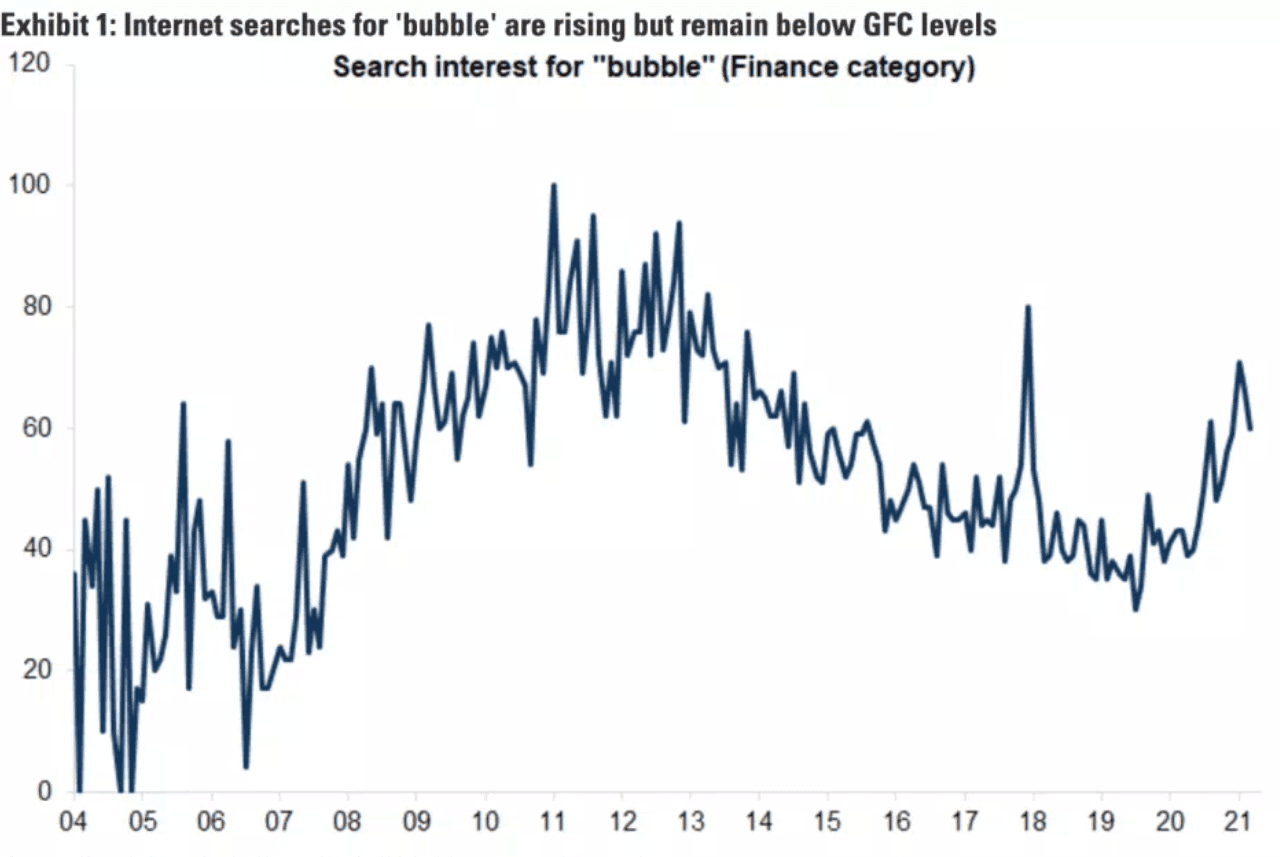

Investors may be growing anxious about the stock market potentially being in a bubble as its climb to new heights continues relatively unabated. But Goldman Sachs offered up a comforting take to these worrywarts on Monday.

“While there are pockets of excessive valuations in equities, and parts of the market are justifiably de-rating as interest rates adjust, in our assessment only a few of these common characteristics are currently present or being partially met,” opines Goldman’s chief global equity strategist. And head of macro research in Europe Peter Oppenheimer wrote in a research note, “Importantly, the absence of significant leverage (outside of the government sector) and the early stage of the cycle suggest that the risks of an imminent bubble with systemic risks to the financial system and economies is relatively low.”

Oppenheimer’s conclusion reflects several factors.

First, historically low interest rates have made stocks more attractive relative to other points in the past. Second, the biggest companies in the market (see FAANG stocks, aka Facebook, Amazon, Apple, Netflix, Google) deserve their valuations as they produce strong cash flows due to dominant market positions. Then, Oppenheimer’s research finds there isn’t widespread excess ownership of risk assets and equities despite the run-up in markets off the 2020 COVID-19 lows.

And last but not least, the country’s largest banks generally have pristine balance sheets absent the excessive risks taken in prior bubble periods (see 2008 pre-Great Recession and late 1990s pre-internet bubble).

“There are certainly many companies that have seen very rapid price increases in the recent past but these are generally small companies that represent a relatively narrow part of the market,” Oppenheimer explained.

One can’t blame bubble hunters coming back out of hibernation.

The Dow Jones Industrial Average is up nearly 7% year-to-date, bringing its one year gain to 94%. Meanwhile, the S&P 500 and Nasdaq Composite are each up 4% this year — both indices have risen 70% in one year’s time.

Goldman’s assurances on there not being a bubble come as volatility has crept back into the market in recent weeks amid concerns about rising inflation as the U.S. economy kicks into gear as people get vaccinated. That has likely spurred concerns among investors of a short-term market top that is ripe to be unwound.

Of note, Deutsche Bank’s Jim Reid found Google searches for inflation are now at their highest levels since late 2010.

“There is little doubt that concerns and interest around inflation are growing exponentially,” Reid said.

“The doves might point out that we saw similar spikes in 2008 and 2010/11 that didn’t ever translate into much actual inflation,” explained Reid. “The hawks would point out that one of the major differences between the post-GFC and post-COVID policy is the scale of the extraordinary fiscal response.”