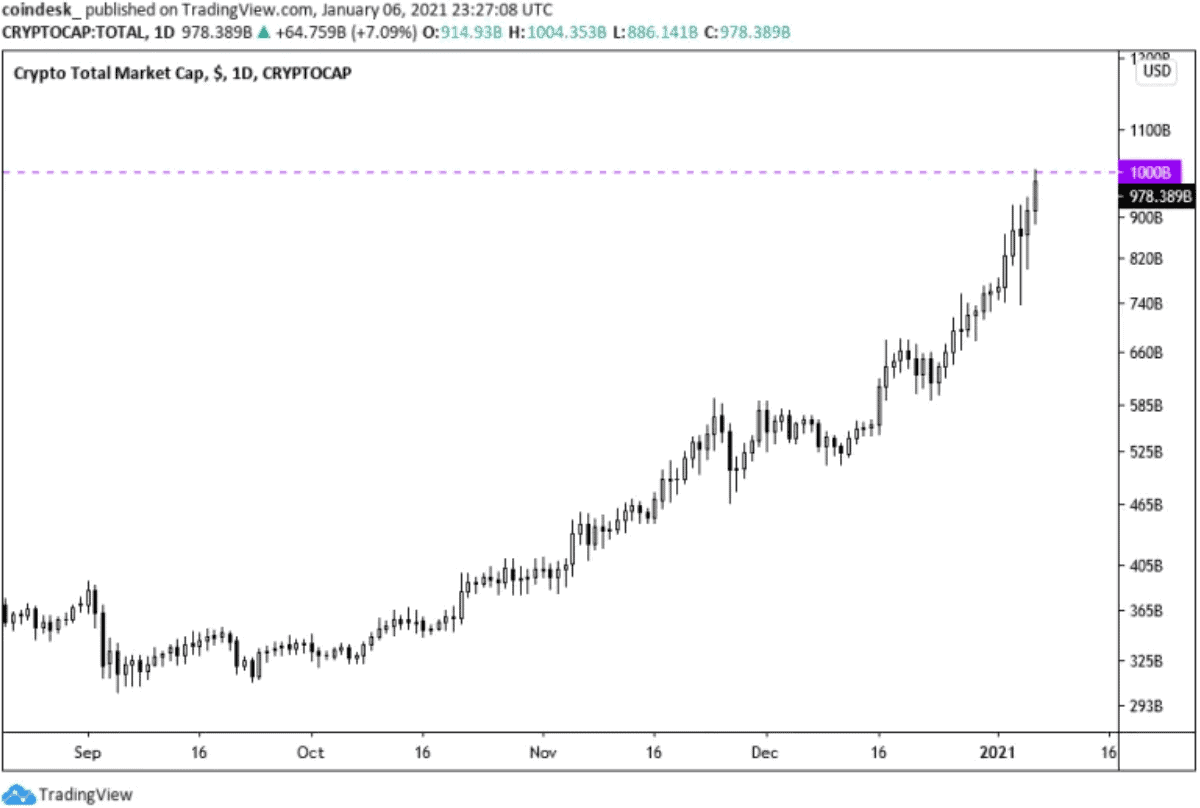

The total value of all cryptocurrencies passed $1 trillion Wednesday for the first time ever, per CoinGecko‘s index of 6,124 assets. At its prior peak in late 2017, the market’s total capitalization was just above $760 billion, according to TradingView.

Bitcoin represents roughly 69% of the market’s value, according to Messari.

Traders aren’t surprised by the market’s soaring value.

“Is it frothy? A little bit in the short term,” said Qiao Wang, co-founder of decentralized finance (DeFi) accelerator firm DeFi Alliance and former quantitative trader at Tower Research. “But is it ridiculous,” he asked rhetorically. “Nope.”

Over the past 12 months, the nearly parabolic rise of bitcoin (BTC, +7.98%) and other cryptocurrencies has come as deep-pocketed institutional investors show increasing interest in bitcoin with a new crop of retail investors following their lead and showing some interesting in alternative cryptocurrencies (altcoins) as well.

Bitcoin has already gained 25% in January, following its more than 300% gain in 2020. Ethereum has also soared over the past 12 months, reaching a total gain of roughly 860% Wednesday after trading above $1,200 for the first time since early 2018.

“The $1 trillion mark cements cryptocurrency as a investable asset class that no longer sits on the fringes of Traditional Finance as a toy for retail investors,” said Jack Purdy, decentralized finance analyst at Messari. “It demonstrates that this asset class is large enough to absorb large orders like we’ve seen recently with the slew of institutions entering over the last few months.”

Some of those large investments have come from firms like technology firm MicroStrategy, who has scooped up over 70,000 BTC with plans to buy more, and London-based asset manager Ruffer Investment, who dumped $740 million into bitcoin toward the end of 2020.

“Cryptocurrencies are now almost an institutional-grade venture bet,” Wang told CoinDesk. “The market is finally liquid enough to deploy large sums of capital, but still early enough for a 10x return.”

For some investors, those returns are coming from altcoins. As bitcoin continues to climb above $30,000, altcoin indexes have gained momentum.

Per FTX’s markets, its index of 10 leading altcoins has rallied over 30% in 2021. The “shitcoin” index, representing micro-cap altcoins, has also gained over 20% so far in January.

“A trillion dollar market cap is a big milestone for crypto, especially considering it was below $200 billion less than a year ago,” said Nate Maddrey, research analyst at Coin Metrics, in a direct message with CoinDesk. “But crypto’s total market cap is still only a fraction of gold, equities, and many other assets.”

From “shitcoin” indexes to the bellwether assets like bitcoin, institutional buyers and retail speculators alike can likely find something to pique there interest in this newly-minted, trillion-dollar market.

“Crypto is in a unique position to be the most important asset class of the 21st century and still has a lot of room to grow,” Maddrey said.