As investors celebrate the outsized gains they made in the stock market in 2019, they may be getting ready to sell some of their winners once 2020 begins.

There’s little to stand in the way of the rising stock market at this point as it drifts, higher, for the most part, into year-end. But come January, analysts say, there should be some tax-related selling, and the broader market may even pull back, after its heady 2019 gains.

“I think people won’t want to add any more taxable gains this year, so they’ll probably defer to next year. They made a lot of money. A lot of them will tend to look at rebalancing,” said James Paulsen, chief investment strategist at Leuthold Group.

Even if there’s a January pullback, analysts expect the stock market to keep rising.

The S&P 500 has gained 8.3% in the final quarter of the year and was up 28.6% for the year so far, its best performance since 2013. If the S&P gains more than 29.6% for the year, that would be the biggest gain since 1997′s 31% gain.

“I suspect we’re going to cool the jets of bullishness in the first quarter. … It wouldn’t surprise me if we had a pullback,” said Paulsen, adding that investors have become a little too bullish.

The ‘January break’

Jeffrey Hirsch, editor-in-chief of Stock Trader’s Almanacsaid it wouldn’t be surprising to see investors taking profits at the start of the new year. “That’s what gives a little bit of weakness on day one. We’ve seen a bit of profit-taking on the first trading day of January when people don’t want to incur capital gains” in December, he said. “There’s been more of that going on in January. There’s also the traditional January break.”

Hirsch said a frequently occurring period of weakness in January was called the “January break” by futures traders in the Chicago pits.

The first five trading days of the year are considered “an early warning system” that has accurately predicted full year gains about 84% of the time when their overall performance is positive, according to the almanac.

The almanac documents the other phenomena of January, known as the January barometer, which is the belief that as the market goes in January, so goes the year. It has a 75% accuracy rate going back to 1950, and it has only missed in a big way nine times. January was positive this year, and Hirsch says the market is lined up for what he calls the January indicator trifecta.

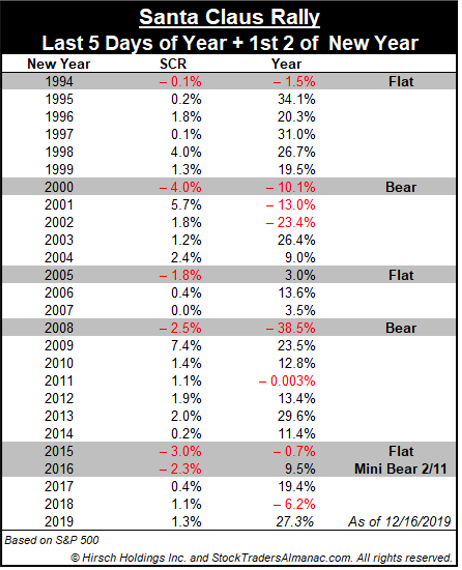

That’s when there’s a positive Santa rally, which covers the final five trading days of one year and the first two of the next, a positive overall first five trading days of the year, and the January barometer is positive.

“The last 30 times, they were all up, the full year was up 27 out of 30 times,” he said.

Scott Redler, who watches the market’s short-term technicals, said he also expects to see some tax-related selling in the new year, and as part of the January effect, stocks that were sold this year might do better in early 2020.

“It might be better to get into some of the weaker sectors, like cannabis or some of the beaten-down IPOs like Uber, Beyond Meat and Slack or some of the energy names,” said Redler. “These could have the January type of effect … where selling pressure will lift and people who took losses in December, after 30 days, they can buy them back.”

“The first two days of the year, you’re either actively trading or measuring your commitment levels to positions,” said Redler, a partner with T3Live.com. “Tesla could easily go to $500 in 2020. It just came from $310. It could also test the breakout we had from $390. What’s your commitment to hold these things in 2020?”

He said the market is becoming extended, and the S&P 500 has been above its eight-day moving average, a momentum indicator.

“We’re about 25 handles above it, and we could easily get a quick brush-back to it. Whenever we get this far away from the eight-day, I always put on a hedge. It means the market is on the move,” he said. “Since Dec. 15, when the tariffs were lifted, the market has been on a steady cruise control and that might change the first week of January.”

Redler said after this year’s strong gain, it’s harder to pick spots. “There were more positions to go long after a 15% decline from October to Christmas last year than a 28% plus move heading into this January.”

He said the market could peak in the first quarter, before it faces more election-related turbulence. The risk is that new flows come into the market and it becomes much more stretched. “I think a quick 2% to 5% pullback in January would be better,” he said, adding that that would get the market back in line and potentially head off a bigger correction.