Check out the companies making headlines midday Monday:

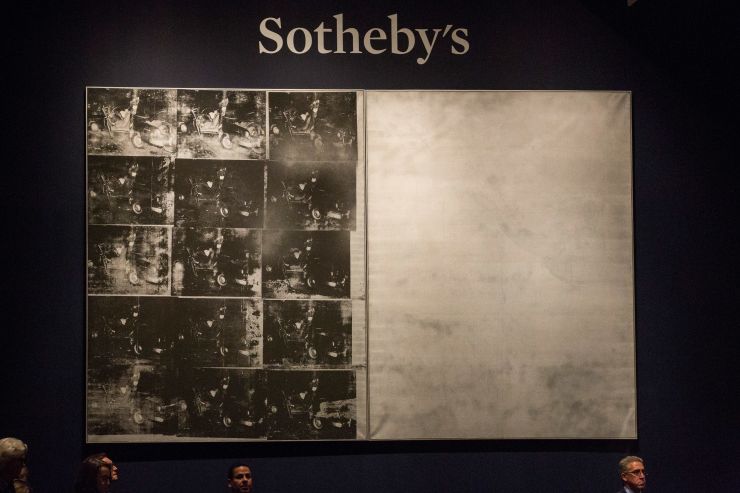

Sotheby’s — Sotheby’s shares jumped 58.6% on news that European art collector Patrick Drahi planned to acquire the art auction house. Drahi will pay shareholders $57 per share, or $3.7 billion in cash to take the company private. If approved, the deal will return Sotheby’s to private ownership after 31 years as a publicly traded company.

Array BioPharma — Array Biopharma surged 57% after Pfizer announced it would acquire the drugmaker for $10.64 billion, or $48 per share. Shares of Array closed Friday at $29.59 per share.

C&J Energy Services — C&J Energy Services gained 20% after announcing it is merging with oilfield services firm Keane Group. The oil and energy service said the combined company will have an enterprise value of about $1.8 billion. However, law firm Halper Sadeh announced it is investigating whether the merger is fair to C&J shareholders.

PaySign — Shares of PaySign fell more than 10% on Monday morning after the stock was downgraded to neutral by BTIG. The stock is up more than 200% this year. “We view that valuation as a fair refection of PAYS’ visible growth prospects,” BTIG said. “We are moving to the sidelines until either new avenues for growth emerge (potentially via acquisition) or a pullback in its share price creates a better entry point.”

Ashford Hospitality Trust — The real estate company’s stock slid 4.4% after an analyst at DA Davidson downgraded it to neutral from buy. The analyst said Ashford’s recent 50% dividend cut adds to the “near-term uncertainty and industry headwinds” the company faces.

Eventbrite — Shares of ticketing platform Eventbrite rose 5.9% after William Blair initiated coverage of the stock with an outperform rating. Blair believes the stock has dropped too far, writing these levels are “an attractive entry point for long-term investors given the duration of the company’s above-average growth prospects.”

Keurig Dr Pepper — Shares of beverage maker Keurig Dr Pepper rose 4.9% after BMO Capital Markets upgraded the stock to outperform from market perform, citing an attractive valuation relative to its peers.

Mosaic — The largest U.S. producer of potash and phosphate fertilizer climbed more than 4% after Bank of America upgraded it to buy from neutral. The bank highlighted a more constructive outlook for the company’s operations in Brazil.

Disney — The entertainment giant’s stock fell 0.5% an analyst at Imperial Capital downgraded it to in-line from outperform, noting the stock’s 30% tear this year has taken its valuation to “record multiples. ”

Symantec — Mizuho upgraded Symantec to buy from neutral and raised the stock’s price target to $23 per share from $22. The firm says Symantec will be able to “focus on optimizing the business” moving forward. Symantec shares were up 2.1% around $19.76.

Corteva — Shares of the agricultural chemical company gained 3% after Deutsche Bank upgraded it to buy from hold after several company guidance cuts due to heavy rainfall in the Midwest and rising trade tensions.

Dow Inc — Dow fell more than 3% after an analyst at BMO Capital Markets downgraded the chemical company to market perform from outperform. The analyst said this year is “turning out more challenging as global trade issues persist.”