Most people vow to start the new year off with a commitment to save more or spend less. This year, recent changes in the tax laws could help.

The IRS has made inflation adjustments to a range of key figures, from the amount you can put in a 401(k) retirement plan to the individual income tax brackets that help you determine your tax rate.

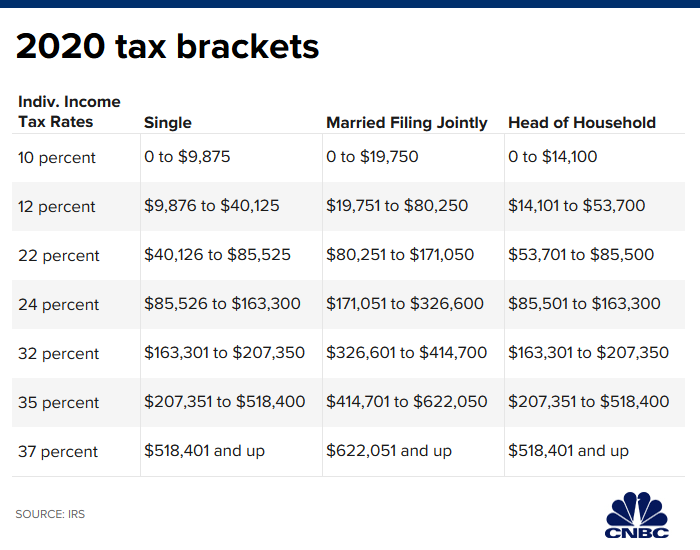

Here are your new tax brackets in 2020.

The IRS also bumped your standard deduction for the 2020 tax year, which could reduce your taxable income.

The current standard deduction is $12,400 for singles, up from $12,200 in the prior year, and $24,800 for married joint filers, up from $24,400 in 2019.

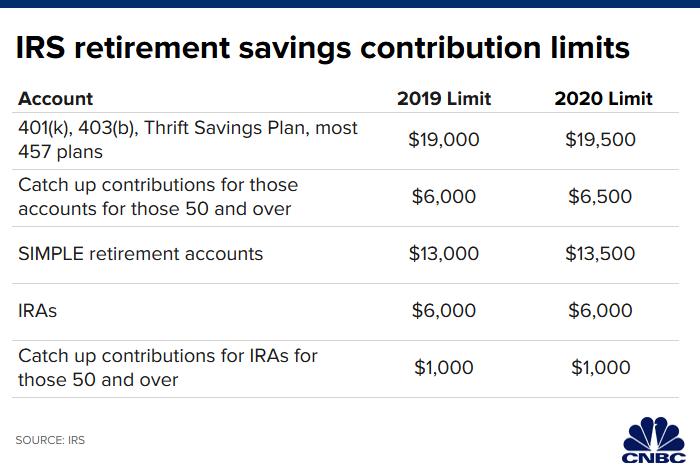

Boosting retirement savings

If you’ve resolved to save a few extra dollars in your retirement account at work, the IRS has raised the employee contribution limit for 401(k), 403(b) and most 457 plans to $19,500, up from $19,000 in 2019.

If you’re age 50 or older, you can kick in an additional $6,500. That’s also a bump up from $6,000 in 2019.

The contribution limit for individual retirement accounts, whether traditional or Roth, is still at $6,000, plus another $1,000 for savers 50 and over.

One caveat: The IRS limits high-income earners’ ability to make direct contributions to Roth IRAs — accounts in which you can save after-tax dollars, have the money grow tax-free and use it in retirement free of taxes.

More health savings opportunities

As of 2020, you can also save more in a health savings account.

These accounts allow you to put away pretax or tax-deductible money and have it grow free of taxes. You can take a tax-free withdrawal to cover qualified health expenses.

This year, you can save up to $3,550 if you’re an individual with self-only health coverage. That’s up from $3,500 in 2019. Account holders with family plans can save up to $7,100 in this account, up from $7,000 in 2019.

HSAs differ from health-care flexible spending accounts primarily in that you can roll over the HSA balance from one year to the next. The money in FSAs generally must be used by the end of the plan year or you lose it.

The IRS also increased the amount you can save in a health-care FSA: It is $2,750 in 2020, up from $2,700 in 2019.

Added gift and estate tax savings

Good news for people sitting on millions: The Tax Cuts and Jobs Act nearly doubled the amount that decedents can bequeath in death — or gift over their lifetime — and shield it from federal estate and gift taxes, which are 40%.

For 2020, the lifetime gift and estate tax exemption was bumped up again. This year, the lifetime exemption is $11.58 million per individual, up from $11.4 million in 2019.

Finally, the annual gift exclusion — the amount you can give to any other person without it counting against your lifetime exemption — holds steady at $15,000 for 2020.