There’s been a revival in the Philippine stock market.

After slumping to become one of the world’s biggest losers last year, the nation’s equities have surged and are now poised to enter a bull market.

The Philippine Stock Exchange Index, a basket of the nation’s 30 biggest companies and most actively traded shares, climbed 1.2% as of 10:10 a.m. in Manila, gaining more than 20% since its November-low amid an interest rate cut, cooling inflation and a stronger peso. The benchmark is now set to enter a bull market Monday.

Inflation Eases

Philippine inflation eased to its slowest pace in almost two years last month, resuming a downward trend that economists say will allow for more cuts to the central bank’s key rate and the amount of reserves required from lenders. That has helped boost the nation’s equity market this year by more than 9%.

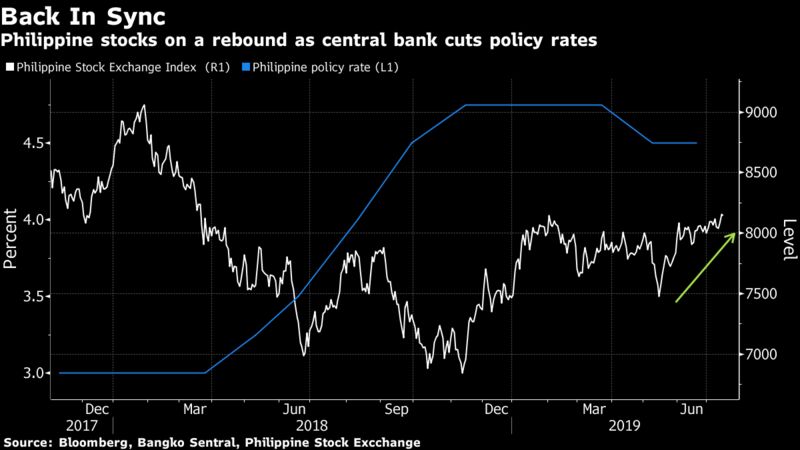

Rate Cut

On Friday, Philippines central bank Governor Benjamin Diokno committed to resume its policy easing this second half, saying the Federal Reserve’s impending rate cut is an “additional input to our decision.” Last year, the central bank staged one of its most aggressive tightening in almost two decades as inflation accelerated and pushed Philippine stocks into a bear market. It then cut its policy rate in May, which sent stocks soaring.

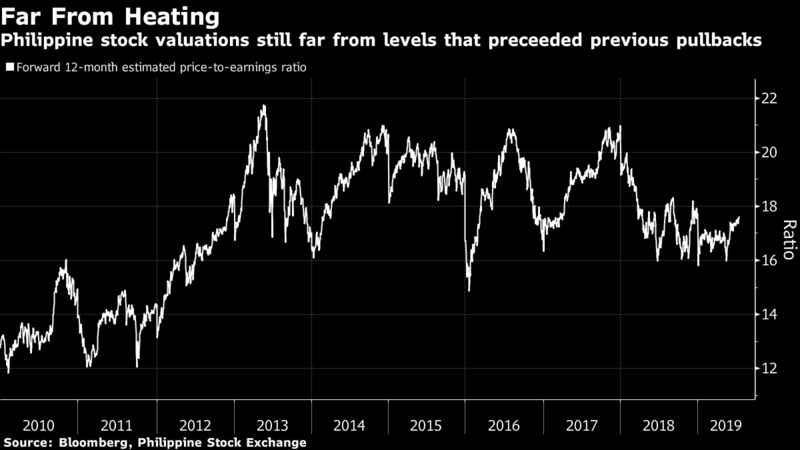

Not That Expensive

Stacked up against the region, Philippine stocks are among the priciest in Asia with shares trading at about 16 times 12-month estimated earnings, the highest after India. Still, on a historical basis, it’s lower than the 19-20 multiple range that preceded stock routs in 2015, 2016, 2017 and 2018.

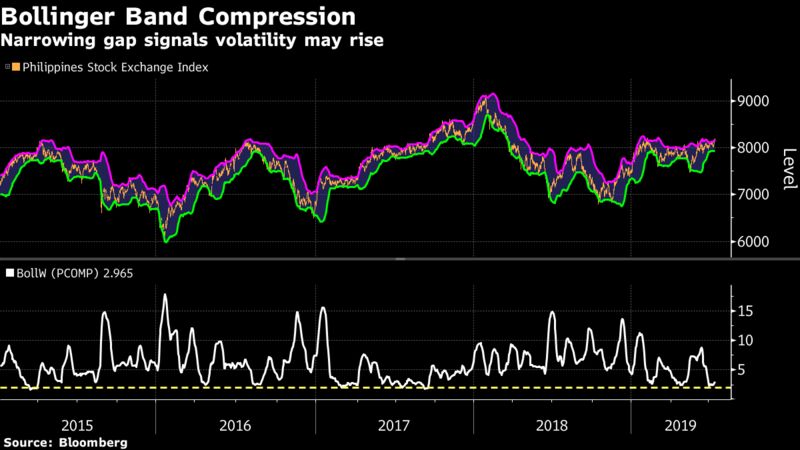

Key Level

The benchmark may finally sustain a breakout from the 8,000 level, Bollinger Bands suggest. The market’s volatility gauge is close to a level that preceded gains in the Philippine Stock Exchange Index.

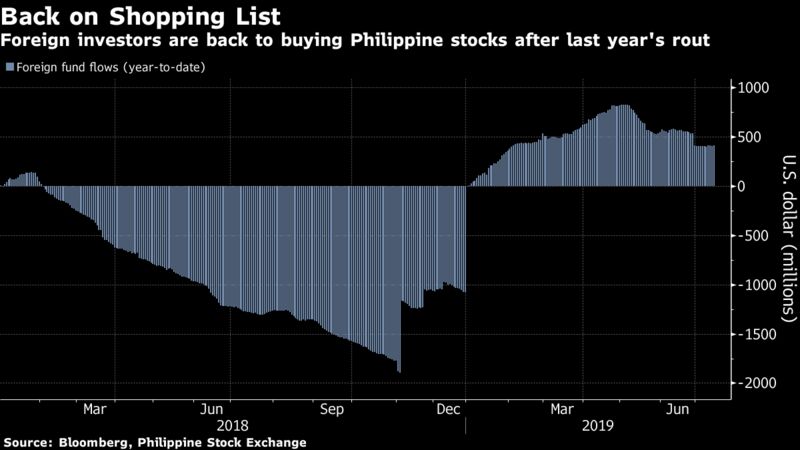

Foreign Flows

After pulling out more than a $1 billion in 2018, overseas funds have forayed back into Philippine equities, with more than $400 million in net inflows so far this year.

What could halt the bulls from marching higher? Analysts say the headwinds are mostly external: a re-escalation of the U.S.-China trade war and a rebalancing of portfolios to reflect the higher weighting of mainland China shares in the MSCI Index and rising oil prices.