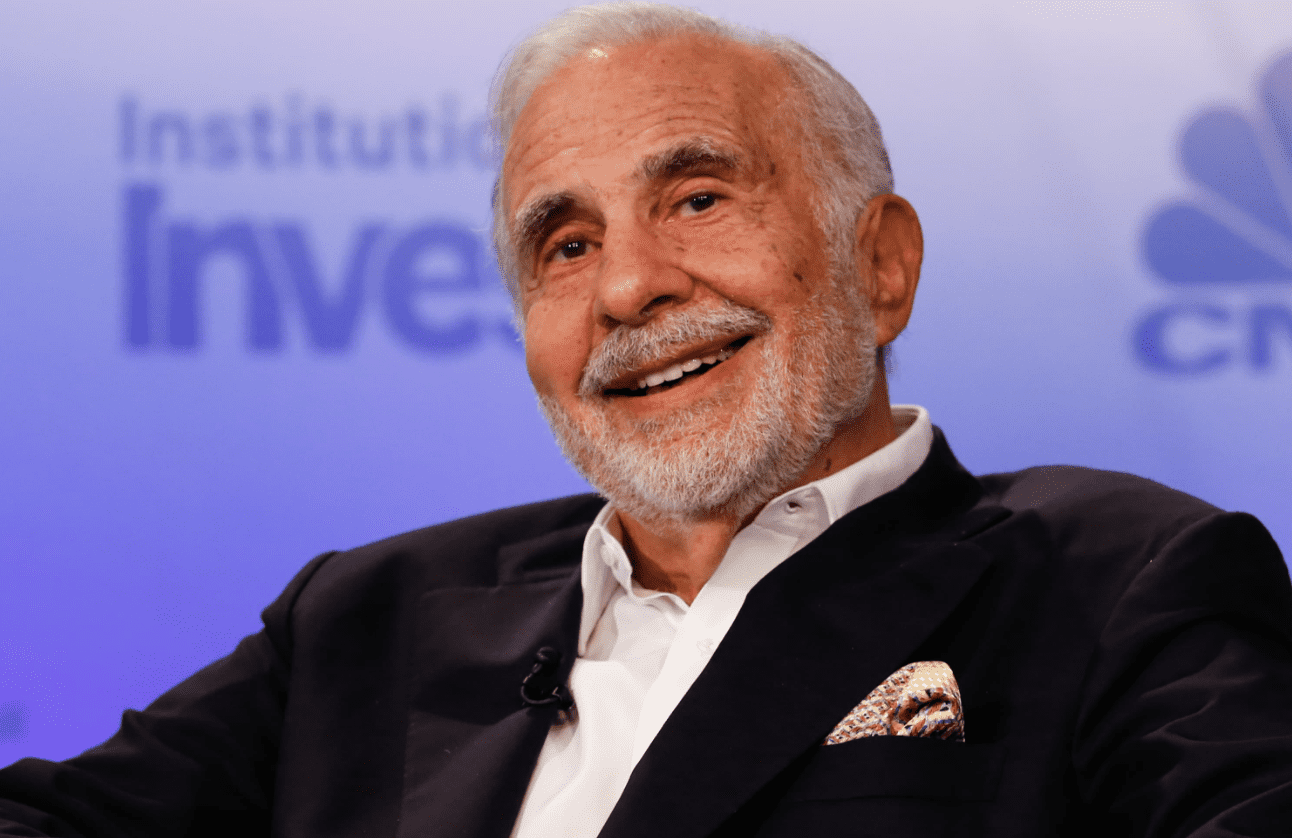

Billionaire investor Carl Icahn warned of the possibility of a significant decline for stocks at some point, telling CNBC’s Scott Wapner that “wild rallies” in the market always meet a dramatic end.

Wapner reported Icahn’s warning on “Halftime Report” during a turbulent day for the stock market.

“In my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction. Nobody can predict when it will happen, but when that does happen, look out below,” Icahn said. “Another thing they have in common is it’s always said, it’s different this time. But it never turns out to be the truth.”

The investor declined to go into the specifics of his positions, but did tell Wapner that he was well hedged.

Icahn’s cautionary statement came as the U.S. stock market fell sharply on the first trading day of the new year. The three major were indexes were all down more than 3% near midday, with the Dow falling as much as 700 points.

The rough start to 2021 follows a banner year for the markets, which saw the S&P 500 rise 16% and certain tech stocks have dramatic jumps even as the Covid-19 pandemic upended the world economy.

The rapid rise and ballooning valuations for stocks have made some Wall Street strategists wary of the market’s path in the near term. Morgan Stanley strategist Mike Wilson said in a note to clients on Monday that the market was “ripe for a drawdown.”

Icahn has made his name as an activist investor. On Monday morning, Herbalife announced that it was buying back $600 million worth of shares from Icahn and that the activist’s representatives would exit the board. Icahn said in a statement that the time for activism at Herbalife, which he invested in more than eight years ago, had passed but he planned to remain a shareholder at a smaller level.