Figuring out how much to save every month so that you’re financially secure when it comes time to retire Opens a New Window. is complicated. In fact, according to the Motley Fool, Opens a New Window. a majority of Americans say they don’t even know how much they will need when they retire, Opens a New Window. much less how much they’ll need to gradually save to achieve that magic number.

Some assume Social Security benefits Opens a New Window. will be enough to live on, but they aren’t. To put it bluntly, Social Security benefits are only supposed to replace about 40 percent of the income you made before retiring. That means your retirement investment Opens a New Window. accounts should account for at least the remaining 60 percent.

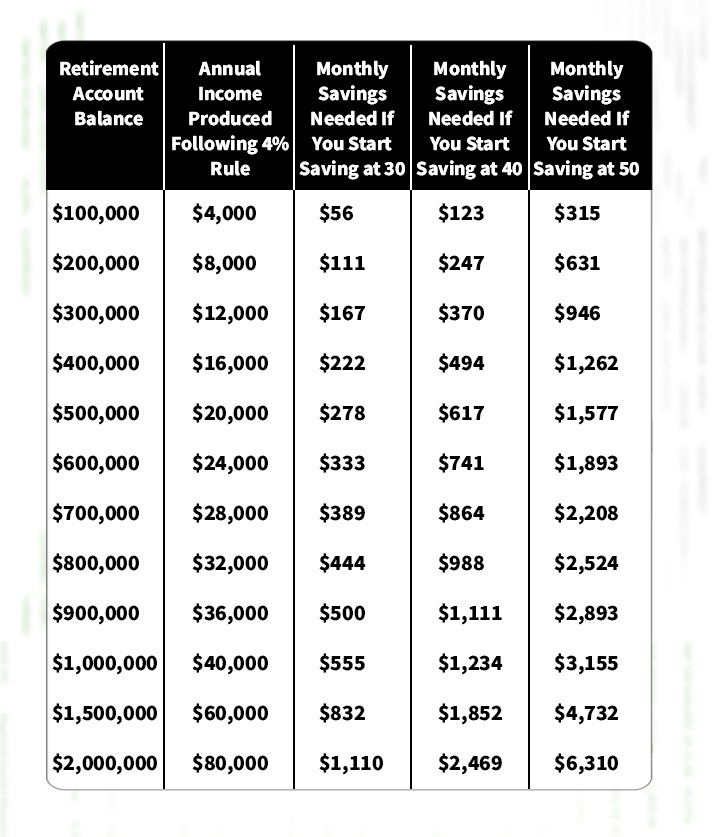

Many people adhere to what is known as the 4 percent rule. The 4 percent rule says you should only withdraw 4 percent of your retirement investment Opens a New Window. during the first year of your retirement.

After that first year, the amount you take out can increase to keep up with the rate of inflation Opens a New Window. . Ideally, you should withdraw less than 4 percent if possible, but it’s a good ballpark estimate.

These calculations are based on the assumption people will save the same amount every year and not increase the amount every year, and that everyone will earn a 7 percent return on their investment.

These calculations are based on the assumption people will save the same amount every year and not increase the amount every year, and that everyone will earn a 7 percent return on their investment.

Obviously, the sooner you start an aggressive savings plan,Opens a New Window. the more prepared you will be for your future. It’s important to remember that it’s much easier to save smaller amounts over the course of many years than it is to generate huge savings amounts later in life.

2. Reminds you a big nest egg only generates a small income

If you have $600,000 in your retirement savingsOpens a New Window. by the time you’re ready to stop working, that will only equate to a $24,000 annual income (if you follow the aforementioned 4 percent rule).

In 2019, the Motley Fool says the average Social Security Opens a New Window. monthly benefit was $1,461. That means if you have that $600,000 account balance and were lucky enough to get Social Security benefits, your monthly household income would be just under $3,500.

It goes without saying that most people can’t and don’t have anywhere close to $600,000 saved for their retirement.

3. The earlier you save, the better – no exceptions

Not shockingly, the earlier you plan for retirement, the easier it is to save for it without feeling the impact in your monthly budget.

For instance, if you want to have an annual income post-retirement of $40,000, you would need to save $555 a month if you start saving at 30 or $3,155 a month if you start saving when you’re 50.

If you’re somewhere between these age guidelines, then do the math to get a good estimate of your savings goal.