolyte in part because the material is less susceptible to dendrite formation—a common trouble area for lithium batteries in which lithium ions clump on the battery’s anode over the course of many charge cycles to form highly reactive stalagtites that can cause a short, loss of power, or even fire. Although QuantumScape’s ASSB requires lithium in its construction, the company asserts dendrites won’t be a threat. In general, battery makers claim that ASSBs will be safer than traditional batteries, offering that solid electrolytes are largely non-flammable, lowering the risk of a battery fire and eliminating the need for thermal-management systems found in liquid-electrolyte batteries.

There’s one place ASSBs in development still won’t likely be able to overtake combustion engines: the time it takes to refuel. QuantumScape says its EV battery will take 15 minutes to go from 10 to 80 percent. That’s dramatically less time than it takes most EVs today, but still longer than the five to seven minutes it takes to refill a conventional vehicle at the pump (though it does render an overnight iPhone charge frustratingly sluggish by comparison).

The transformative potential of solid-state battery-powered EVs has galvanized auto makers to enter the fray alongside companies like QuantumScape. Toyota announced a $13.6 billion investment in an in-house battery development and production program, one that includes solid-state batteries, in 2021. This year, they said that its first solid-state battery EVs would appear on roads in 2025—quicker than other auto makers’ ASSBs—partially because the batteries will appear in hybrid cars first, which use smaller battery packs and require less charging than fully electric vehicles.

Other companies, like Nissan, have a longer but more ambitious plan to roll out solid-state batteries. That’s not too surprising given the slow but pioneering path the company has taken with EVs. In 1998, Nissan became the first automaker to use Li-on batteries in a production vehicle; about a decade later, its Leaf became the first mass-produced EV. For the past 10 years, it has been researching and developing solid-state tech, and the company now says it aims to begin large-scale battery production by 2028. The longer timeline has come with hefty performance goals: ASSBs with twice the energy-density as lithium-ion batteries, and one-third the charge time. But Nissan has provided few details so far about how they plan to achieve that. Reportedly, it’s focusing on a sulfide-based solid electrolyte that includes a “hopping” mechanism, which increases the speed and ease at which ions move between the cathode and anode during the battery’s charge and discharge. Still, Nissan’s development team leaders, Yoshiaki Nitta and Kenzo Oshihara, say that the company hasn’t settled yet on a specific battery chemistry. They suggest Nissan might use different ASSB chemistries for different cars. “We have multiple options for materials and anodes,” Oshihara says. “Because we use a solid electrolyte, we are able to develop [special] material.”

That’s a lot for potential EV buyers to consider. But there’s also likely to be some unmet promises in those claims. Tim Holme, Ph.D., co-founder and CTO of QuantumScape says that’s long been the case with emerging battery tech. “I’ve been working in batteries for 20 years,” he says, “and once a week you hear about the ‘breakthrough’ in batteries that’s going to revolutionize your iPhone [for example]. It’ll charge in five minutes and last for a week. Then they never come to market.”

If companies like QuantumScape, Nissan, and others expect to deliver on their promises, they have considerable hurdles to overcome. Yang Shao-Horn, Ph.D., leads a team of researchers working to improve the efficiency of ASSBs at MIT’s Electrochemical Energy Lab. She urges a cautious view of commercial ASSB-developer claims about cycle-life and energy density. There are a lot of differences between the theoretical possibilities of this technology and what’s practically achievable, she says.

“There are challenges with how you translate energy density demonstrated in a research laboratory cell to a larger cell for practical applications. There are physical limitations to energy density,” she says. Basically, you can’t cram solid components into a battery as if it were an overpacked suitcase, then call it more efficient.

Just producing the batteries will be a challenge. Unlike Li-on batteries, solid-state versions breathe during use, which can alter the pressure on the materials between the electrodes. “In lithium-ion batteries we spend a lot of effort to control temperature within a range. In solid state batteries, we will likely expend the same amount of effort to control their pressure within a range,” says Darren H.S. Tan, the co-founder of ASSB startup UNIGRID Battery.

Despite the obstacles, Nissan, QuantumScape, and others say they have designs or processes that will allow them to scale up battery production. Nissan stresses that its design will boast “uniform pressure stability,” referring, in part, to mitigating stack pressure, the degree of contact between the electrolyte layer of the battery and the other components. Consistent stack pressure between different parts of the battery, which are layered like a cake, helps ensure the battery doesn’t decay at different rates in different places. Kenzo Oshihara says that the automaker is still working on this problem. “If we have too much pressure on the cell, we have some charge and discharge issues. We have to control that pressure. This is quite a difficult task.”

QuantumScape aims to avoid the problem altogether by making an adjustment to the typical layer-cake configuration of an ASSB—in essence, one of those layers will move. QuantumScape’s batteries contain just one nickel-manganese-cobalt or lithium-iron-phosphate electrode. In this “anode-free” configuration, all the lithium initially lies within the battery’s cathode until, upon the first charge, it migrates across the electrolyte to the electrolyte surface on the other end of the battery, electrochemically making an anode and ensuring equal distribution of the lithium ions.

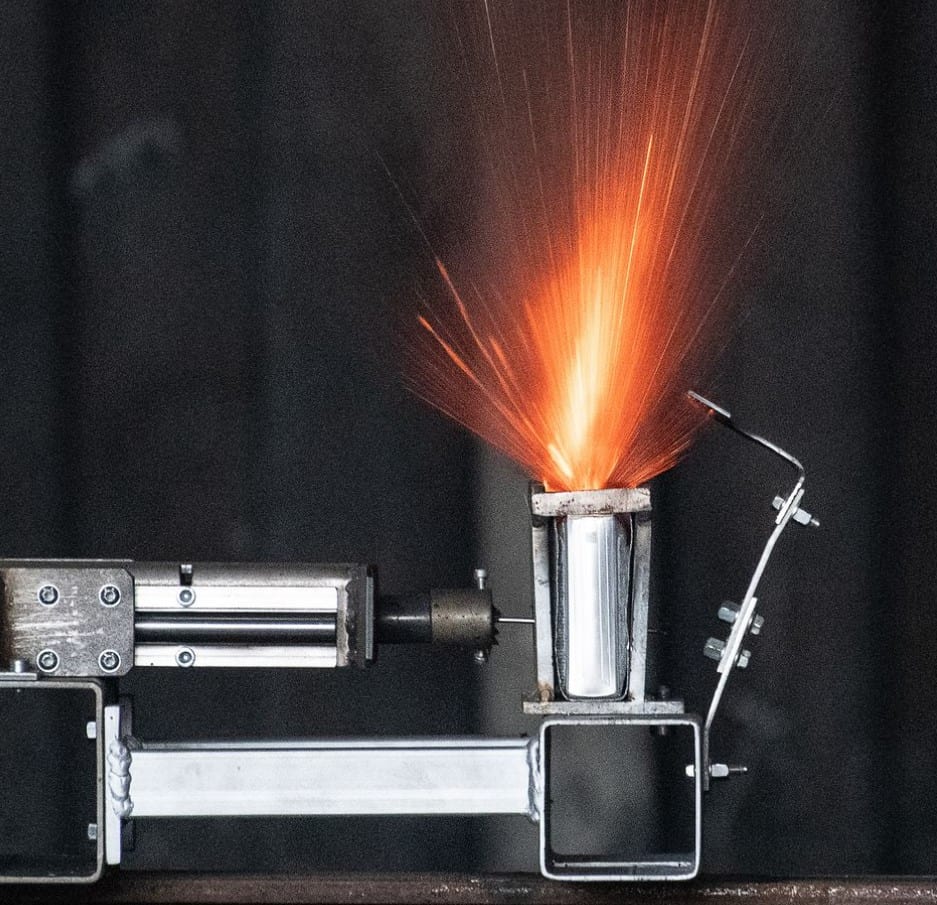

ASSB developers must also safely harness the batteries’ high energy density. Explosions are a rare but well-noted problem in lithium-ion batteries—In 2021 Chevrolet expanded an earlier recall of its Volt EV to include every iteration of the vehicle due to battery-fire concerns—and it might persist in ASSBs. Research suggests that the overall design of ASSBs should make them safer than Li-on batteries, but developers acknowledge they have some risks.

“We are doubling the energy density which means that the energy is very high, just like a bomb for example,” says Yoshiaki Nitta, who leads Nissan’s battery strategy group. “We have to secure safety for ASSBs. We emphasize safety first.”

QuantumScape’s current anode-free design doesn’t entirely eliminate this risk, either, says Kieran O’Regan, an analyst with the market research firm Benchmark Mineral Intelligence. “At any one point, if those cells are penetrated or open, there’s going to be a lot of volatile lithium [exposed], which is very flammable. It’s hard to believe that solid state can be completely safe when it’s relying on a very reactive, volatile metal.”

“We still have testing to do, but we expect our battery to be safer [than lithium-ion],” Asim Hussain says. QuantumScape’s CMO asserts that the company has tested its batteries under a range of pressures, and has configured its cells in a low-pressure design from the start.

No matter which company first gets its technology into electric cars, they might have difficulty declaring a full-fledged victory. Even if massive gigafactories start churning out batteries at places like QuantumScape, ASSBs likely will occupy only a small part of the battery market.

O’Regan says that reaching a “mass market” at all might be optimisic. “A lot of the narrative about ASSBs being the next step for EVs is more about trying to build a narrative for investors,” he says. “So [battery makers] are selling a very big [EV] market that I don’t think ASSBs will penetrate as much as claimed.”

Instead, O’Regan believes ASSBs will allow automakers to differentiate their EVs, by adding range to particular models, for example. He says that for more accessible consumer vehicles like the Tesla Model 3, Tesla will likely opt for a more affordable battery than an ASSB. “Cost will be the key decision [factor] for battery technology in most EVs,” O’Regan says.

Whether ASSBs will cost more to produce than current Li-on batteries is a matter of debate. Some ASSB makers project that the technology will lower the cost of electric vehicles. Nissan, for example, says that its battery packs could cost as little as $75/kwh by 2028, with a long-term goal of $65/kwh—about half of the $132/kwh Li-on batteries averaged in 2021. But some analysts are skeptical, given the batteries’ predicted initial low volumes and rising raw-materials costs. Independent analyses by Benchmark and the financial-data company Bloomberg show high demand for common ASSB metals like manganese, cobalt, nickel, and iron—if this holds, it could keep prices high. “Most ASSBs by the kilowatt-hour are more material intense than a lithium-ion battery,” O’Regan says. “You’ve got an electrolyte that has lithium in it, a cathode that has lithium in it, and an anode that has lithium in it.”

The massive investment in existing lithium-ion battery production and infrastructure could be another hurdle for solid-state proliferation. General Motors will spend more than $35 billion on electric-vehicle development over the next three years, much of it on the company’s Ultium Li-on batteries. Nissan last year, despite its enthusiasm for solid-state batteries, announced it would spend $17.6 billion over the next five years on Li-on battery development. “We have made a huge investment in liquid lithium batteries as you can imagine,” Nissan’s Oshihara says. “We are not just giving up the [lithium-ion] battery investment. We aren’t able to increase the number of ASSBs drastically. So, gradually we would like to phase in ASSBs.”

“There is going to be a phase of co-existence,” QuantumScape’s Hussain says. “Even if we scale to where we expect to with our plant, that’s still a small fraction of a maker like VW’s EV demand for batteries.”

Current solid-state battery programs have attracted huge investments and interest in part because of the potential they hold: ASSBs might be the final step to producing all-electric vehicles that run as long as internal-combustion counterparts, refill as fast, and don’t cost any more. Amid ripples of skepticism, companies like QuantumScape have used that compelling vision to build pre-production lines and plan forthcoming gigafactories. There are intense efforts around the world to put solid-state batteries in vehicles by the middle of the decade, and QuantumScape’s Hussain is adamant there is a “massive” market for the firms who reach the finish line first. Now, just like the batteries themselves, the scientists and researchers developing ASSBs need to turn that potential energy into something kinetic—a real product with enough power to shake the entire automotive industry.