Nissan may have turned a corner, Volvo wants 2021 to be epic, and Honda. All that and more in The Morning Shift for February 9, 2021.

1st Gear: Nissan Is Seeing Results

The story of Nissan over the last year or two has inextricably been tied up in the story of former CEO Carlos Ghosn, for understandable reasons, as that story involves a former Green Beret, private jets, and musical instrument cases. In the meantime those still at Nissan are trying to salvage what is left, which includes a vast retrenchment from Nissan’s strategy under Ghosn, which was all about volume.

They are starting to see results.

From Bloomberg:

Japan’s second-largest carmaker forecast a net loss of 530 billion yen ($5.1 billion) for the year through March, narrower than the previously expected 615 billion yen. Nissan posted an operating profit of 27.1 billion yen for the three months through December. Analysts had on average predicted a 46.8 billion yen loss.

Last quarter saw a recovery for the global auto market as a whole, with retail sales hitting the previous year’s levels in the U.S. and exceeding them in China, Nissan Chief Operating Officer Ashwani Gupta said at a briefing Tuesday. “We are gaining momentum,” he said.

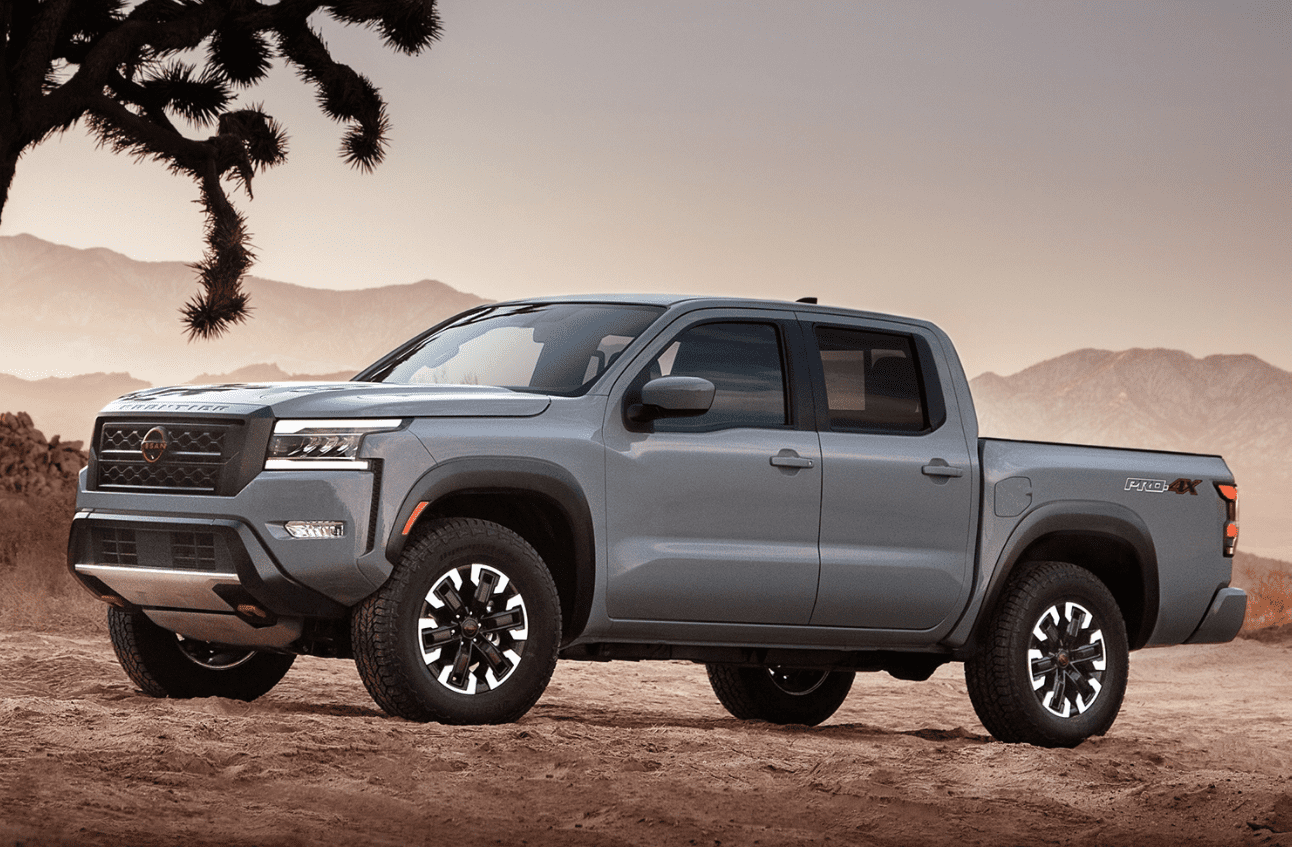

Nissan is about nine months into an aggressive turnaround plan that involves slashing its global production capacity by around a fifth and churning out 12 new models in the 18 months through November to refresh its aging lineup and rouse stagnating consumer interest.

Sales of new models like the Rogue SUV, which debuted in the U.S. in October, have been charting higher, limiting the drop in Nissan’s overall global sales to less than 10% year-on-year in November and December, compared with a more than 30% decline in the first half of 2020.

As much fun as the Ghosn story was, I’d prefer for Nissan to get back to doing what it does best, which is every 10 years or so doing something interesting.

2nd Gear: Volvo Is Taking A Big Swing In 2021

Volvo sold 661,713 cars last year, which is nearly double the number of cars it sold in 2010. That number is less than the 800,000 Volvo originally hoped to sell in 2020 before the pandemic happened, but those aspirations have merely been delayed to this year.

From Automotive News:

[Volvo Cars CEO Hakan Samuelsson] is optimistic because Volvo had the best second half in its 93-year history, selling 391,751 vehicles worldwide during the final six months of 2020.

It started 2021 by having its best January ever with monthly global sales up 30 percent to 59,588 vehicles on strong demand from Europe (+9 percent), the U.S. (+32 percent) and China (+91 percent). The big rise in China occurred because Volvo’s January 2020 sales were stunted by the COVID-19 outbreak in the country.

When asked whether 2021 would also be the year that Volvo achieves its long-standing goal of 800,000 global sales, Samuelsson was a bit more cautious.

“We are eyeing continued strong growth and let’s see where we land,” he said.

For context, Tesla delivered almost 500,000 cars last year, whereas Toyota, the world’s biggest automaker by volume, delivered 9.5 million.

3rd Gear: Honda Is Also Expecting A Big 2021

Things are getting back to normal. I mean “normal.” I mean ““normal.””

From Reuters:

Honda reported a 67 percent profit increase in the latest quarter on higher demand and cost reductions.

Operating profit for the three months to Dec. 31 was 277.7 billion yen ($2.65 billion), Honda said in a statement on Tuesday.

“Automobile sales results exceeded the same period last year since October due mainly to the launch of new N-ONE,” Seiji Kuraishi, Honda’s chief operating officer, said at a press briefing, referring to the company’s micro city car launch in Japan in November.

Honda raised its fiscal full-year profit forecast to 520 billion yen ($5 billion), up from the 420 billion yen profit it predicted three months ago.

The N-One, if you’re not familiar, completely rules.

4th Gear: I Am Already Very Tired Of Reading About This Damn Chip Shortage

Reuters says that the chip shortage will cost Honda and Nissan a quarter-million cars this year.

But Honda cut its sales target by 100,000 vehicles, or 2.2%, on Tuesday to 4.5 million cars, while Nissan lowered its target by 150,000 vehicles, or 3.6%, to 4.015 million units as a chips shortage forced both companies to curb output.

“Popular models that sell well were hit hard by semiconductor shortage,” Seiji Kuraishi, Honda’s Chief Operating Officer said during an online press briefing. “We needed to swap around and adjust production plans. But that wasn’t enough,” he added.

The global automobile industry has been grappling with a chip shortage since the end of last year, which has in some cases been exacerbated by the former U.S. administration’s sanctions on Chinese chip factories.

That some of the chip shortage can be directly mapped to former President Donald Trump is the least surprising thing.

5th Gear: More On Apple And Hyundai

Bloomberg has an interesting day-two story on the ramifications of Apple and Hyundai’s deal to build a car apparently falling apart. Ultimately, Bloomberg concludes, this could be for the best.

While a lesson in how to play the big leagues, the Apple car experience may turn out to be a good thing for Chung and Hyundai, by re-focusing its ambitions, according to Kim Jin-woo, analyst at Korea Investment & Securities Co., which rates Hyundai a buy.

“Hyundai has the know-how on how to manage supply chains with its experience of more than four decades,” Kim said. “The Apple news could have become a catalyst for stock prices, but Hyundai has been developing its own projects for future mobility.”

Investors have already started to listen. Shares in Hyundai Motor jumped almost 60 percent in 2020 while stock in Kia rose 41 percent — an impressive result in a year many automakers would rather forget as the coronavirus pandemic weighed on sales. Hyundai gained 2 percent on Tuesday, bringing gains since January to 24.5 percent.

Kia last month rebranded with a new, sleeker logo, scrapping its oval shaped badge and announcing a fresh slogan ‘Movement that inspires’ to replace its older ‘Power to surprise’ mantra.

“Hyundai’s ultimate goal isn’t to become an Apple car supplier,” said Kim Joon-sung, an analyst at Meritz Securities Co. in Seoul, who also rates Hyundai a buy. “It would want to be the next Tesla.”

A partnership with Apple sounds nice on paper, and might provide for a short-term bump in stock price, but the actual work of making the damn thing seems like a big lift, when you could be spending that time making your own thing.