Bitcoin’s (BTC-USD) price plunged 28% this week, this most recent meltdown spurred by an announcement from China and an Elon Musk tweet. The controversial crypto is now losing even more love on Wall Street a day after UBS’s CIO Mark Haefele questioned the need to own bitcoin in a portfolio.

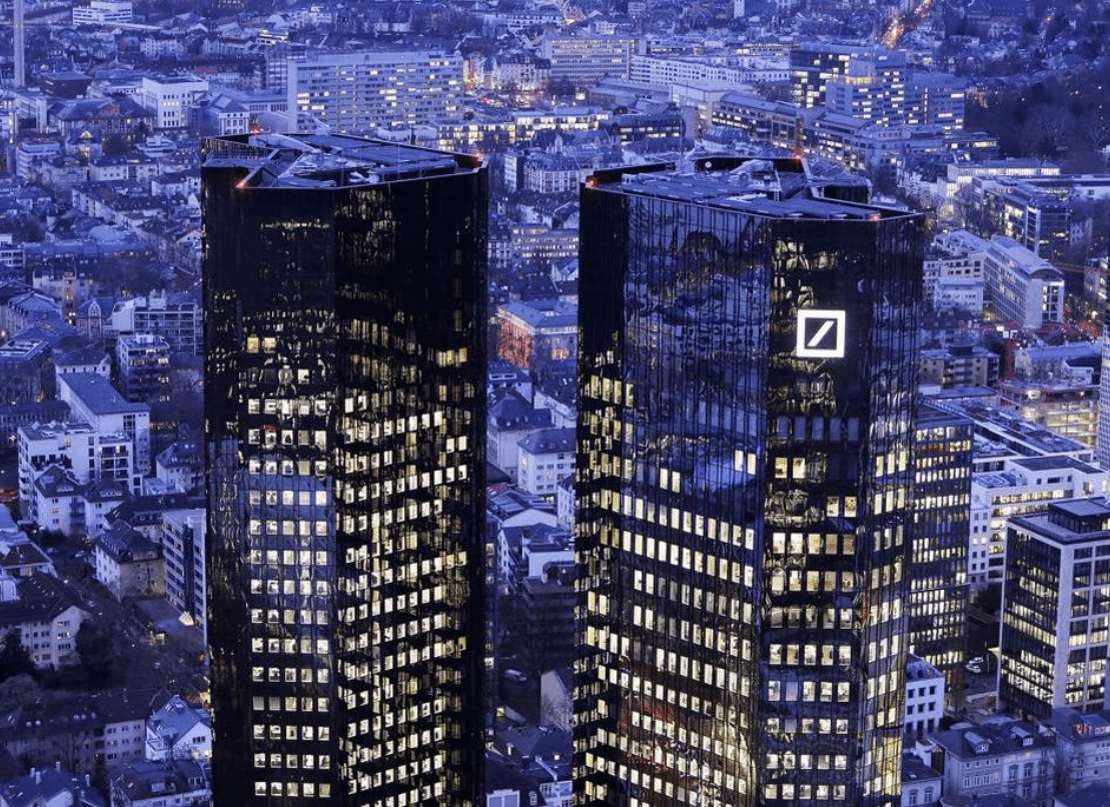

In a note published Thursday, Deutsche Bank analysts joined the conversation with a research note entitled “Bitcoin: Trendy is the last stage before tacky,” quoting the late fashion icon Karl Lagerfeld.

“What’s true for glamour and style might also be true for bitcoin,” wrote Deutsche Bank’s Marion Labouré after the latest plunge. “Just as a ‘fashion faux pas’ can happen suddenly, we just received the proof that digital currencies can also quickly become passé.”

In Labouré’s estimation, something has snapped in the cryptocurrency market in the past three months.

“All it took for the cryptocurrency to fall out of style was one tweet and a Chinese government statement,” she wrote.

On May 12 CEO Elon Musk tweeted that Tesla (TSLA) would stop accepting bitcoin for payment due to environmental concerns.

“Those few words caused bitcoin’s value to plummet from nearly $60,000 in the days before to below $48,000,” she wrote. “Next, on Tuesday, the PBoC reiterated that it would ban digital tokens as a means of payment, thus causing bitcoin to plunge just above $30,000 at one point — its lowest value since January.”

‘Not a surprise’

According to Labouré, the $1 trillion market cap of bitcoin makes it impossible to ignore, but bitcoin’s limited utility for transactions means that “real debate is whether rising valuations alone can be reason enough for bitcoin to evolve into an asset class, or whether its illiquidity is an obstacle.”

This is why Labouré says “the value of bitcoin is entirely based on wishful thinking.”

“Bitcoin’s value will continue to rise and fall depending on what people believe it is worth,” a phenomenon that Labouré says is called the “Tinkerbell effect,” because belief is critical.

A common bitcoiner’s retort is “ok now do fiat,” and while it is the government that makes the dollar the dollar, this power is anything but irrelevant.

Especially, Labouré says, because central banks and governments are likely to begin regulating crypto by early next year — as well as potentially launching their own, like the Federal Reserve’s or China’s digital currency.

Labouré said the medium- and long-term future of digital assets is uncertain, and it would take a long time for any sort of crypto payments to gain any widespread traction. In the meantime, bitcoin “would circulate and its value can remain volatile.”

By Deutsche Bank’s estimations, 30% of bitcoin’s activity is for payments and the rest as “financial investment.” And contrary to what its volatility may suggest, the total liquidity isn’t that high. Last year, Apple’s trading volume was 270% of its number of shares; for bitcoin the number was 150%.

Besides Musk and China, this is another reason why the cryptocurrency may stay volatile.

“Due to bitcoin’s limited tradability, it is expected to remain ultra-volatile; a few additional large purchases or market exits could significantly impact the supply-demand equilibrium,” Labouré wrote. “The root causes of bitcoin’s volatility include small tactical asset allocations and the entries and exits of large asset managers.”

Pressure from central banks

The dream of a currency free from central banks dies hard.

Federal Reserve Chair Jerome Powell sees digital currency as complementing the dollar rather than supplementing it, and whatever the Fed does will affect the crypto markets. In China, the government is taking a more aggressive approach against bitcoin, to make space for its own digital currency.

“It is clear that China’s targeted regulatory actions are designed to support the launch of its digital currency (CBDC),” Labouré wrote.

A reminder, Deutsche Bank notes, of the strength of the government’s hand in crypto regulation is the Libra situation, where Facebook announced in 2019 a futuristic global currency that would result in governments having less control over their money supplies. Facebook has since tweaked its plans for a digital currency to be less ambitious.

“The product now focuses on reducing the cost of payments, rather than competing with governments and central banks by creating a parallel means of payments. In other words, Facebook is not planning to create a competitor currency to the dollar; instead, they hope to compete with traditional ways of paying in dollar,” wrote Labouré.

This, could be the best lens through which to view crypto, she said — not as a speculative asset but rather a fintech solution to faster and cheaper global payments.

“In the end, regulating cryptocurrencies is not that difficult,” she wrote, noting that governments will jump to protect their fiscal monopoly even if they left crypto alone for innovation reasons for so long. If there’s a can’t-beat-‘em-join-‘em environment going forward, bitcoin’s transaction issues might leave it behind for a digital asset that provides more utility.

On Thursday, however, bitcoin was back above $40,000.